Mergers & Acquisitions

180 likes | 883 Vues

Mergers & Acquisitions. Prof. Ian Giddy New York University. Mergers and Acquisitions. Mergers & Acquisitions Divestitures Valuation Concept: Is a division or firm worth more within the company, or outside it?. Corporate Finance. CORPORATE FINANCE DECISONS. INVESTMENT. FINANCING.

Mergers & Acquisitions

E N D

Presentation Transcript

Mergers & Acquisitions Prof. Ian Giddy New York University

Mergers and Acquisitions • Mergers & Acquisitions • Divestitures • Valuation Concept: Is a division or firm worth more within the company, or outside it?

Corporate Finance CORPORATE FINANCE DECISONS INVESTMENT FINANCING RISK MANAGEMENT PORTFOLIO MEASUREMENT CAPITAL DEBT EQUITY TOOLS M&A

Principles of Financial Management • Invest in projects that yield a return greater than the minimum acceptable hurdle rate. • The hurdle rate should be higher for riskier projects and reflect the financing mix used - owners’ funds (equity) or borrowed money (debt) • Returns on projects should be measured based on cash flows generated and the timing of these cash flows; they should also consider both positive and negative side effects of these projects. • Choose a financing mix that minimizes the hurdle rate and matches the assets being financed. • If there are not enough investments that earn the hurdle rate, return the cash to stockholders. • The form of returns - dividends and stock buybacks - will depend upon the stockholders’ characteristics • Minimize unnecessary financial risks. Objective: Maximize the Value of the Firm

The Market for Corporate Control When you buy shares, you get dividends; and potential control rights There is a market for corporate control—that is, control over the extent to which a business is run in the right way by the right people. This market is constrained by • Government • Management • Some shareholders Example: Allied Signal’s attempts to acquire AMP, which is located in Pennsylvania

The Market for Corporate Control • M&A&D situations often arise from conflicts: • Owner vs manager ("agency problems" • Build vs buy ("internalization") • Agency problems arise when owners' interests and managers' interests diverge. Resolving agency problems requires • Monitoring & intervention, or • Setting incentives, or • Constraining, as in bond covenants • Resolving principal-agent conflicts is costly • Hence market price may differ from potential value of a corporation

“Internalization”: Is an activity best done within the company, or outside it? Issue: why are certain economic activities conducted within firms rather than between firms? • As a rule, it is more costly to build than to buy—markets make better decisions than bureaucrats • Hence there must be some good reason, some synergy, that makes an activity better if done within a firm • Eg: the production of proprietary information • Often, these synergies are illusory

Takeovers as a Solution to “Agency Problems” • There is a conflict of interest between shareholders and managers of a target company—Eg poison pill defenses • Individual owners do not have suffcient incentive to monitor managers • Corporate takeover specialists, Eg KKR, monitor the firm's environment and keep themselves aware of the potential value of the firm under efficient management • The threat of a takeover helps to keep managers on their toes—often precipitates restructuring.

Goal of Acquisitions and Mergers • Increase size - easy! • Increase market value - much harder!

Value Changes In An Acquisition Taxes on sale of assets 10 40 Profit on sale of assets Synergies and/ or operating improvements Value of acquired company as a separate entity Value of acquiring company without acquisition Takeover premium 30 50 Gain in shareholder value 50 75 250 175 Initial value plus gains Final value of combined company

Goals of Acquisitions Rationale: Firm A should merge with Firm B if [Value of AB > Value of A + Value of B + Cost of transaction] • Synergy • Gain market power • Discipline • Taxes • Financing

Goals of Acquisitions Rationale: Firm A should merge with Firm B if [Value of AB > Value of A + Value of B + Cost of transaction] • Synergy • Eg Martell takeover by Seagrams to match name and inventory with marketing capabilities • Gain market power • Eg Atlas merger with Varity. (Less important with open borders) • Discipline • Eg Telmex takeover by France Telecom & Southwestern Bell (Privatization) • Eg RJR/Nabisco takeover by KKR (Hostile LBO) • Taxes • Eg income smoothing, use accumulated tax losses, amortize goodwill • Financing • Eg Korean groups acquire firms to give them better access to within-group financing than they might get in Korea's undeveloped capital market

M&A Program Must be Part of Long-Range Strategic Planning: • What’s our business? Company’s capabilities and limitations? Our mission? • Key trends in the business environment? • Corporate flexibility to meet critical changes and challenges? • Competitive analysis? • Relationships with suppliers, customers, complementary firms? • Internal performance measurement system? Reward system? • Organization and funding for implementation? • Where do we want to go, and how are we going to get the resources to get there? Example: Merrill Lynch and the Internet

Developing an Acquisition Strategy • Define your acquisition objectives • Establish specific acquisition critieria • Select a good team of advisors • Focus on the company’s “wish list” • Is it the right target? • Is the market going to like the deal? Why? • What is the business vision that justifies it? • How much dilution is the buyer’s stock price will there be? • What will it take after the deal to make it work? Example: Ciba SC and Allied Colliods

Rigorous Search Procedures • What are our weaknesses and how do we have to improve? • What companies can help us or how can we help them? • How can we build a group of complementary business groups that will give strength to one another? Example: IBM and e-commerce

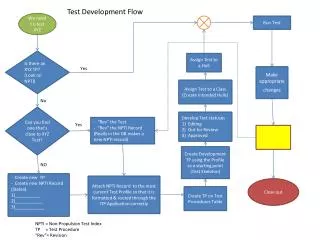

Steps in a Successful Merger and Acquisition Program - Step 1 and 2 1. Manage preacquisition phase • Instruct staff on secrecy requirements • Evaluate your own company • Identify value-adding approach Understand industry structure, and strengthen core business Capitalize on economics of scale Exploit technology or skills transfer 2. Screen Candidates • Identify knockout criteria • Decide how to use investment banks • Prioritize opportunities • Look at public companies, divisions of companies, and privately held companies

Steps in a Successful Merger and Acquisition Program - Step 3 to 5 3. Value remaining candidates • Know exactly how you will recoup the takeover premium • Identify real synergies • Decide on restructuring lan • Decide on financial engineering opportunities 4. Negotiate • Decide on maximum reseervation price and stick to it • Understand background and incentives of the other side • Understand vlue that might be paid by a third party • Establish negotiation strategy • Conduct due diligence 5. Manage postmerger integration • Move as quickly as possible • Carefully manage the process

Case Study: Sterling Drug Questions: • What was Kodak’s acquisition strategy? • What was the motivation for the bid for Sterling Drug? • What were the potential sources of synergy? • What would you expect to happen to the value of Kodak’s shares? Of its debt?