When it comes to technical analysis in stock trading, chart patterns play a vital role in helping traders identify potential breakout opportunities. Among the most reliable and widely recognized formations is the Cup and Handle Pattern. This pattern, when interpreted correctly, can provide traders with strong entry and exit points. In this article, we’ll dive deep into the Cup and Handle Pattern, along with its variations like the Reverse Cup and Handle Pattern and the Inverted Cup and Handle Pattern, to help you trade smarter and more effectively.

What is the Cup and Handle Pattern?

The Cup and Handle Pattern is a bullish continuation pattern that resembles the shape of a tea cup. It indicates a period of consolidation followed by a breakout to higher levels. The pattern is divided into two main parts:

The Cup: This forms after a downtrend and represents a rounded bottom, signaling a gradual shift from bearish to bullish sentiment.

The Handle: After the cup is formed, a short pullback occurs, forming the handle. This usually resembles a flag or wedge pattern and is followed by a breakout on the upside.

Key Characteristics: Typically occurs over a few weeks to months. Best identified on longer timeframes (daily or weekly charts). Volume often decreases during the cup formation and increases at the breakout.

How to Trade the Cup and Handle Pattern

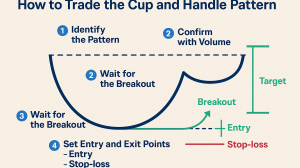

Here’s a simple step-by-step strategy to trade the Cup and Handle Pattern:

1. Identify the Pattern Look for a “U” shaped curve that forms the cup followed by a smaller downward drift forming the handle.

2. Wait for the Breakout Once the handle forms, a breakout above the resistance (the lip of the cup) signals a potential buying opportunity.

3. Confirm with Volume Ensure that the breakout is accompanied by higher volume, which adds confirmation to the validity of the pattern.

4. Set Entry and Exit Points Entry: Buy slightly above the breakout point. Stop-loss: Place it below the handle’s low to manage risk. Target:

Measure the depth of the cup and project it upwards from the breakout point to set a price target. The Reverse Cup and Handle Pattern While the traditional Cup and Handle Pattern is bullish, its opposite—the Reverse Cup and Handle Pattern—is bearish. It indicates a potential trend reversal from bullish to bearish.

Characteristics: The cup in this case is inverted, showing a gradual loss of bullish momentum. The handle represents a short upward retracement before a breakdown.

Trading Strategy: Sell or short once the price breaks below the support formed at the bottom of the reverse cup. Use volume confirmation for added reliability. Stop-loss can be placed above the high of the handle. Inverted Cup and Handle Pattern The Inverted Cup and Handle Pattern is essentially the same as the Reverse Cup and Handle Pattern. These terms are often used interchangeably. Just like its counterpart, it suggests bearish market sentiment and a potential decline in prices. Traders use this pattern to identify short-selling opportunities or to exit long positions before a significant downturn. The same rules apply—look for breakdown confirmation and use protective stop-loss strategies.