International Payment

470 likes | 1.35k Vues

International Payment. Presentation Outline Cash Advance Letters of Credit (L/C) Documentary Collections Open Account. Trade Statistics.

International Payment

E N D

Presentation Transcript

International Payment Presentation Outline • Cash Advance • Letters of Credit (L/C) • Documentary Collections • Open Account

Trade Statistics • According to U.S. Department of Commerce (October, 1999), U.S. exports to Taiwan amounted to U.S.$ 10.466 billion from January to July of this year, while during the same period only U.S.$ 7.466 billion worth of American products were sold to mainland China. • The United States exported 1.4 times more goods to Taiwan than to the mainland. Mainland China is, however, 265 times the geographical size of Taiwan with a population 58 times larger.

Cash in Advance • Buyer pays before shipment • Used in new relationship • Transactions are small and buyer has no choice • Maximum security to sellers • No guarantee that goods are shipped

Draft: • A bill of exchange-- an unconditional promise drawn by party (exporter), instructing the importer (buyer) to pay the face amount of the draft upon presentation

Letters of Credit • What is L/C? • A document issued by a bank stating its commitment to pay someone (seller or exporter) a stated amount provided the seller or exporter meets specific terms and conditions • also called the documentary letters of credit • Most common payment method in international trade

International Methods of Payment: Advantages and Disadvantages

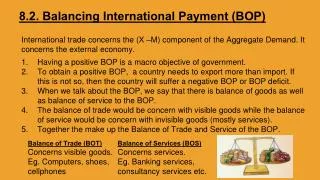

Methods of Payment Risk Protection Buyer Max Min Con- firmed Uncon- firmed Sight Draft Time Draft Max Min Seller Cash in Advance Letter of Credit Documentary Collection Open Account

Steps in Obtaining L/C • Buyer and seller agree on the terms of a sale, seller requests buyer to arrange for his bank to open a L/C • The buyer’s bank (issuing bank) prepares a L/C • The buyer’s bank then sends the L/C to its corresponding bank (buyer’s bank), which is called the advising bank • The advising bank forwards the L/C to the buyer for approval-- terms can be amended • After final terms (agreed), goods shipped

L/C (continued) • Shipping documents • Bill of Lading: • title document- • contract between carrier and shipper • shipper’s receipt of the goods • document assigns control of goods • Commerce Invoice: • description of the product, price and others

Packing list: • outlines things to be filled • Certificate of Insurance • Certificate of Origin

Documentary Credit Procedure (1) Contract of Sale Buyer (Importer) Seller (Exporter) (5) Delivery of Goods (2) Request to Provide Credit (8) Documents & Claim for Payment (4) Letter of Credit Delivered (6) Documents Presented (7) Documents Presented to issuing Bank Importer’s Bank (Issuing Bank) Correspondent Bank (9) Payment (3) Credit Sent to Correspondent

Irrevocable Documentary (Commercial) Letter of Credit (L/C) Advised or Confirmed

Documentary Letter of Credit • Conditional, legal obligation of bank to pay beneficiary • Bank places its internationally accepted credit rating before customer’s • Eliminates commercial risk

Principal Parties to Letter of Credit • Applicant (importer/buyer/account party) • Beneficiary (exporter/seller) • Issuing Bank (guarantor) • Correspondent Bank

Use a Letter of Credit to Seller when: • Credit standing of buyers is uncertain • Your ability to absorb risk is low • Merchandise is custom-made or high value • Economic, political conditions unstable • Use does not harm you competitive stand

To the seller,having a Letter of Credit means: • Issuing bank eliminates commercial risk of buyer • Confirmation eliminates economic, political, foreign bank risk • Streamlines pre-export financing

To the buyer,having a Letter of Credit means: • Payment made upon full compliance of L/C term • Possible import/export financing (bankers’ acceptance) • Buyer must tie up credit availability (potential loan)

The life of a Typical Banker’s Acceptance 1. Purchase Order Mr. Susuki (Exporter) Mr. Jones (Importer) 5. Shipment of Cars Prior to B/A Creation 10. Signed Promissory Note for Face Value of B/A 6. Shipping Documents &TimeDraft 9. Payment-Discounted Value of B/A 9. Payment - Face Value of B/A At and just after B/A Creation 4. L/C Notification 2. L/C Application 6. Shipping Documents At maturity date of B/A 3. L/C 7. Shipping documents & Time Draft American Bank Japan Bank Draft Accepted (B/A Created) 8. Payment - Discounted Value of B/A 15. B/A Presented at Maturity 16. Payment - Face Value of B/A Money Marker Investor 13. Payment-Discounted Value of B/A 12. B/A

Where We Go Wrong: • L/C expired • Late shipment • Documents discrepancy • Amount differs with invoice • Amount in excess of L/C • Signatures missing • Drawn on wrong party

Where We Go Wrong Commercial Invoices • Good description differs from L/C • Extension of cost wrong • Partial shipment not authorized • Term of shipment missing

Where We Go Wrong Insurance Certificates • Required risks not covered • Amount of coverage not enough • Currency not consistent with L/C • Effective date later than bills of lading

Exporter Trouble Shooting • Can you meet documentary requirements • Can you meet shipping/expire/dates? • Is description of goods accurate? • Are names and addresses correct?

Exporter Trouble-Shooting • Is credit irrevocable? • Is credit confirmed? • Is credit amount correct? • Is credit tenor correct? • Is L/C negotiable?

A Letter of Credit Does Not: • Replace a contract • Substitute for buyer’s confidence in seller and vice versa • Constitute a guarantee of performance • Assure payment if an condition not meet

Advantages to both parties: • Flexible document • Governed by internationally accepted set of rules The Uniform Customs and Practice for Documentary Credits (The UCP)

Problems of L/C • Shipping schedule is not met • stipulations concerning freight cost are unacceptable • price is insufficient due to FX rate changes • unexpected quantity of product • description of product insufficient or too detailed • documents are impossible to obtain specified in L/C

Documentary Collections (DC) • Three Types of DC • Documents against Payment (D/P) • Documents against Acceptance (D/A) • Collection with Acceptance (Acceptance D/P)

Documents against Payment (D/P) • Buyer may only receives the title and other documents after paying for the goods • Documents against Acceptance (D/A) • the buyer may receive the title and other documents after signing a time draft promising to pay at a later date. • Acceptance Documents against Payment(Acceptance D/P) • the buyer signs a time draft for payment at a later date. Goods remain in escrow until payment is made

Why DC? • Easier to use and lower bank fee • collection procedure entails risk • Conditions to use DC • No doubt on buyer’s integrity • buyer’s country is stable and safe • No foreign exchange control • goods are marketable (exporter resell goods)

DC Procedure • Exporter ships the goods • exporter forwards the documents to seller bank (remitting bank),which in turns gives the document to the buyer’s bank (collecting bank) • Collecting bank informs the importer the conditions of the document or contract

Export Incentive Programs • Export-Import Bank of the U.S. (Exim-Bank) • set up in 1934 • to facilitate finance and export of American goods and services and maintain American companies in oversea market • offers programs like guarantees, bank insurance and export credit insurance • Foreign Export Credit Insurance • provide insurance to exporters (nonpayment and preshippment risk • Small Business Administration (SBA) • provide business loans and financing for small companies

Export Incentive Programs • Commodity Credit Corporation (CCC) • provide assistance in production/marketing of US agricultural products overseas • Overseas Private Investment Corporation(OPIC) • formed in 1971 • insuring direct US investments in foreign countries • provide medium and long-term financing • Private Export Funding Corporation (PEFCO) • consortium of commercial banks and industrial companies • provides medium to long-term financing to foreign buyers • United States Export Assistance Center (USEAC)