1. BACKGROUND

280 likes | 430 Vues

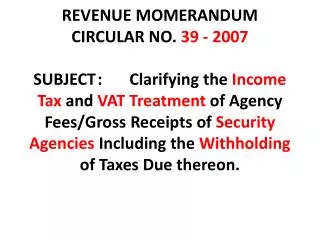

REVENUE MOMERANDUM CIRCULAR NO. 39 - 2007 SUBJECT : Clarifying the Income Tax and VAT Treatment of Agency Fees/Gross Receipts of Security Agencies Including the Withholding of Taxes Due thereon. 1. BACKGROUND

1. BACKGROUND

E N D

Presentation Transcript

REVENUE MOMERANDUM CIRCULAR NO. 39 - 2007SUBJECT : Clarifying the Income Tax and VAT Treatment of Agency Fees/Gross Receipts of Security Agencies Including the Withholding of Taxes Due thereon.

1. BACKGROUND For income tax purposes, all sellers of services, as well as sellers of goods or properties, may adopt either the cash basisoraccrual basisas their accounting method for reporting income. This means that the timing of the imposition of the tax depends on the accounting method employed by the taxpayer.

However, for VAT purposes, seller of services, including security agencies, have to be taxed solely on a cash basis – that is upon actual or constructive receipt of the income because the VAT on sale of services is specifically imposed by law on the taxpayer’s gross receipts.

But in order that an amount received will form part of gross receipts, the same must constitute the gross income of the taxpayer when received or earned. Hence, if something is received by a taxpayer but the amount received does not or will not form part of its gross income (i.e., receipt of money constituting a loan or liability), the same cannot be part of its gross receipts subject to VAT.

ISSUE: The issue that comes into fore is whether or not the security guard’s salaries, which form part of the Contract Price of the security services rendered by the Security Agency, which will constitute as part of the taxable gross receipts subject to VAT, whether actually or constructively received.

“PAST TENSE RULINGS” (1981, 1985, 2002)In several rulings issued by the Bureau, it has been consistently maintained that salaries of the security guardsform part of the taxable gross receipts of a security agency. As cited in BIR Ruling Nos. 69-02, 049-85 and 271-81, the reason for this is “that the salaries of the security guards are actually the liability of the agency and that the guards are considered their employees; hence, for percentage tax purposes, the salaries of the security guards are includible in its gross receipts.”

However, technically speaking, the salaries of the security guards are being paid for by the principals or clients of the Security Agency. Under Section 6 of RA No. 6727 (The Wage Rationalization Act) amending PD No. 442 (The Labor Code of the Phils.), the liability of the security agencies for the prescribed increases in the wage rates of workers are explicitly required to be borne by the principals or clients of the service contractors (e.g. Security Agency), with the latter (Security Agency) being made jointly and severally liable for the same, but only in the event that the principal or clientfails to pay the prescribed wage rates, to wit:

Section 6. In the case of contractors for construction projects and for security, janitorial, and similar services, the prescribed increase in the wage rates of the workers shall be borne by the principals or clients of the construction/service contractors and the contract shall be deemed amended accordingly. In the event, however, that the principal or client fails to pay the prescribed wage rates, the construction/service contractor shall be jointly and severally liable with its principal or client.”

Furthermore, under Section 1, Rule XIV of the 1994 Revised Rules and Regulations implementing RA No. 5487, as amended, which governs the “Organization and Operation of Private Security Agencies and Company Security Forces throughout the Philippines,” it is so provided that:

Section 1. Compensation. – No watchman, security guard or private detective shall be paid salary or compensation less than prescribed by existing laws, rules and regulations including those that may be promulgated relative thereto. The amount prescribed therein shall be earmarked and set aside for the purpose aforestated; thus, the same shall thereafter be segregated from the monies received by the agency from its clients as an amount reserved for the remuneration of the guard or detective.

Clearly, the Security Agency has no control or dominion over that portion of the payment received from its Client which is intended or earmarked as salaries of the security guards. The Security Agency does not own the funds such that it cannot use it for any other purpose like payment of rentals, utilities, taxes and other expenses. It is now settled that only receipts which is subject to a taxpayer’s unfettered command and which he is free to enjoy at his option is taxed to him as his income whether he sees fit to enjoy it or not. (Corliss v. Bowers, 281 U.S. 376)

In view of the clear language of the law and its implementing regulations placing the primary obligation on the Client to pay the salaries of the security guards coupled with the requirement that the monies received by the Security Agency representing salaries shall be earmarked and segregated for the said guards, the amount paid by the Client the salaries of the security guardswill notform part of the Security Agency’s gross income, and neither will it form part of its taxable gross receipts when actually or constructively received. This peculiarity obviously places the Security Agency on a tax situation different from other service providers.

INCOME TAX TREATMENTSecurity Agency (Vigilant Security)For Security Agency must record as part of its gross income the Agency Feeportion of the payment, net of the VAT thereon. Since the security guards salaries are tacked in as part of the service fees, the Security Agency must always recognize that portion (salaries) of the fees as a LIABILITY.

For this purpose, the Contract for Security Services entered into by and between the Security Agency and its Client must provide for a breakdown of the amount of security services into 2 components: (1) the Agency Fee, and (2) the Security Guards’ salaries.

CAVEAT (BEWARE)If the Contract does not provide for a breakdown of the amount payable(1) Agency Fee (2) Security Guards’ salaries, to the Security Agency, the entire amount representing the Contract Price will be taxed as income to the Agency, which must form part of its gross receipts, whether actually or constructively received.

Assume that Vigilant Security Agency, Inc. was contracted by Tanzo Jewelry Corp. to provide security services in the latter’s store. The contract price on a monthly basis is P18,000 broken down into: Security Guards salaries of P14,179.08 and Agency Fee of P3,411.54 and Output Tax of P409.38. Entry:Cash P17,931.77Prepaid Income Tax 68.23(2% X P3,411.54)(advanced income tax Form 2307)Service Income P3,411.54Output Tax 409.38Due to Security Guards (liability) 14,179.08

The Security Agency which is the trustee of the funds segregated and earmarked as salaries of the security guards is the withholding agent for purposes of the withholding tax on compensation income. Upon payment of the security guards’ salaries, the Security Agency shall record the same as follows:Entry:Due to Security Guards (liability)P14,179.08 Cash P12,637.11 Withholding Tax Payable 1,541.97

Client of Security Agency (DMCI)The client(DMCI) who is engaged in business can claim as a deduction (EXPENSE) from gross income the total amount paid to the Security Agency, net of the VAT on the Agency Fee. It is allowed to recognize an Input Tax based on Agency Fee if the transaction is covered by a VAT O.R. issued by the Security Agency. It is also required to withhold and remit the Expanded Withholding Tax (EWT) on the Agency Fee. The portion of the expense pertaining to the security guards’ salaries will be covered by a NON-VAT Acknowledgment Receiptissued by the Security Agency (VIGILANT).

Entry of Client (DMCI): (To recognize Expense)Security Services-Agency Fee P3,411.54Security Services-Salaries of SG 14,179.08Input Tax (P3,411.54 X 12%) 409.38Cash P17,931.77Withholding Tax Payable 68.23(2% X P3,411.54 top 20,000 corp.) (DMCI is the withholding agent and shall issue the BIR Form 2307)

VAT TREATMENTSecurity Agency (VIGILANT)For VAT purposes, the taxable gross receipts of the Security Agency pertains to the amount actually or constructively received by it constituting its gross income. Since only the amount covering the Agency Fee represents its gross income, then that portion alone of the Contract Price, when actually or constructively received, will constitute the Security Agency’s taxable gross receipts.

Security AgencyThis means that the amount received by the Security Agency (VIGILANT) which will be segregated, earmarked or set aside for the salaries of the security guards will not form part of its gross receipts but should be recognized as a LIABILITY.Accordingly, the 12% Output Tax will be computed on the Agency Fee of the Security Agency (VIGILANT) which shall in turn the Input Tax of its client (DMCI).

Client (DMCI)Only the portion of the payment of the Agency Fee if covered by a VAT O.R. will entitle the VAT registered client (DMCI) to a claim of Input Tax credit. This means that the amount of output tax paid by the Security Agency (Vigilant) is the amount of input tax available to the client (DMCI). The client (DMCI) cannot claim an Input Tax on the salary portion of the expense (Security Services Expense-Salary of SG) because it pertains to services exempt from VAT under Section 109(I) of the Tax Code (employer-employee relationship)

Receipts issued for the entire contract price Pursuant to Section 113 (invoicing and accounting requirement of a VAT registered TP) of the NIRC as implemented by RR 16-2005, as amended, the Security Agency (Vigilant) shall issue a VAT O.R. for every sale, barter or exchange of services. The VAT O.R. shall cover the entire amount which the client (DMCI) pays to the Security Agency (Vigilant) representing the compensation of its services, Agency Fee, plus VAT.

The Security Agency (Vigilant) shall issue a NON-VAT Acknowledgment Receipt to the client (DMCI) representing the salaries of the Security Guards.A notarized certification of the EWT shall be a sufficient substantiation for the expense that will be claimed as a deduction from gross income of the client (DMCI).

WITHHOLDING TAX COMPLIANCE“All income payments which are required to be subjected to withholding tax of income tax shall be subject to the corresponding withholding tax rate to be withheld by the person having control over the payment and who, at the same time, claims the expenses.” (Revenue Regulations No. 2-98, as amended by RR 30-03.)

The client (DMCI) is constituted as the withholding agent of the EWT. However, the portion of the Contract Price representing the salaries of the Security Guards, the Security Agency (Vigilant) shall be the one responsible for the withholding tax on compensation. This is because while the client (DMCI) who claims the payment of the salary as an expense under Section 34(K), it is the Security Agency (Vigilant) who physically controls the payment to the salaries of the Security Guard.

A Notarized Certification must be furnished by the Security Agency (Vigilant) to the client (DMCI) indicating the names of the guards employed by the client (DMCI), their TINs, the amount of salaries and tax withheld.This Notarized Certification together with the NON-VAT Acknowledgment Receipt must be kept by the client (DMCI) as substantiation for the claim of the expense.

The above requirement is without prejudice to the provisions of RR 2-2006 mandatorily requiring the filing and submission of the Monthly Alphalist of Payees (MAP) and Summary Alphalist of Withholding Agents (SAWT).