CHAPTER V

570 likes | 845 Vues

M c. Graw. Hill. ENGINEERING ECONOMY Fifth Edition. Blank and Tarquin. CHAPTER V. PRESENT WORTH ANALYSIS. CHAPTER TOPICS. Formulating Alternatives PW of Equal-Life Alternatives PW of Different-Life alternatives Future Worth Analysis Payback Period PW of Bonds Spreadsheet Applications.

CHAPTER V

E N D

Presentation Transcript

Mc Graw Hill ENGINEERING ECONOMYFifth Edition Blank and Tarquin CHAPTER V PRESENT WORTH ANALYSIS

CHAPTER TOPICS • Formulating Alternatives • PW of Equal-Life Alternatives • PW of Different-Life alternatives • Future Worth Analysis • Payback Period • PW of Bonds • Spreadsheet Applications

Mc Graw Hill ENGINEERING ECONOMYFifth Edition Blank and Tarquin CHAPTER V 5.1 FORMULATING ALTERNATIVES

5.1 FORMULATING MUTUALLY EXCLUSIVE ALTERNATIVES • Viable firms/organizations have the capability to generate potential beneficial projects for potential investment • Two types of investment categories • Mutually Exclusive Set • Independent Project Set

5.1 FORMULATING MUTUALLY EXCLUSIVE ALTERNATIVES • Mutually Exclusive set is where a candidate set of alternatives exist (more than one) • Objective: Pick one and only one from the set. • Once selected, the remaining alternatives are excluded.

5.1 INDEPENDENT PROJECT SET • Given a set of alternatives (more than one) • The objective is to: • Select the best possible combination of projects from the set that will optimize a given criteria. • Subjects to constraints

5.1 Evaluating Alternatives • Part of Engineering Economy is the selection and execution of the best alternative from among a set of feasible alternatives • Alternatives must be generated from within the organization • One of the roles of engineers!

Do Nothing Alt. 1 Alt. 2 Alt. m 5.1 Alternatives Analysis Selection Problem Execution

5.1 Type of Alternatives • Revenue/Cost – the alternatives consist of cash inflow and cash outflows • Select the alternative with the maximum economic value • Service – the alternatives consist mainly of cost elements • Select the alternative with the minimum cost value

Mc Graw Hill ENGINEERING ECONOMYFifth Edition Blank and Tarquin CHAPTER V 5.2 Present Worth Approach

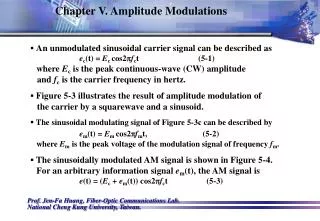

5.2 Present Worth Approach • A process oftransforming all of the current and future estimated cash flow back to a point in time (time t = 0) – called the Present Worth P(i%) = P( + cash flows) +P( - cash flows)

5.2 THE PRESENT WORTH METHOD If P(i%) > 0 then the project is deemed acceptable. If P(i%) < 0 – the project is usually rejected. If P(i%) = 0 Present worth of costs = Present worth of revenues – Indifferent!

5.2 THE PRESENT WORTH METHOD – Depends upon the Discount Rate Used • The present worth is purely a function of the discount rate. • If one changes the discount rate, a different present worth will result.

5.2 Equal Lives – Straightforward! • Given two or more alternatives with equal lives…. Alt. 1 N = for all alternatives Alt. 2 Alt. N Find PW(i%) for each alternative then compare Smallestif cost and largestif profit.

5.2 PRESENT WORTH: Example Consider: Machine AMachine B First Cost $2,500 $3,500 Annual Operating Cost 900 700 Salvage Value 200 350 Life 5 years 5 years i = 10% per year Which alternative should we select? Note: Where costs dominate a problem it is customary to assign a positive value to cost and negative to inflows

F5=$200 F5=$200 MA 0 1 2 3 4 5 0 1 2 3 4 5 A = $900 $2,500 MB A = $700 $3,500 5.2 PRESENT WORTH: Cash Flow Diagram

5.2 PRESENT WORTH: Solving • PA = 2,500 + 900 (P|A, .10, 5) – 200 (P|F, .01, 5) • = 2,500 + 900 (3.7908) - 200 (.6209) • = 2,500 + 3,411.72 - 124.18 = $5,788 • PB = 3,500 + 700 (P|A, .10, 5) – 350 (P|F, .10, 5) • = 3,500 + 2,653.56 - 217.31 = $5,936 SELECT MACHINE A: Lower PW cost!

Mc Graw Hill ENGINEERING ECONOMYFifth Edition Blank and Tarquin CHAPTER V 5.3 PRESENT WORTH: Different Lives

5.3 PRESENT WORTH: Different Lives • Comparison must be madeover equal time periods • Compare over the least common multiple, LCM, for their lives Example: {3,4, and 6} years.

5.3 PRESENT WORTH: Example Unequal Lives • EXAMPLE Machine A Machine B First Cost $11,000 $18,000 Annual Operating Cost 3,500 3,100 Salvage Value 1,000 2,000 Life 6 years9 years i = 15% per year Which alternative should we select?

5.3 PRESENT WORTH: Example Unequal Lives A common mistake is to compute the present worth of the 6-year project and compare it to the present worth of the 9-year project. NO! NO! NO!

Machine A F6=$1,000 0 1 2 3 4 5 6 A 1-6 =$3,500 F6=$2,000 $11,000 0 1 2 3 4 5 6 7 8 9 A 1-9 =$3,100 Machine B $18,000 5.3 PRESENT WORTH: Unequal Lives i = 15% per year LCM(6,9) = 18 year study period will apply for present worth

6 years 6 years 6 years Cycle 1 for A Cycle 2 for A Cycle 3 for A Cycle 1 for B Cycle 2 for B 9 years 9 years 18 years 5.3 Unequal Lives: 2 Alternatives Machine A Machine B i = 15% per year

5.3 Example: Unequal Lives Solving • LCM = 18 years • Calculate the present worth of a 6-year cycle for A PA = 11,000 + 3,500 (P|A, .15, 6) – 1,000 (P|F, .15, 6) = 11,000 + 3,500 (3.7845) – 1,000 (.4323) = $23,813, which occurs at time 0, 6 and 12

0 6 12 18 $23,813 $23,813 $23,813 5.3 Example: Unequal Lives Machine A PA= 23,813+23,813 (P|F, .15, 6)+ 23,813 (P|F, .15, 12) = 23,813 + 10,294 + 4,451 = 38,558

F6=$2,000 0 1 2 3 4 5 6 7 8 9 A 1-9 =$3,100 $18,000 5.3 Unequal Lives Example: Machine B • Calculate the Present Worth of a 9-year cycle for B

5.3 9-Year Cycle for B Calculate the Present Worth of a 9-year cycle for B PB = 18,000+3,100(P|A, .15, 9) – 1,000(P|F, .15, 9) = 18,000 + 3,100(4.7716) - 1,000(.2843) =$32,508which occurs at time 0 and 9

$32,508 $32,508 0 9 18 5.3 AlternativeB – 2 Cycles Machine A: PW =$38,558 PB = 32,508 + 32,508 (P|F, .15, 9) = 32,508 + 32,508(.2843) PB = $41,750 Choose Machine A

5.3 Unequal Lives – Assumed Study Period • Study Period Approach • Assume alternative: 1 with a 5-year life • Alternative: 2 with a 7-year life Alt-1: N = 5 yrs LCM = 35 yrs Alt-2: N= 7 yrs Could assume a study period of, say, 5 years.

5.3 Unequal Lives – Assumed Study Period • Assume a 5-yr. Study period • Estimate a salvage value for the 7-year project at the end of t = 5 • Truncate the 7-yr project to 5 years Alt-1: N = 5 yrs Now, evaluate both over 5 years using the PW method! Alt-2: N= 7 yrs

Mc Graw Hill ENGINEERING ECONOMYFifth Edition Blank and Tarquin CHAPTER V 5.4 Future Worth Approach

5.4 FUTURE WORTH APPROACH • FW(i%) is an extension of the present worth method • Compound all cash flows forward to some specified time using (F/P), (F/A),… factors or, • Given P, find F = P(1+i)N

5.4 Future Worth Example (Figure 5.3) • Example 5.3(P172) • Calculate the Future Worth of determining the selling price in order to earn exactly 25% on the investment • Draw the cash-flow diagram!!

Mc Graw Hill ENGINEERING ECONOMYFifth Edition Blank and Tarquin CHAPTER V 5.6 Payback Period Analysis

5.6 Payback Period Analysis • Payback is the period of time it takes for the cash flows to recover the initial investment. • Two forms for this method • Discounted Payback Period (uses an interest rate) • Conventional Payback Period (does not use an interest rate)

5.6 Payback Period Analysis • Discounted Payback Approach • Find the value of np such that:

5.6 Payback Period Analysis - Example • Example 5.8 i = 15% Machine 1: N=7 Machine 2: N=14

5.6 Payback Period Analysis - Example 5.8 • Tabular Format: Machine 1

5.6 Payback Period Analysis- Machine A Payback is between 6 and 7 yeas (6.57 yrs) PW(15%)= +$481.00

5.6 Non-Discounted Analysis – Machine A At a “0” interest rate the PB time is seen to equal 4 years!

5.6 Payback for Machine B at 15%, N = 14 yrs Payback for B is between 9 and 10 years! Longer time period to recover the investment. 9.52 years

5.6 Payback at “0”% for Machine B Payback for B at 0% is 6 years!

5.6 Payback for Example 5.8 • Discounted • Machine A: 6.57 years • Machine B: 9.52 years • Undiscounted • Machine A: 4.0 years • Machine B: 6.0 years • Go with Machine A – lower time period payback to recover the original investment

5.6 Payback Method Summarized • Payback is only a rough estimator • Use as an initial screening method • Avoid using this method as a primary analysis technique for selection projects

Mc Graw Hill ENGINEERING ECONOMYFifth Edition Blank and Tarquin CHAPTER V 5.8 Present Worth of Bonds

5.8 Present Worth of Bonds • Bonds represent a source of funds for the firm. • Bonds are sold (floated) by investment banks for firms in order to raise additional debt capital • Bonds are evidence of Debt

Investment Bankers Sell the Bonds to The lending public The Firm Commissions/Fees Proceeds from The sale Bondholders 5.8 Present Worth of Bonds – Overview

5.8 Bonds – Notation • V – The face value of the bond (债券面值) • b – Bond coupon rate(债券票面利率) • I – Bond interest • c – number of payment periods per year I=(face value) (bond coupon rate)/c = Vb /c

5.8 Bonds – Notation and Example • Example: • V = $5,000 (face value) • b= 4.5% per year paid semiannually • N = 10 years • What is the interest the firm would pay to the current bondholder semiannually?

5.8 Bonds – Example – Continued • The interest is calculated as: The bondholder, buys the bond and will receive $112.50 every 6 months for the life of the bond