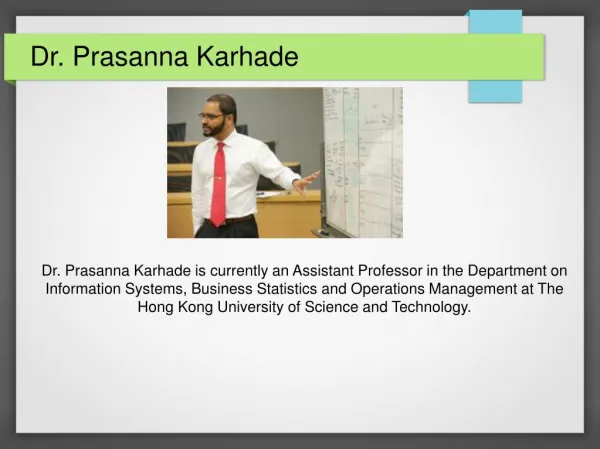

Dr. Prasanna Karhade

130 likes | 332 Vues

Dr. Prasanna Karhade is currently an Assistant Professor in the Department on Information Systems, Business Statistics and Operations Management at The Hong Kong University of Science and Technology.

Dr. Prasanna Karhade

E N D

Presentation Transcript

Dr. Prasanna Karhade Dr. Prasanna Karhade is currently an Assistant Professor in the Department on Information Systems, Business Statistics and Operations Management at The Hong Kong University of Science and Technology.

About Dr. Prasanna Karhade Dr. Prasanna is from Mumbai, India and studied at Sardar Patel College of Engineering where he earned a Bachelor of Engineering in Computer Engineering. He earned a Master of Science in Computer Science from Georgia State University. He worked as a software engineer for about 30 months in Atlanta, Gerogia. He earned a PhD in Business Administration from the University of Illinois at Urbana-Champaign.

Research 1) Journal Papers a) Contractual Provisions to Mitigate Holdup: Evidence from Information Technology Outsourcing b) Patterns in Information Systems Portfolio Prioritization: Evidence from Decision Tree Induction 2) Selected Conference Papers a) Information Technology And Innovation Outputs: The Missing Link of Search Evolution b) Dynamic Adjustment Of Information Technology, Corporate Governance, And Firm Profitability c) The Penrose Effect In Resource Investment For Innovation: Evidence From Information Technology And Human Capital

Journal Papers a) Contractual Provisions to Mitigate Holdup: Evidence from Information Technology Outsourcing: Information Systems Research: Anjana Susarla, Ramanath Subramanyam, Prasanna Karhade Abstract: The complexity and scope of outsourced information technology (IT) demands relationship-specific investments from vendors, which, when combined with contract incompleteness, may result in underinvestment and inefficient bargaining, referred to as the holdup problem. Using a unique data set of over 100 IT outsourcing contracts, we examine whether contract extensiveness, i.e., the extent to which firms and vendors can foresee contingencies when designing contracts for outsourced IT services, can alleviate holdup. While extensively detailed contracts are likely to include a greater breadth of activities outsourced to a vendor, task complexity makes it difficult to draft extensive contracts. Furthermore, extensive contracts may still be incomplete with respect to enforcement. We then examine the role of nonprice contractual provisions, contract duration, and extendibility terms, which give firms an option to extend the contract to limit the likelihood of holdup. We also validate the ex post efficiency of contract design choices by examining renewals of contracting agreements. Keywords: contract duration, extendibility clauses, holdup, underinvestment, information technology outsourcing, incomplete contracts Cite: Susarla, A., Subramanyam, R., & Karhade, P. (2010). Contractual provisions to mitigate holdup: Evidence from information technology outsourcing. Information Systems Research, 21(1), 37-55.

Journal Papers b) Patterns in Information Systems Portfolio Prioritization: Evidence from Decision Tree Induction: MIS Quarterly: Prasanna Karhade, Michael J. Shaw, and Ramanath Subramanyam Abstract: Questions pertaining to the locus of information systems (IS) governance have been extensively examined in existing research. However, questions pertaining to the decision rationale applied for Information Systems portfolio prioritization—why are certain initiatives approved, and why are certain others rejected—noted to be a critical component of IS governance need further investigation. We submit that the Information Systems strategy of a firm is likely to explain the decision rationale it applies to Information Systems portfolio prioritization and maintain that it is critical to ensure this decision rationale is in congruence with the firm’s Information Systems strategy. By extending prior theoretical work on Information Systems strategy types, we develop theoretical profiles of the decision rationale applied to Information Systems portfolio prioritization using three attributes: communicability of decision rationale, consistency in applying decision rationale, and risk appropriateness of decision rationale. Since the decision rationale applied for Information Systems portfolio prioritization is often tacit, unknown even to the decision makers themselves, we employ the decision tree induction methodology to discover this tacit decision rationale. We analyze over 150 Information Systems portfolio prioritization decisions on a multimillion dollar Information Systems portfolio of a multibusiness, Fortune 50 firm and our findings, which support our propositions, indicate that firms that adopt different Information Systems strategies rely on systematically different profiles of decision rationale for Information Systems portfolio prioritization. Implications for IS governance practices are developed. Keywords: Information Systems strategy, Information Systems portfolio prioritization, IT portfolio management, IS governance, IT governance, decision making, decision tree induction Cite: Karhade, P., Shaw, M. J., & Subramanyam, R. (2015). Patterns in Information Systems Portfolio Prioritization: Evidence from Decision Tree Induction. MIS Quarterly, 39(2).

Selected Conference Papers a) Information Technology And Innovation Outputs: The Missing Link of Search Evolution John Qi Dong, Prasanna Karhade, Arun Rai, Sean Xin Xu Academy of Management (AoM 2015) Abstract: Recent literature documents mixed findings on the impact of information technology (IT) investment on film innovation outputs, calling for deeper exploration of the mechanisms through which IT influences innovation that can reconcile these mixed findings. Based on the evolutionary theory of the firm, we theorize the impacts of IT investment on the variation of firm search behavior in spanning various existing boundaries. Specifically, we explain how and why firms with greater IT investment are more likely to search across technological, organizational, geographical, and temporal boundaries in recombining knowledge elements, which has curvilinear impacts on the quantity and quality of innovation outputs. Using a panel data set from multiple archival sources, we found robust empirical evidence corroborating our theory. Keywords: information technology investment; search: knowledge recombination; innovation; business value of information technology; evolutionary theory of the firm

Selected Conference Papers b) Dynamic Adjustment Of Information Technology, Corporate Governance, And Firm Profitability John Qi Dong, Prasanna Karhade, Arun Rai, Sean Xin Xu European Conference on Information Systems (ECIS 2013) Abstract: How do managers make their decisions with regard to adjustment and deployment of information technology (IT) over time? Motivated by this complex dynamics, we draw on behavioral theory of the firm and theorize a bounded rational process of managerial decision making for IT investment. In particular, we explain the dynamic adjustment of IT investment by bounded rational managers’ pursuing of satisfaction. When performance feedback of prior profitability is below their aspiration, they become unsatisfied and adjust IT investment to facilitate problemistic search directed toward innovative solutions to performance problems. As a result, performance problems will be solved and future profitability can be improved. We also deepen our understanding by theorizing the contingency of above dynamics based on the possibility of agency problems and the appropriateness of corporate governance mechanisms, which is largely omitted in behavioral theory. We further draw on agency theory and examine the moderating roles of different corporate governance mechanisms (i.e., incentive alignment versus monitoring) in the effects of IT investment on problemistic search and rent generation. By using a recent, large-scale panel data set, we find that managers are indeed bounded rational and dynamically adjust IT investment over time based on performance feedback. We also find that incentive alignment outgoes monitoring in directing managerial decision making toward innovating with and generating rent with IT investment. Novel theoretical and practical implications are discussed. Keywords: dynamic adjustment of IT investment, dynamics of managerial decision making, IT innovation, corporate governance, behavioral theory of the firm, agency theory.

Selected Conference Papers c) The Penrose Effect In Resource Investment For Innovation: Evidence From Information Technology And Human Capital John Qi Dong, Jinyu He, Prasanna Karhade European Conference on Information Systems (ECIS 2013) Abstract: Resource-based theory views the firm as a bundle of resources administrated and coordinated by managers. We introduce the theoretical lens of Penrose effect to IS research, which refers to the fact that finite managerial capacities will suffer if the complexity of resource coordination is high. Therefore, although investment in knowledge-related assets, such as information technology (IT) and human capital, is associated with better innovation performance on the one hand, too much capital investment is likely to induce diminishing return on the investment because of Penrose effect. Accordingly, we take a curvilinear approach and propose that the relationships between IT/human capital investments and innovation performance are likely to be inverted U shaped. Furthermore, we suggest that, in addition to bringing resource synergy, resource coordination also incurs costs, especially when the complexity of coordination among multiple resources is high. Thus, we take a nonlinear approach to examine the interaction effect of IT and human capital investments on innovation performance, which may not be always positive as past research often maintained. Longitudinal data from 404 German firms across several recent years confirm inverted U-shaped relationships between IT/human capital investments and innovation performance. In addition, we find that IT and human capital investments have a negative interaction effect, suggesting that high level of investment in one capital will lead to increasing coordination costs and diminishing return on investment in the other. Keywords: IT capital investment, human capital investment, IT value, IT innovation, Penrose effect, resource based theory, resource-based view.

Summary of Recent Teaching Dr. Prasanna Karhade also teaches Strategic Management of Information Technology. This PG course has been offered in the Master of Science in Information Systems Management and the Master of Science in Global Operations programs at HKUST.

Recent Service Field WITS 2015, Program Committee Member CIST 2015, Program Committee Member ICIS 2015, AE – IS Strategy Track ICIS 2014, AE – IS Governance Track University HKUST Business School Outreach in India for the HKUST Business School PhD Program. Dr. Prasanna Karhade (along with Prof. Anirban Mukhopadhyay) visited 9 schools in India and talked to hundreds of the eager young minds of India about pursuing a career in academia.

Dr. Prasanna Karhade’s Blog • 1) OCIS Best Conference Paper Runner-Up! • 2) Seminar on National Energy Policy 2015 • 3) GloColl 2015 • 4) AoM 2015 Best Paper Proceedings • 5) Academy of Management 2015 Meeting • 6) HKUST Business Insights Series

Honors & Awards Research Grants IT Assets and Firm Innovation Output: An Empirical Examination,” (with Jeevan Jaisingh, Jinyu He, Arun Rai) Hong Kong Research Grants Council Competitive Earmarked Research Grant HKUST 641612, 2012-14, HK$215,670, Principal Investigator. Awards OCIS Best Conference Paper Runner-Up, AoM 2015

Dr. Prasanna Karhade’s Official Website Website : http://prasannakarhade.com/ Email : karhade@ust.hk