Feasibility Study

130 likes | 179 Vues

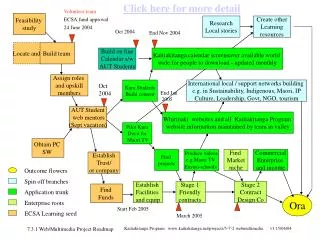

Learn about the importance of scale in project evaluation, determining the right scale for projects, and making choices with different project lengths. Explore the relationship between net present value and scale, and understand the timing of investments in various project scenarios.

Feasibility Study

E N D

Presentation Transcript

Feasibility Study Lecture 4 : Determination Of Optimal Scale, Timing Of Projects And Choice Of Mutually Exclusive Projects With Different Lengths Of Life Lecturer Hazhar Khalid Ali

The Importance of Scale and Timing in Project Appraisal 2 Why is scale important? Too large or too small can destroy a good project

Bt - Ct B3 B2 B1 0 Time C1 C2 C3 Choice of Scale • Rule: Optimal scale is when NPV = 0 for the last addition to scale and NPV > 0 for the whole project • Net benefit profiles for alternative scales of a facility < NPV (B1 – C1) 0 ? < NPV (B2 – C2) 0 ? < NPV (B3 – C3) 0 ? 3

NPV (+) NPV of Project 0 Scale of Project A B C D E F G H I J K L M N (-) Determination of Scale of Project 4 Relationship between net present value and scale

Determination of Scale of Project for Environmental Improvement Projects that generate Benefits forever Year Scale $000s 0 1 2 3 4 5 to MC MB $000s MNPV 10% MIRR S0 S1 - S0 S2 - S1 S3 - S2 S4 - S3 S5 - S4 S6 - S5 -3000 -1000 -1000 -1000 -1000 -1000 -1000 50 75 275 400 200 101 49 50 75 275 400 200 101 49 50 75 275 400 200 101 49 50 75 275 400 200 101 49 50 75 275 400 200 101 49 -2500 -250 1750 3000 1000 10 -510 0.017 0.075 0.275 0.400 0.200 0.101 0.049 Year Scale 0 1 2 3 4 5 to Costs Benefits NPV 10% IRR S0 S1 S2 S3 S4 S5 S6 -3000 -4000 -5000 -6000 -7000 -8000 -9000 50 125 400 800 1000 1101 1150 50 125 400 800 1000 1101 1150 50 125 400 800 1000 1101 1150 50 125 400 800 1000 1101 1150 50 125 400 800 1000 1101 1150 -2500 -2750 -1000 2000 3000 3010 2500 0.017 0.031 0.080 0.133 0.143 0.138 0.128 5

Note: 6 • NPV of last increment to scale 0 at scale S5. i.e. NPV of scale 5 = 10. • NPV of project is maximized at scale of 5, i.e. NPV1-5 = 3010. • IRR is maximized at scale 4. • When the IRR on the last increment to scale (MIRR) is equal to discount rate the NPV of project is maximized.

Timing of Investments 7 Key Questions: 1.What is right time to start a project? 2.What is right time to end a project? Four Illustrative Cases of Project Timing Case 1. Benefits (net of operating costs) increasing continuously with calendar time. Investments costs are independent of calendar time Case 2. Benefits (net of operating costs) increasing with calendar time. Investment costs function of calendar time Case 3. Benefits (net of operating costs) rise and fall with calendar time. Investment costs are independent of calendar time Case 4. Costs and benefits do not change systematically with calendar time

Case 1: Timing of Projects: When Potential Benefits Are a Continuously Rising Function of Calendar Time but Are Independent of Time of Starting Project Benefits and Costs B (t) I D E rK A C B1 Time t0 t1 t2 rKt Bt+1 <> K rKt > Bt+1 Postpone rKt < Bt+1 Start K 8 Net Benefit of postponing in year 0 IDAC. Net Benefit of postponing in year 1 DEC

Case 2: Timing of Projects: When Both Potential Benefits and Investments AreA Function of Calendar Time Benefits and Costs B (t) D E rK0 A C B1 B2 0 Time t1 t2 t3 K0 K1 rKt >Bt+1+ (Kt+1-Kt) Postpone rKt < Bt+1 + (Kt+1-Kt) Start K0 F G K1 I H Net Benefit of postponing in year 0 ADEC - IFGH 9

Case 3: Timing of Projects: When Potential Benefits Rise and Decline According to Calendar Time Benefits and Costs SV B C rK I A rSV B (t) 0 Time t0 t1 tn tn+1 t* K0 K1 K2 K 10

The Decision Rule n n+1 n+1 n n+1 n+1 11 If (rSVt - Bt - ΔSVt ) > 0 Stop < 0 continue ΔSVt = SVt - SVt

Case 4: Timing of Projects:When The Patterns of Both Potential Benefits and CostsDepend on Time of Starting Project Benefits and Costs D Benefits From K1 C B A Benefits From K0 0 t0 t1 t2 tn tn+1 K0 K1 K0 K1 12