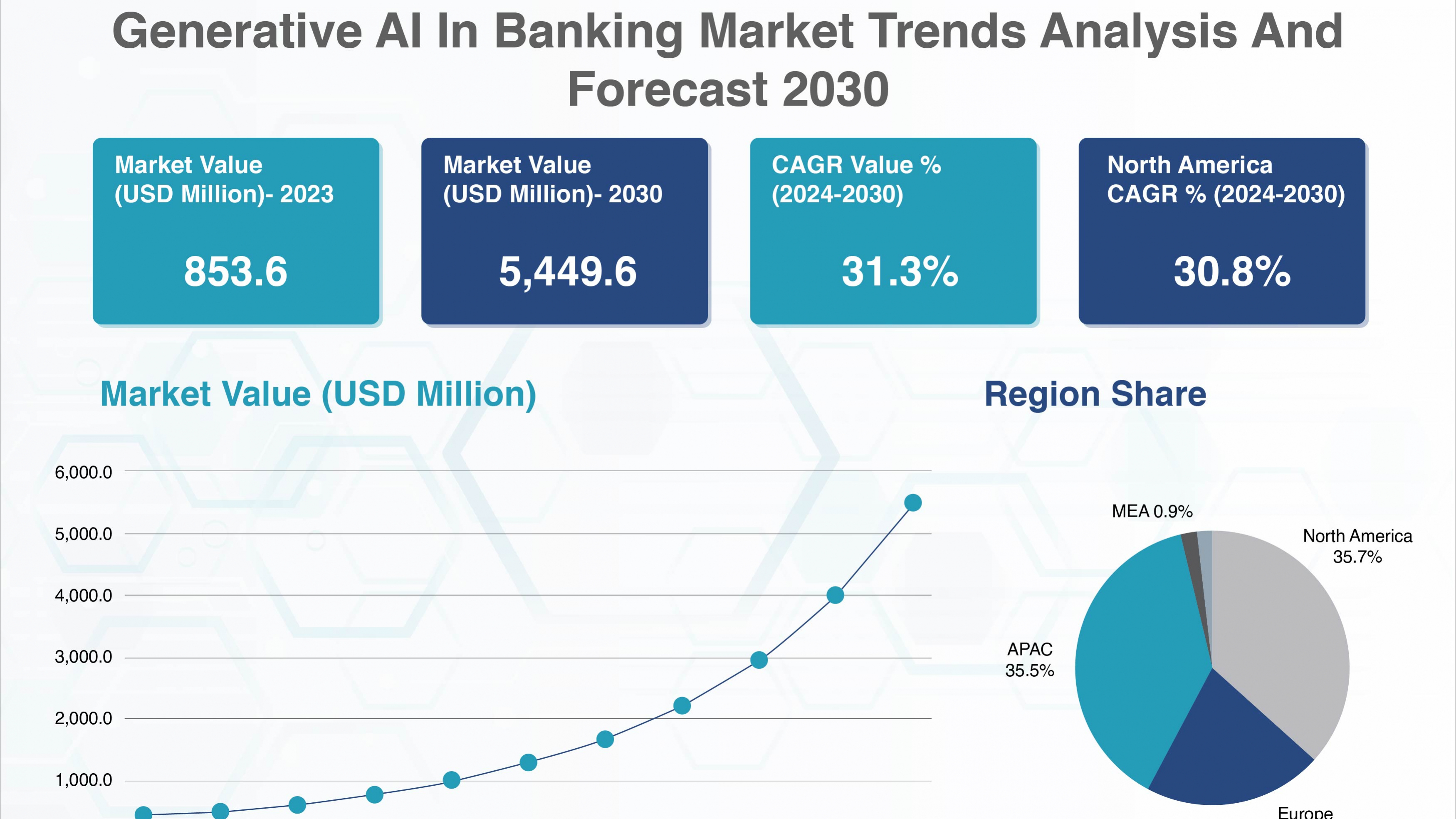

The Generative AI in Banking sector is redefining the financial landscape through automation, predictive analytics, and intelligent customer interaction. The technology’s ability to create personalized solutions and detect anomalies is transforming how banks operate and deliver value to customers. According to the Generative AI in Banking Market Report , the market was valued at USD 853.6 million in 2023 and is projected to reach USD 5,449.6 million by 2030, growing at a CAGR of 31.3% from 2024 to 2030. The Generative AI in Banking Industry leverages large datasets, natural language processing (NLP), and machine learning algorithms to streamline lending, enhance customer support, and prevent fraud. Key Generative AI in Banking Market Trends include AI-driven credit scoring, automated document generation, and virtual financial advisors. As financial institutions embrace innovation, the Global Generative AI in Banking Market continues to expand, reshaping traditional banking operations with data-driven intelligence and personalization.