Deceased Employees in OSPA

740 likes | 929 Vues

Deceased Employees in OSPA. May 18, 2010. Class Will Cover:. An overview of the process, including: A basic checklist Some things to think about in developing agency policy and business practices. Class Objectives:. By the end of class students will be able to:

Deceased Employees in OSPA

E N D

Presentation Transcript

Deceased Employees in OSPA May 18, 2010

Class Will Cover: • An overview of the process, including: • A basic checklist • Some things to think about in developing agency policy and business practices

Class Objectives: • By the end of class students will be able to: • Describe the differences in OSPA entries between a separation and a death • Describe the ORS defined payees • Describe issues to consider with the agency’s business practice

Overall Steps • Evaluate the timing of the payment • Determine the payee(s) • Gather applicable documentation and information • Make entries in OSPA if in year of death • Request manual check(s) if processed through OSPA

Where Are We in the Payroll Cycle? • Is there an approaching payday? • Have you distributed the employee’s check? • Did the employee have net pay direct deposit? • Had the employee already received the pay?

When is Payment Due? • What is your agency’s policy? • What is the basis for that policy? • ORS 652.190:“to the same extent as if the wages had been earned by the surviving spouse or dependent children” – (as though alive and still working for the state)

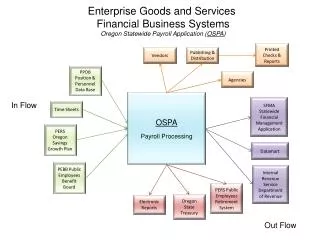

Payment from OSPA or R*STARS? • If payment in year of death, make payment through OSPA • Subject to social security and Medicare taxes • Not subject to Federal and state income taxes • If payment is made in a subsequent year, make payment through R*STARS • Not subject to Federal or state income tax withholding or social security and Medicare taxes

Determine Payee(s) • ORS 652.190:All wages earned by an employee, not exceeding $10,000, shall, upon the employee’s death, become due and payable to the employee’s surviving spouse, or if there is no surviving spouse, the dependent children, or their guardians or the conservators of their estates, in equal share

Surviving spouse or registered partner? Dependent children? Pay all to estate No No Start Yes Yes Divide up to $10,000 equally for dependent children Pay spouse or partner up to $10,000 Wages & Pay-offs ≤$10,000? Pay amount above $10,000 to estate No End Note: historically the $10,000 was intended to help cover funeral expenses Yes ORS 652.190

Dependent Children Defined • ORS is “silent” • Suggest use IRS definitions • Publication 501, Exemptions, Standard Deduction, & Filing Information (http://www.irs.gov) • If questions, contact BOLI

Pub 501 Definition Includes: • Son, daughter, stepchild or foster child: • Younger than the deceased • Under 19 at the end of the year or • Under 24 at the end of the year and a full-time student or • Permanently or totally disabled

Pub 501 Continued • Lived in employee’s household for more than half of the year • Did not provide more than half of his/her own support for the year

Documentation and Information • What documentation do you request prior to payment? • What information does your agency collect? • Do you have a form or a checklist?

Possible Documentation: • Certified copy of the death certificate • IRS Form W-9 Request for Taxpayer Identification Number and Certification for each payee • Court documents for appointment of guardianship or conservatorship for dependents

Documentation Cont’d: • “Representative” for the estate: • Letters of Testamentary or Administration from Probate Court • Court seal on Affidavit Claiming Successor for Small Estate • Sworn affidavit under ORS 293.49 for estate not in probate

Taxes for Payee(s) • OSPS is required to issue a 1099-MISC for each payee that receives ≥$600.00 • Includes imputed value for domestic partner insurance • If we do not have a TIN, we are required to do back-up withholding

Taxpayer Identification Number • Spouse, partner and children = SSN • Available from the Social Security Administration • Estate = EIN • Available by phone or on the IRS website

Other Payment Information • Legal name • Mailing address (optional for OSPS)

Entries in OSPA • Confirm the PPDB separation • Confirm final time entered • Enter final check dates on P010 • Adjust leave on the P435 and pay-off leave on the P050

OSPA Entries Cont’d • Outdate deductions on the P070 • Review P080 and P050 • Deduct any overpayments • Make RGD and DEC entries on the P050

1. Confirm Data from the PPDB on the P030 • JOB STAT STOP: date of death • PERSONNEL TRANS CD: • Temporaries = 567 • Other employees = 540 • SEPARATION DT/REASON: • Temporaries = 65 • Other employees = 40

P030 Example P030 #########,#####,1,051510 JOB STATUS DATA 030 LASTNAME, FIRSTNAME *** JOB STATUS INFO *** *** CONCURRENT JOB INFO *** JOB STAT START/STOP 070109/051510 REPORT DISTR CD 509 PERS AGY/POS/DFC/SC #####/9902021/0/0 RECOG SVC DT 012800 PT-FT CD/PCT F/1.0000 CITY CNTY CD 30/K APPOINTMENT TYP DT/CD 012800/P STANDARD HRS PER DAY 8.000 EMP REPR/CLS/OPT/STEP AAON/C6783 /A/A/06 MASS TRANSIT DIST X PERSONNEL TRANS CD 540 TIMESHEET CD 2 BENEFIT PKG CD AC LEAVE ACCRUAL SVC CD 3 EMPLOYEE ID OR####### PERS JOB CLASS CODE 2 CREW-UNIT 509 WAGE BASIS CD S PERSONNEL BASE RATE 4347.00 ---FUND SPLITS--- -FIXED MLY DIFFS-- ADJUSTED BASE 4520.88 LABOR COSTING PCT PAY PCT/ PCT/ PERSONNEL PAY RATE 4347.00 TYPE AMT AMT EQUIVALENT RATE 26.08 CD HOLIDAY PKG CD O 07########## 1.0000 LOA BEG DT/CD/END DBL P 0.040 SEPARATION DT/REASON 051510 40 O-T/FLSA CD Y/N LAST PA NUMBR/TRAN DT death 051810

2. Confirm Final Time Entered Start Prior month closed? Time entered for prior mo? Enter prior month’s time No No Yes Yes Enter current month’s time End

P001 Dates • Timesheet start date – first of the month • Timesheet end date – JOB STAT STOP from the P030 • Pay period ending date – last day of the month

P001 Example P001 TC20 CUR DEFAULTS payroll time capture establish session default values agency ##### timesheet start date 050110 timesheet end date 051510 pay period ending date 053110 batch number 000

P003 Example P003 #########,1,01 ##### TIME CAPTURE BTCH 000 NAME LASTNAME, FIRSTNAME ssn ######### TC91 TRANS COMPLET total reg 80.00 lwop .00 other .00 f/t hours 170.00 wcd days 17 LN TYPE HOURS WORK CHARGE OVERRIDE ERR * SESSION DEFAULTS * 1 RG 80.00 AGENCY #####0 2 t/s 050110/051510 3 period end 053110 4 *job change data* 5 LABOR COST/PCT 6 920745902300 100.00 7 8 9 10 j/c 070109/051510 11 CREW 509 POS 9902021 12 APP P CL AAONC6783 06 13 WS BA7 BASIS S O/T YN 14 forecast 80.0 15 f/t hours 170.0 16 max hours 80.0 17 LV ACCR 3 P/T 100.00 18 ADJUST BASE 4520.88 PB 8.00 SL 50.20 VA 143.71 equiv rate 26.08 hol O ben AC cont N

3. P010 Final Check Dates • FINAL CHECK ISSUED: date printed on check • FINAL CHECK PERIOD ENDING: end of pay period for FINAL CHECK ISSUED

P010 OR####### ##### WITHHOLDING DATA / LOCATOR DATA 010 LASTNAME, FIRSTNAME WH02 ENTER UPDATES RDC/CREW/CST CTR 509 ----------MANDATORY WITHHOLDING---------- ? TAX DATA FOLLOW-UP FLAG: N BEG DATE STAT EXEM ADDL END DATE ? FINAL CHECK ISSUED: 052010 ? FED 000000 00 0000 000000 ? FINAL CHECK PERIOD ENDING: 053110 ? STATE 000000 00 0000 000000 ? RETIREMENT START DATE: 000000 EFF ----FEDERAL---- -----STATE----- EIC RTMT RTMT RTMT FICA SAIF UNEM DATE STAT EXEM ADDL STAT EXEM ADDL CD SYST STAT ACCT SUBJ SUBJ SUBJ ? 053196 S 00 0000 S 00 0000 N S D ###### Y Y Y ----WAIVERS---- CLASS DATE CLASS DATE CLASS DATE CLASS DATE CLASS DATE CLASS DATE ? ? ? ? ? ? P010 Withholding Data / Locator Data

4. Adjust & Pay-off Leave • Accrue SL & VA • Transfer SL to the Clearing Account • Pay-off VA & CT • Adjust remaining leave balances to .00 • Make sure balance for all leaves is or will be .00 in BAL, ADV, and LOST columns

Accrue SL & VA EE eligible? Prior mo accruals run? Adjust prior month’s accruals Yes No Start No Yes EE worked required hrs? Adjust current month’s accruals Yes End No For some benefit packages employee must work 32 hours in the month to accrue leave

Pro-rating Leave Accrual • If death occurs before the end of the month:

P435 Example – SL P435 ######### ##### SL EMPLOYEE LEAVE DATA LASTNAME, FIRSTNAME J SVC LV USE ACCR ACCR MAX MAX MAX ACCRUAL REMAIN TIME LAST B CD TP WAIT MO RATE ACCR USE MO BAL ADV LOST ACTV 1 3 SL 00 00 8.00 9999.0 .0 00 FWD 50.20 .00 .00 043010 LV BAL DT CUR/CONT 043010/022900 CUR .00 3.76- .00 ADJ OR CLR ACCT HOURS REMAIN TIME LV EXP ENTRY TRFR FM/TO OTHR JOB LEAVE ADV LOST DATE DATE COMMENTS A A 3.76 3.76- .00 000000 051810 ACCRUE 0510 A T C 53.96- .00 .00 073110 051810 DEATH 051510 ? ?

P050 Example P050 #########,#####,1,053110 GROSS PAY ADJUSTMENTS ON FILE LASTNAME, FIRSTNAME GP93 TRANSACTION COMPLETE PAY STRT STOP ADJ DAYS TRAN TYP DATE DATE TYP RATE UNITS AMOUNT WRKD DATE ERROR MSG ? IR 013100 999999 .00 .00 .00 031400 INS RETURN PRO COMMENT INS RETURN a vap A 26.08 151.36 COMMENT death 051510 ? A COMMENT

P435 Example – VA P435 ######### ##### VA EMPLOYEE LEAVE DATA LASTNAME, FIRSTNAME LV09 ENTER UPDATES OR NEW KEY J SVC LV USE ACCR ACCR MAX MAX MAX ACCRUAL REMAIN TIME LAST B CD TP WAIT MO RATE ACCR USE MO BAL ADV LOST ACTV 1 3 VA 00 00 12.00 300.0 .0 00 FWD 145.71 .00 .00 043010 LV BAL DT CUR/CONT 043010/022900 CUR .00 5.65- .00 ADJ OR CLR ACCT HOURS REMAIN TIME LV EXP ENTRY TRFR FM/TO OTHR JOB LEAVE ADV LOST DATE DATE COMMENTS ? A 5.65 5.65- .00 000000 051810 ACCRUE 0510 ? 151.36- .00 .00 000000 051810 GR PAY ADJ ? ? ? ? ?

Adjust Other Leave to Zero • E492 Terminated Employee Having Leave Balance Report • Includes CT, LA, ML, PB, PR, SL & VA • Accrued leave = positive balance, negative transaction • Other leaves = negative balance, positive transaction

5. Outdate P070 Deductions • PEBB Benefits • Garnishments • Voluntary Deductions

PEBB Benefits Include • Medical • Dental • Vision • Basic & optional life • Accidental death & dismemberment • Long & short-term disability • Long-term care • Flexible spending accounts

OSPA / pebb benefits Interface The PPDB interfaces death to pebb.benefits (PDB) Agency staff member reviews P070 Nightly PDB sends COBRA information to BHS Agency staff member approves separation in PDB Every Friday BHS sends COBRA notice, if spouse or dependent coverage PDB interfaces insurance changes to OSPA OSPA interfaces actual hours worked to PDB Every 2 min. After run 2

PEBB Benefit Eligibility • Normally, only alter P070 entries interfaced from PDB if directed by PEBB • Deduction pays for insurance for the next month • If hours worked + paid leave < 80 hrs, employee not eligible for benefits for the next month

PEBB Benefit Eligibility Cont • PEBB benefits calculates # of business days between 1st of month & separation date • If ≤9 business days, benefits for spouse / dependents will end in current month • If >9 business days, benefits for spouse / dependents will end next month • Force premiums, OSPA will not pay with basic life deductions missing

Parking Direct Deposit(s) Charitable Fund Drive Food Bank Deferred Comp Union Dues/Fair Share Savings Bonds Union insurances Voluntary Deductions

Voluntary Deductions Cont • DAS Parking is for the current month • Pro-rated if death during month • Private parking for next month • Union dues / fair share are for the current month

Voluntary Deductions Cont • Delete OSGP for final month • Deduct direct deposits 3 months prior • Outdate other deductions for final pay

P070 Example – Not in Final Pay P070 #########,#####,053110 DEDUCTIONS AND DEDUCTION ADJUSTMENTS LASTNAME, FIRSTNAME DA98 PRESS ENTER FOR NEXT PAGE A DED PLAN OPE DATE -EMPLOYEE---SHARE- JOB EMPLR BOARD VENDOR D CODE CODE CD BEGIN END PCT PCT FIXED SHR SHARE SHARE SHARE J DESC DESC GRS NET AMOUNT PCT ? DKTA 111 N 073105 103105 .00 .00 .00 .00 AFSCME L3743 DUES COMM TRANS DATE 102405 ACH ACCT ACCT CD ? ADNN 050 N 083104 999999 .00 .00 .00 .00 EMP/DEP AD&D POSTAX/50K COMM TRANS DATE 081104 ACH ACCT ACCT CD d DCNN 100 N 022805 999999 100.00 .00 .00 .00 DEF/COMP REGULAR COMM TRANS DATE 020705 ACH ACCT ACCT CD ? LTNN 001 N 083104 999999 .00 .00 .00 .00 DEP LIFE 5K/DEPNDT COMM TRANS DATE 081104 ACH ACCT ACCT CD

P070 Example – In Final Pay P070 #########,#####,063010 DEDUCTIONS AND DEDUCTION ADJUSTMENTS LASTNAME, FIRSTNAME DA98 PRESS ENTER FOR NEXT PAGE A DED PLAN OPE DATE -EMPLOYEE---SHARE- JOB EMPLR BOARD VENDOR D CODE CODE CD BEGIN END PCT PCT FIXED SHR SHARE SHARE SHARE J DESC DESC GRS NET AMOUNT PCT ? ADNN 050 N 083104 999999 .00 .00 .00 .00 EMP/DEP AD&D POSTAX/50K COMM TRANS DATE 081104 ACH ACCT ACCT CD ? DCNN 100 N 022805 999999 100.00 .00 .00 .00 DEF/COMP REGULAR COMM TRANS DATE 020705 ACH ACCT ACCT CD d DKTA 111 N 073105 999999 .00 .00 .00 .00 AFSCME L3743 DUES COMM TRANS DATE 062705 ACH ACCT ACCT CD ? LTNN 001 N 083104 999999 .00 .00 .00 .00 DEP LIFE 5K/DEPNDT COMM TRANS DATE 081104 ACH ACCT ACCT CD

P070 Example – Direct Deposit P070 #########,#####,022810 DEDUCTIONS AND DEDUCTION ADJUSTMENTS LASTNAME, FIRSTNAME DA98 PRESS ENTER FOR NEXT PAGE A DED PLAN OPE DATE -EMPLOYEE---SHARE- JOB EMPLR BOARD VENDOR D CODE CODE CD BEGIN END PCT PCT FIXED SHR SHARE SHARE SHARE J DESC DESC GRS NET AMOUNT PCT d XDNN 130 N 033103 999999 2.00 .00 .00 .00 DIRECT DEP FIXED 3 COMM XXXXXXXX TRANS DATE 032503 ACH ACCT ################## ACCT CD C d XDNN 222 N 022900 999999 250.00 .00 .00 .00 DIRECT DEP FIXED 6 COMM XXXXXXXXXXX TRANS DATE 022500 ACH ACCT ############### ACCT CD S d XDNN 333 N 013102 999999 125.00 .00 .00 .00 DIRECT DEP FIXED 7 COMM XXXX TRANS DATE 011502 ACH ACCT ################## ACCT CD S d XDNN 444 N 113003 999999 5.00 .00 .00 .00 DIRECT DEP FIXED 8 COMM XXXXXXX TRANS DATE 110603 ACH ACCT ################## ACCT CD C

6. Check for Savings Bonds • If employee was purchasing savings bonds: • Delete P070 and P080 • If prior to run 1, delete for current month • If after run 1, delete for next month

6. Review P050 • If employee opted out of medical insurance, delete IR for final pay • If employee had domestic partner insurance and not tax dependents: • If worked ≥80 hours, delete DPT / DPN for next pay period • If worked <80 hours, delete for final pay period

7. Identify Outstanding Overpayments • OAM 45.50.00 PO & PR • If employee has outstanding overpayment, deduct from final paycheck • If final pay does not cover the amount owed, work with Accounting Staff to set-up A/R

Overpayment Cont • Use OAM Chapter 35 to manage and collect A/R • If not successful in collecting, ORS 292.170 – Procedure when employee leaves employment… provides the authority to refer the account to DOR for collection