Measurable Value Functions for Project Portfolio Selection and Resource Allocation

140 likes | 318 Vues

Measurable Value Functions for Project Portfolio Selection and Resource Allocation. Dr. Juuso Liesiö Systems Analysis Laboratory Aalto University P.O. Box 11100, 00076 Aalto, Finland http://www.sal.tkk.fi juuso.liesio@aalto.fi. Multi-criteria project portfolio selection.

Measurable Value Functions for Project Portfolio Selection and Resource Allocation

E N D

Presentation Transcript

Measurable Value Functions for Project Portfolio Selection and Resource Allocation Dr. Juuso Liesiö Systems Analysis Laboratory Aalto University P.O. Box 11100, 00076 Aalto, Finland http://www.sal.tkk.fi juuso.liesio@aalto.fi

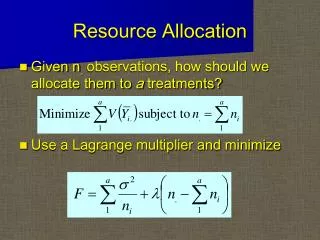

Multi-criteria project portfolio selection • Choose a subset (=a portfolio) of projects from a large set of proposals • Projects evaluated on multiple criteria • Resource and other portfolio constraints • Maximize multi-criteria portfolio value subject to resource constraints → Zero-one linear programming problem • Applications • Healthcare (Kleinmuntz, 2007), R&D (Golabi et al., 1981), infrastructure asset management (Liesiö et al., 2007), military (Ewing et al., 2006), strategy development (Lindstedt et al., 2008) etc. • Additive-linear portfolio value function widely used • We derive a more general class of portfolio value functions

Standard additive-linear portfolio value • xji ϵ Xji : Performance of project j w.r.t. criterion i • vi(xji ) ϵ [0,1]: The value of project j w.r.t. crit. i (score) • wi : ‘Importance’ weight of criterion i • Constant marginal value on each criterion • Does not often hold in practice (Kleinmuntz, 2007; Mild and Salo, 2009) • E.g., as financial performance increases other criteria become relatively more important Crit. n Crit.1 Crit. i ... ... X1n X11 X1i Project 1 ... ... ... ... ... Xj1 Xji Xjn Project j ... ... ... ... ... Xm1 Xmi Xmn Project m →m x n attributes in total

Additive-linear portfolio value model Example: choosing forest sites for conservation Weighting w1=0.6 w2=0.3 w3=0.1 Scoring

Measurable value functions (Dyer and Sarin, 1979) • V represents two preference relations • Portfolio xais preferred to portfolio xb • A change from xb to xa is preferred to a change from xd to xc → Measurable value is “cardinal” or “captures strength of preference” • If the subset of attributes X’ is… … Preference Independent (PI), then preference order (1.) of levels of X’ does not depend on the levels of the other attributes … Weak Difference Independent (WDI), then preference order (2.) of changes between levels of X’ does not depend on the levels of the other attributes • WDI implies PI

Additive-linear portfolio VF: assumptions A1. Equitable treatment of projects Portfolio value does not change if project indexing is changed Crit. n Crit.1 Crit. i ... ... X1n X11 X1i Project 1 A2. Each Xji is WDI Makes project scoring possible ... ... ... ... ... Xj1 Xji Xjn A3. X1i x…xXmi is WDI for each i=1,…,n Each criterion is a portfolio performance measure Project j ... ... ... A4. Xj1 x…xXjn is WDI for each j=1,…,m Value of including a project into the portfolio does not depend on other projects in the portfolio ... ... Xm1 Xmi Xmn Project m

Weaker preference assumptions A1. Equitable treatment of projects Portfolio value does not change if project indexing is changed Crit. n Crit.1 Crit. i ... ... X1n X11 X1i Project 1 A2. Each Xji is WDI Makes project scoring possible ... ... ... ... ... Xj1 Xji Xjn A3. X1i x…xXmi is WDI for each i=1,…,n Each criterion is a portfolio performance measure Project j ... ... ... ... ... Xm1 Xmi Xmn Project m • Theorem. A1-A3 hold iffV(x)=f(V1(xJ1),...,Vn(xJn)), where • V1..,Vn are the symmetric multilinear criterion specific portfolio value functions and xJi=(x1i,…,xmi)T • f is a multilinear function (multiplicative and additive function are special cases)

Symmetric multilinear criterion specific portfolio VF • vi(xji )ϵ[0,1]: value of project j w.r.t. criterion i (score) • wi (.): weighting function for criterion i • wi(k)=Vi(xJi), where portfolio xJihas k projects at the most preferred performance level in criterion i and m-k projects at the least preferred performance level • E.g. k sites with “Endangered species = 100” and 50-k sites with “Endangered species = 0” • If wi(k+1)-wi(k)=constantfor all k, then Vi reduces to the linear criterion specific value (sum of scores)

Multilinear vs. linear criterion specific value (1/2) • m=10 projects • X-axis: sum of scores ∑vi(xji) • Y-axis: sym. multilinear crit. specific value Vi(xJi) • Black dots: weighting function wi(k), k=1,…,10 • Gray: range of possible values for Vi when the sum of scores is fixed Portfolio x with scores (1,1,1,1,1,1,0,0,0,0) Portfolio x with scores (6/10,...,6/10)

Multilinear vs. linear criterion specific value (2/2) • m=50 projects • X-axis: sum of scores • Y-axis: sym. multilinear value • Black dots: wi(k), k=1,…,50 • Gray: range of Vi • When m is large and wi is ‘smooth’, a function gican be chosen such that gi

Additive-linear portfolio value model Example revisited Weighting w1=0.6 w2=0.3 w3=0.1 Scoring

Example revisited Additive-multilinear portfolio value model Scoring Weighting

Conclusions • If the project’s value depends on how it “fits” the portfolio, then • The criterion specific portfolio value functions are symmetric multilinear • These are aggregated using a multilinear, a multiplicative or an additive function • Use of the additive-multilinear VF straightforward in decision support processes based on the additive-linear VF • No need to re-do/change criteria, feasibility constraints or project scoring • Criterion weights depend on the portfolio’s performance w.r.t. to the criterion • Optimization of portfolio value • Implicit enumeration when the number of projects < 100 • MILP approximation for large additive-multilinear problems (piecewise linear gi )

J. Liesiö: Measurable Multiattribute Value Functions for Portfolio Decision Analysis http://www.sal.tkk.fi/publications/pdf-files/mlie11.pdf References: Dyer, J., Sarin, R., (1979). Measurable Multiattribute Value Functions, Operations Research, Vol. 27, pp. 810-822. Ewing Jr., P.L., Tarantino, W., Parnell, G.S., (2006). Use of Decision Analysis in the Army Base Realignment and Closure (BRAC) 2005 Military Value Analysis, Decision Analysis, Vol. 3, pp. 33-49. Golabi, K., Kirkwood, C.W., Sicherman, A., (1981). Selecting a Portfolio of Solar Energy Projects Using Multiattribute Preference Theory, Management Science, Vol. 27, pp. 174-189. Kleinmuntz, D.N., (2007). Resource Allocation Decisions, in Edwards, W., Miles, R.F. & von Winterfeldt, D. (Eds.); Advances in Decision Analysis, Cambridge University Press. Liesiö, J., Mild, p., Salo, A., (2007). Preference Programming for Robust Portfolio Modeling and Project Selection, European Journal of Operational Research, Vol. 181, pp. 1488-1505. Lindstedt, M., Liesiö, J., Salo, A., (2008). Participatory Development of a Strategic Product Portfolio in a Telecommunication Company, International Journal of Technology Management, Vol. 42, pp. 250-266. Mild P., Salo, A., (2009). Combining a Multiattribute Value Function with an Optimization Model: An Application to Dynamic Resource Allocation for Infrastructure Maintenance, Decision Analysis, Vol. 6, pp. 139-152.