Mastering Money: Banking Basics and Monetary Tricks

70 likes | 182 Vues

Learn how banks turn deposits into profits, create money through loans, and impact the economy. Discover reserve requirements, excess reserves, and the magic of monetary growth in this interactive session.

Mastering Money: Banking Basics and Monetary Tricks

E N D

Presentation Transcript

Magic Trick • Would you believe me if I told you I can take these $10 and turn them into over $34 without: • Printing any new money • Receiving any new money

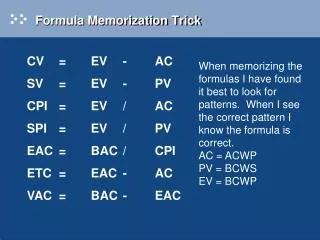

Deposits • Ex: Check/savings deposit, Certificate of Deposit (CD), etc • When a deposit is made into a bank, the bank is required to keep a % of the deposit in reserve • What are reserves? • Known as the reserve requirement (%) • The remaining amount, excess reserves, is free for the bank to use as it pleases • Give it out as a loan • Buy government bonds • Pay expenses

Loans • Excess reserve money given to borrowers • Bank earns interest on loans to make a profit

Monetary Growth • Banking (loans & deposits) can cause the supply of money to increase • “Creates” more money for people to use • How? • Simulation – 2 volunteers • Banker • Bank customer

Results of Monetary Growth • How do banks benefit from monetary growth? • More money = more loans = more interest = more profit • How do people benefit from monetary growth? • More money available to buy houses, cars, boats, computers, etc. • Amount of monetary growth depends on the reserve requirement percentage • Lower percentage = more money creation

Quick Review • What do we call the amount of a deposit that is required to go into reserves? • What do we call the leftover amount that is not put into reserve? • How do banks use excess reserves to make a profit? • How does banking (loans & deposits) impact the supply of money? • How does the reserve requirement impact monetary growth? Reserve requirement Excess reserves Offer loans which earn interest Makes it grow Higher requirement = small growth Low requirement = large growth