Market Structure

520 likes | 1.22k Vues

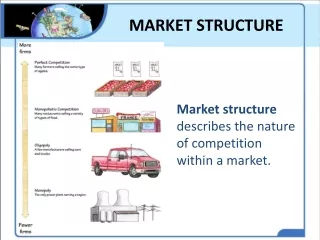

Market Structure. Market Structure. Market structure – identifies how a market is made up in terms of: The number of firms in the industry The nature of the product produced The degree of monopoly power each firm has The degree to which the firm can influence price Profit levels

Market Structure

E N D

Presentation Transcript

Market Structure • Market structure – identifies how a market is made up in terms of: • The number of firms in the industry • The nature of the product produced • The degree of monopoly power each firm has • The degree to which the firm can influence price • Profit levels • Firms’ behaviour – pricing strategies, non-price competition, output levels • The extent of barriers to entry • The impact on efficiency

Types of Market Structure • Perfect Competition • Monopoly • Monopolistic Competition • Oligopoly

Market Structure Perfect Competition Pure Monopoly Greater degree of monopoly power More competitive

Features • Large number of buyers and sellers • Homogeneous products • Perfect mobility of factors of production • Free entry & free exit of firms • Perfect knowledge • Absence of collusion or artificial restaraint • No govt. intervention

Price determination under perfect competition is analyzed under three different time periods: • Market period or very short run • Short run • Long run

Pricing in “Market Period” Supply determined Price Demand determined Price

Pricing in the “Short Run” Firm industry

Pricing in the “Long Run” Firm Industry

Monopoly • Only one seller of a particular product

Characteristics of Monopoly • Single Producer • No close substitute • Inelastic demand curve • Price Maker • Barriers to entry • Legal restrictions or barriers to entry of other firms • Control over key raw material • Examples: Public utilities – telephones and electricity etc.

Pricing & Output Decision: Monopoly Costs / Revenue Given the barriers to entry, the monopolist will be able to exploit abnormal profits in the long run as entry to the market is restricted. AR (D) curve for a monopolist likely to be relatively price inelastic. MC 7.00 Monopoly Profit AC 3.00 AR MR Output / Sales Q1

Price Discrimination • It refers to discrimination of price for different consumers on the basis of their income or purchasing power, geographical location, age, sex, colour, marital status, quantity purchased, time of purchase etc. for eg:- • Physicians and hospitals • Merchandise sellers • Railways and Airlines • Cinema shows or musical concerts • Domestic and foreign markets

Necessary conditions • Different Markets must be separable for a seller • The Elasticity of demand must be different in different markets • There must be imperfect competition in the market • Profit maximizing output should be larger than the quantity demanded in a single market or section of consumers

First Degree of Price Discrimination Costs / Revenue S P 0 D Q Output / Sales

Second Degree of Price Discrimination Costs / Revenue S P1 P2 P3 P 0 D Q1 Q2 Q3 Q Output / Sales

Third Degree of Price Discrimination Costs / Revenue Market B Total Market Market A MC PB PA AR=D ARA ARB MRB MRA MR Q 0 QA 0 QB 0 Output / Sales Output / Sales Output / Sales

Features: • Large no. of sellers • Free entry & free exit • Perfect factor mobility • Complete dissemination of market information • Differentiated product

Monopolistic vs. Perfect Competition • Differentiated & Homogeneous products • Decision making

Non Price Competition: Selling Cost • Two common forms of non price competition are • Product Innovation • Advertisement

Oligopoly Ipod Zune

Oligopoly Few producers control supply and price

Characteristics of Oligopoly • Small number of sellers • Homogenous or differentiated products • Interdependence of decision making • Barriers to entry • Indeterminate price and output • Examples : Aluminum, steel, cigarettes, cars etc

d1 is relatively elastic d2 is relatively inelastic

The kinked demand curve indicates the possibility of price rigidity

Changes in cost do not impact output and prices as long as MC remains in the vertical portion of MR

Price Leadership Models • Sometimes, a Leading role is played by the dominant firm due to its size, efficiency, economies of scale or firm’s ability to forecast market conditions accurately. It initiates a change in price and other small firms follow. • The dominant firm may also serve as a means to price discipline and price stabilization which is knows as “Effective Price leadership”

Price Leadership by Low Cost Firm Costs / Revenue MC’ P3 AC’ P2 MC AC E’ P1 E AR MR 0 Q1 Q2 Output / Sales

Price Leadership by Dominant Firm Cost/Revenue Cost/Revenue D S MCD E P3 P3 A B P P’ P’ C F P2 P2 P1 P1 DM DD QD 0 MRD 0 Output/Sales Output/Sales

Barometric Price Leadership The barometric Firm may not necessarily be the largest firm but it is supposed to have a better knowledge of the prevailing market conditions. Advantages: • Better Price • Dependence • Reaction to Economics warfare

Collusion Model : The Cartel A cartel is an association of business firms formed by an explicit agreement between them. They jointly establish a cartel organization to: • Make Price and output decisions • Establish Production Quotas. • Supervise market activities of the firms.

Market Allocation under Cartel Costs / Revenue Firm B Industry Firm A ac1 MC mc1 ac2 mc2 P C AR=D MR 0 q1 0 q2 0 Q Output / Sales Output / Sales Output / Sales