Alternative Investments

210 likes | 584 Vues

Alternative Investments. Fortress Investment Group. Wesley R. Edens Chairman and CEO. FORTRESS INVESTMENT GROUP Global Alternative Investment Manager. Hedge Funds $10.5 billion Drawbridge Special Opportunities Drawbridge Global Macro Fortress Partners Fund Drawbridge Relative Value.

Alternative Investments

E N D

Presentation Transcript

Alternative Investments Fortress Investment Group Wesley R. Edens Chairman and CEO

FORTRESS INVESTMENT GROUP Global Alternative Investment Manager • Hedge Funds • $10.5 billion • Drawbridge Special Opportunities • Drawbridge Global Macro • Fortress Partners Fund • Drawbridge Relative Value • Private Equity • $19.9 billion • Fortress Investment Fund I to IV • Fortress Residential Investment Deutschland • Drawbridge Long Dated Value I and II • 5 co-investment funds • Castles • $4.7 billion • Newcastle Investment Corp. (NYSE: NCT) • Eurocastle Investment Ltd (Euronext Amsterdam: ECT) Fortress Investment Group • First public global alternative asset manager listed on the New York Stock Exchange with $35.1 billion assets under management • Over 550 employees with headquarters in New York and affiliates with offices worldwide • Today, Fortress has three primary business lines with a broad investor base As of December 31, 2006.

Our History • Founded in 1998 as an asset-based investment management firm focused on performance • One of the only companies to manage both private equity and hedge funds Assets Under Management ($ in billions) CAGR Since 2003 Hedge Funds 85% Private Equity 110% Castles 76% Total 96% CAGR: 96% As of December 31, 2006.

Growth of Hedge Funds and Private Equity • Alternative investments constitute one of the fastest growing sectors • From a niche industry for wealthy individuals, it has turned into a mainstream industry for institutions seeking high return/low volatility investments uncorrelated to their other assets Hedge Fund Assets Under Management Capital Raised by US Private Equity Firms $1.3 trillion ($ in billions) AUM ($ in billions) CAGR: 27% CAGR: 25% # of Funds Source: Hedge Fund Research Industry Report Q3 2006 Source: BUYOUTS Magazine

Continued Demand for Alternatives • Aging populations across the world and pension plan asset/liability mismatch are expected to fuel demand for alternative assets • Aggregate pension deficits in the U.S. for all under-funded plans total approximately $489 billion (£79.3 billion in the UK) Pension Deficits Private Defined Benefits, Contributions vs. Distributions(3) ($ in billions) (2) ($ in billions) (1) • Data from PBGC 2005 Databook, published in June 2006. • Data from UK Pension Regulator's Purple Book, published in December 2006. • 2000-2010 estimated by Morgan Stanley Research. Source: Department of Labor – Private Pension Plan Bulletin No. 12, Federal Reserve, company reports, Morgan Stanley Research.

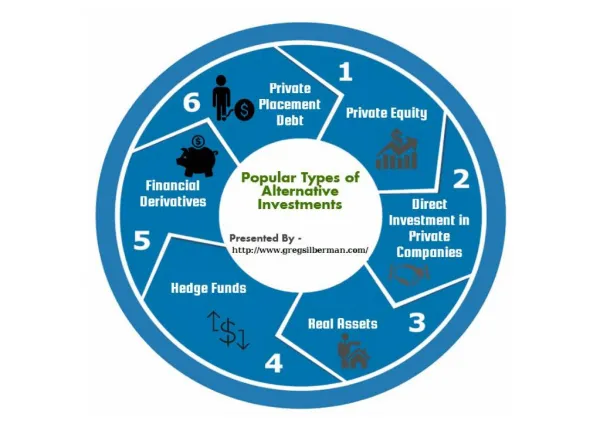

What Are Alternative Investments? • “Alternative Investments” cover a broad world of investment categories where the common element is a manager’s ability to create value on an absolute return basis “BETA” TRADITIONAL INVESTMENTS “ALPHA” ABSOLUTE RETURN

Why Are Alternative Investments Attractive? WHY ATTRACTIVE TO INVESTORS? WHY ATTRACTIVE TO MANAGERS? • Positive returns in both up and down markets • Low correlation with traditional assets • Enhance portfolio returns while lowering the overall risk • High margin • Paid for performance • High growth

Our Culture “We Are Investors First” • In the alternative asset management business, performance is everything • Top tier returns in every business • Consistent performance over time Historical Performance(1) Castles51.5%(7) Fortress PE39.7%(3) MSCI US REIT Index(7)28.7% Hybrid Hedge Fund13.7%(5) Liquid Hedge Funds14.2%(6) HFR Composite Index(4)9.7% Thomson PE Index(2)8.9% • Note: Returns on hedge funds and private equity are shown net of all management and performance fees as of September 30, 2006. • (1) Annualized returns for Fortress Funds shown since inception. • (2) Annualized return for the ten-year period ended June 30, 2006. • Assumes liquidation of private equity fund investments at the NAV of the applicable fund, without taking illiquidity or other potential discounts into effect. • Annualized return for the five-year period ended September 30, 2006. • Excludes Fortress Partner Fund returns (with Partners Fund return is 13.7%). • Excludes Drawbridge Relative Value Fund returns (with Relative Value Fund return is 13.3%). • Annualized total return since Oct-02 IPO of Newcastle through January 17, 2007. $3.0bn

Fortress Private Equity – A Very Different Approach • Fortress is one of the world’s largest private investors ($19.9B AUM) • Cash-flowing • Asset-based Inception through December 31, 2006

Private Equity Investment Record • Fortress’s private equity funds have produced 45.8% net investment IRRs through December 31, 2006 • 85 private equity investments (since 1995), only 1 write-off to date, representing less than 1% of invested capital Gross Since-Inception Returns By Investment* 2006 Realized Partially Realized / Unrealized Note: A significant number of the funds' more recent portfolio investments have not yet been resolved; any such unresolved investment could upon resolution result in a loss. *Performance figures provided in the bar chart above are investment level and are presented gross of management fees, incentive income, taxes and other fund expenses. Excludes recent investments without meaningful performance history and Long Dated Value Funds. Net returns to investors will be lower. ** Represents full write-off of one investment in Q1 2002 in the amount of $50 million.

Private Equity Investment Strategy • Focus on undervalued assets and companies which can be improved through intensive investment management • Investments generally fall into two categories: CASH FLOWING UNDERVALUED ASSETS

Accessing Public Markets • By accessing public equity markets for growth capital, Fortress has been able to create significant investment value post-IPO • Today, we have a total of seven public companies in our portfolios, and own a total of ~$11.5 billion in stock Selected Portfolio Companies Public Co Stock Price Appreciation(1) Cell towers Airplanes German commercial real estate Newspapers UK real estate German apartments Senior living facilities • As of April 16, 2007.

Innovation in the Alternative Management Industry “Blackstone is following a path blazed by Fortress Investment Group LLC…” – WSJ, 5/2/2007 “Apollo Management Said to Be Considering IPO” – Seeking Alpha, 4/4/2007 “Carlyle – next for the market?” – FT, 4/17/2007 “. . . Every hedge fund and private equity fund is at least considering an initial public offering following the success earlier this year of the IPO of Fortress Investment Group LLC.” – Associated Press, 4/24/07 “FortressTo Pave Way with IPO” --Financial Times, 11/9/06 “Blackstone and several rivals have been exploring IPOs in the wake of the successful stock market listing of hedge fundFortress Group in January.” – WSJ, 3/17/07 “…Wall Street has been buzzing about who will be the next firm to announce plans for an IPO and invite the public into a world once reserved for high-net-worth individuals and institutional investors.” – Fortune Magazine, 4/2/07

“I’ll be happy to give you innovative thinking. What are the guidelines?” Curiosity + Hard Work = Innovation • Ultimately, performance is everything • Status quo is overrated