May 2001

220 likes | 375 Vues

Business Information Markets. Presentation to . National Online 2001. Presentation by Kenneth B. Marlin Managing Director. May 2001. Business Information Markets. Where are we? What happened? Where are we headed? What to do to take advantage?. Where are we?.

May 2001

E N D

Presentation Transcript

Business Information Markets Presentation to National Online 2001 Presentation by Kenneth B. Marlin Managing Director May 2001

Business Information Markets Where are we? What happened? Where are we headed? What to do to take advantage?

Where are we? Over the past 12 months many content-oriented firms have seen significant decreases in market value. At least 500 Public Companies have seen 90% plus declines in Market Value Source: Bridge

Traditional Content Companies have not been immune to Cutbacks and Layoffs CBS – Market Watch Conde Nast Disney – Go.com Dow Jones – Interactive Forbes.com Hearst – Woman.com NY Times – Digital Primedia - Intertec

Business Models are in Question: B2C B2B Subscriptions Advertising CPMs Metrics

Money seems to have dried up • Venture Equity • Banks • Junk Bonds 300+ Dot Coms have Shut Down in 4 months

Business Information • What Happened?

Veronis Suhler & Associates • Merchant Bank Founded in 1981 – – 20 years • Solely Dedicated to Information Media and Communications • Largest Firm in the Field – – 125 People – New York & London • Two Primary Functions • M & A Advisory • Private Equity Investing ($1 Billion LBO Fund)

Unique Combination of Skills MEDIA-EXPERIENCED INVESTMENT BANKING AND LENDING PROFESSIONALS PAST OWNERS & SENIOR EXECUTIVES OF MAJOR COMMUNICATIONS COMPANIES JP MORGAN CHASE & COMPANY CBS Publishing Group DRESDNER KLEINWORT WASSERSTEIN JAMES D. WOLFENSOHN EXXON VENTURE CAPITAL

Business Information Industry is still Healthy • 2000 Business Info. Expenditures ($ Millions) $44,200 • Growth Rate in 2000 7.3% • 1995 – 2000 Compound Annual Growth (%) 7.6% • Annual Increase in Spending ($ Millions) $3,000 • Operating Cash Flow Margins 28% Source: Veronis Suhler, The Publishing & Media Group

What Happened – Some Dot Coms Forgot the Basics • Accounting Profit must equal Cash Profit over the long term • Real Cash Profit = Cash in (Revenue) – Cash out (Costs) • Revenue = Price x Quantity • Price must be rational • TV = $17 CPM • Outdoor = $2 CPM • Banner = $30 CPM • Quantity must be Rational • How big is the Pie? • What is the Value Proposition? • Value = Present Value of Expected Future Cash

What Happened? – Bad Assumptions! • 90% is Not Good Enough • Adoption of New Technology takes time • Brand building takes a lot of time (and money) • Customers’ Willingness to pay cash is based on a Value proposition • People don’t WANT to change – they need a good reason • First Mover is not a Barrier to entry and may be disadvantage • Competitors will react – even old media ones • Success invites new participants • Valuations based on metrics other than expected future cash flow are not real

Economic Environment has contributed • Veronis Suhler expectslittle growth during first half 2001 as energy prices and inventories remain high, consumer confidence remains low • VS&A expects the US Economy to pick up by 3rd Quarter as interest rate cuts kick in, energy prices stabilize, inventories balance, and consumer confidence returns • VS&A expects Nominal GDP and Real GDP to drop to 4.7% and 2.9% (CAGR), respectively. Forecast Veronis Suhler Communications Industry Forecast, 2001 - (Pre Publication) Bureau of Economic Analysis, March 2001

Business Information • Where Are We Headed?

Over the next five years, VS&A expects Rate of Growth for Business Information Services Spending to slow to 6.9% • From 1996 to 2000 BIS Spending increased at a 7.6% CAGR Forecast $ Billions $80.0 $60.0 $50.0 $40.0 $30.0 $20.0 $10.0 $0.0 1996 1997 1998 1999 2004 2005 2000 2001 2002 2003 Veronis Suhler Communications Industry Forecast, 2001, (Pre Publication)

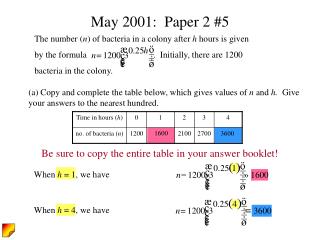

Year Spending Nominal GDP 1996 8.4 5.6 1997 7.5 6.2 1998 7.1 5.5 1999 7.7 5.7 2000 7.3 7.1 2001 7.1 4.5 2002 7.0 5.7 2003 7.0 5.5 2004 6.9 5.2 2005 6.8 5.0 Business Information Services Spending Should Continue to Exceed Nominal GDP Growth Business Information Services Source: Veronis Suhler, The Publishing & Media Group

By 2005, Total BIS Market Should Exceed $60 BillionMarketing and Financial Information Will Continue to Lead 1995-2000 CAGR 2000-2005 CAGR • 8.2% • 7.6% • 6.2% • 8.5% • 7.0% • 8.2% • Marketing • Economic & Financial • Credit • Payroll & Human Resources • Product & Price • General Business • 7.9% • 8.1% • 6.3% • 6.8% • 6.0% • 8.3% Veronis Suhler Communications Industry Forecast, 2001 (Pre Publication)

Bertelsmann McGraw Hill Bloomberg Pearson Dun & Bradstreet Primedia Dow Jones Reed Elsevier Gartner Reuters Hoover’s Thomson Hearst VNU Reed Elsevier reported $650 mm in “Internet” delivered Revenue in 2000 up from $180 mm Subscription Models Rule “e”-Content Continues To Be Integrated by Traditional Business Information Firms

On-Line Advertising Is Not Dead, but it is concentrating • $6 Billion forecast to be spent in 2001 – $4.6 Billion in 1999 – $7.7 Billion spent in 2000 • Long term trend is up • All sites are not created equal • AOL gets 45% of on-line Ad revenue – Top 9 Publishers get nearly 84% of Revenue • Depth, and Demographics count • Measured Effectiveness is required

Non-Strategic (Financial) Investment is Available But Investors are demanding • Careful Strategic Business Plan • Rational Revenue Model • Clear Competitive Advantage • Close Control of Costs • Reasonable Path to Profit – – near team milestones • Sane Valuations based on revenue and cash flow

Last Minute Advice For Those Looking For Money • Forget What Your theoretical Value “Was” • Market is much closer to Rational Now • A very few firms over-corrected • Some will fall farther • Real Cash Profit counts • Everybody says they are going to be profitable in six months • Deals are moving slowly – – Six Months + • Be proactive – – Right now, mergers often are easier than cash sales

Business Information • Questions & Answers • Kenneth B. Marlin • Veronis Suhler & Associates • 350 Park Avenue • New York, NY 10022 • marlink@veronissuhler.com