Insurance

190 likes | 373 Vues

Insurance. RB, p 30. Insurance is like marriage. You pay, pay, pay, and you never get anything back. Al Bundy The chief beneficiary of life insurance policies for young, single people is the life insurance agent. Wes Smith. Want to take out an insurance policy? Put in the right order:.

Insurance

E N D

Presentation Transcript

Insurance RB, p 30

Insurance is like marriage. You pay, pay, pay, and you never get anything back. • Al Bundy • The chief beneficiary of life insurance policies for young, single people is the life insurance agent.Wes Smith

Want to take out an insurance policy?Put in the right order: M contact an insurance agent or broker Gfile/submit a claim in case of an accident D consider the risks you face Adecide to insure sth. against an accident/ theft or damage (or: seek insurance cover) S receive compensation / indemnity Acontract an insurance policy and pay a premium for the insurance cover Ethe insurance company settles a claim Write the letters in the right order...

Want to take out an insurance policy?Put in the right order: D consider the risks you face Adecide to insure sth. against an accident/ theft or damage (or: seek insurance cover) M contact an insurance agent or broker A contract an insurance policy and pay a premium for the insurance cover Gfile/submit a claim in case of an accident Ethe insurance company settles a claim S receive compensation / indemnity DAMAGES or indemnity →RB, p 30

WHAT DO THEY DO? UNDERWRITER BROKER INSURER POLICY HOLDER LOSS ADJUSTER

WHO IS IT? The person charged with evaluating an insurance claim to determine the insurance company's liability under the terms of an owner's policy.

WHO IS IT? The person who evaluates the risk and exposures of potential clients. S/he decides how much coverage the client should receive, how much they should pay for it, or whether even to accept the risk and insure them.

WHO IS IT? A person or organization that has an insurance policy. S/he receives the specific types of coverage (life, health, etc.) stated in the policy, subject to the payment of premiums, usually on a monthly basis.

WHO IS IT? The party to an insurance arrangement who undertakes to indemnify for losses.

WHO IS IT? The person who works with many insurance companies to find the very best available policies for his or her clients.

Pair the halves of sentences: • 1. It is important to keep the value of your policy • 2. Make sure you get insured • 3. When you say what you want your insurance to cover, • 4. If an accident does happen, • 5. If the company agrees to your claim, • a) you make a claim to the insurance company. • b) against accidents. • c) you receive compensation. • d) then the broker will tell you which policy you could take out. • e) closely linked to the value of your property.

1. It is important to keep the value of your policy closely linked to the value of your property. • 2. Make sure you get insured against accidents. • 3. When you say what you want your insurance to cover, then the broker will tell you which policy you could take out. • 4. If an accident does happen, you make a claim to the insurance company. • 5. If the company agrees to your claim, you receive compensation.

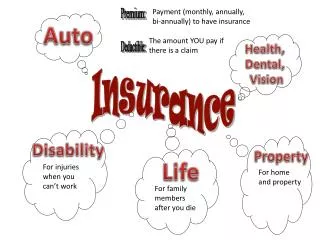

Where does your premium go? claims overheads pool of premiums investments industry government individuals profits

Describe the graph! • As can be seen from the graph, thousands of people pay _____________ to insurance companies, which use the money to pay ____________, fixed and variable costs. The rest of the pool of premiums can be ______________ in the form of lending to ___________, ___________, or _____________ in order to earn _____________. In this way insurance companies become large institutional investors that place great sums of money in various securities.

Describe the graph! • As can be seen from the graph, thousands of people pay premiumsto insurance companies, which use the money to pay overheads, fixed and variable costs. The rest of the pool of premiums can be invested in the form of lending to industry , government, or individuals in order to earn profit. In this way insurance companies become large institutional investors that place great sums of money in various securities.

Lloyd’s tsunami exposure limited (R, p40) • Explain the headline in simple terms! • Explain the following: - unscathed - property claims - limited/minimal exposure - reinsurers - penetration of insurance - insured losses - insurance spent per head - exclusions for “acts of God” - the worst on record in terms of... - softening of premium rates Optional hw: STRUCTURED NOTES

VOCABULARY • unscathed – not harmed or injured • reinsure – to share the insurance of something between two or more insurance companies • penetration (of insurance) – MARKETING – how much of a particular market insurance sales cover • exposure – the amount of money (the insurance) company risks losing • property claims – insurance claims for property that has been damaged • soft (premium) rates – falling because supply exceeds demand ( = a soft insurance market)

Revision: fill in the missing prepositions • face risk / face a risk ____ fire • insure ______ risk / burglary / theft / injury • to be covered _______ loss • two parties ____ an insurance contract • receive money ____ premiums • pay money ____ compensation • penetration ___ insurance • worst year ___ record • big number ___ insurance terms • compared ____ $ 2000 ___ head • exclusions ____ “acts ___ God” • an analyst ___ Numis Securities / PBZ / CNB

Revision – fill in the missing prepositions • face risk / face a risk of fire • insure againstrisk / burglary / theft / injury • to be covered against loss • two parties toan insurance contract • receive money inpremiums • pay money in compensation • penetration of insurance • worst year onrecord • big number in insurance terms • compared to $ 2000 per head • exclusions for “acts ofGod” • an analyst at Numis Securities / PBZ / CNB BREAK