Understanding County Clerk Budget Process Under Chapter 2008-111: Surplus and Deficit Management

50 likes | 182 Vues

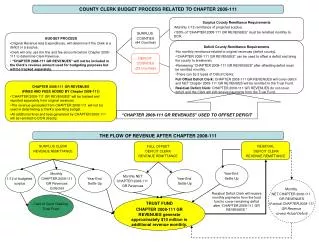

This document outlines the budget process for County Clerks under Chapter 2008-111, detailing the remittance requirements for surplus and deficit counties. Surplus counties must remit a monthly portion of projected surplus revenues, while deficit counties can utilize Chapter 2008-111 GR revenues to offset their deficits. The revenue generated will be tracked separately and not included in the operating budget calculations. The document also specifies the responsibilities of Full Offset and Residual Deficit Clerks regarding remittances to the Trust Fund and the management of additional revenues.

Understanding County Clerk Budget Process Under Chapter 2008-111: Surplus and Deficit Management

E N D

Presentation Transcript

COUNTY CLERK BUDGET PROCESS RELATED TO CHAPTER 2008-111 • Surplus County Remittance Requirements • Monthly 1/12 remittance of projected surplus. • 100% of “CHAPTER 2008-111 GR REVENUES” must be remitted monthly to DOR. SURPLUS COUNTIES(44 Counties) • BUDGET PROCESS • Original Revenue less Expenditures, will determine if the Clerk is a deficit or a surplus. • Clerk will only use the fine and fee amounts before Chapter 2008-111 to determine Clerk Revenue. • “CHAPTER 2008-111 GR REVENUES” will not be included in the Clerk’s revenue amount used for budgeting purposes but will be tracked separately. • Deficit County Remittance Requirements • No monthly remittance related to original revenues (deficit county). • “CHAPTER 2008-111 GR REVENUES” can be used to offset a deficit and bring the county to breakeven. • Remaining “CHAPTER 2008-111 GR REVENUES” after offsetting deficit must be remitted monthly. • There can be 2 types of Deficit Clerks; • Full Offset Deficit Clerk: CHAPTER 2008-111 GR REVENUES will cover deficit and NET Chapter 2008-111 GR REVENUES will be remitted to the Trust Fund. • Residual Deficit Clerk: CHAPTER 2008-111 GR REVENUES do not cover deficit and the Clerk will still receive payments from the Trust Fund. DEFICIT COUNTIES (23 Counties) • CHAPTER 2008-111 GR REVENUES • (FINES AND FEES ADDED BY Chapter 2008-111) • “CHAPTER 2008-111 GR REVENUES” will be tracked and reported separately from original revenues. • The revenue generated from CHAPTER 2008-111 will not be used in determining a Clerk’s operating budget. • All additional fines and fees generated by CHAPTER 2008-111 will be remitted to DOR directly. “CHAPTER 2008-111 GR REVENUES” USED TO OFFSET DEFICIT THE FLOW OF REVENUE AFTER CHAPTER 2008-111 SURPLUS CLERK REVENUE REMITTANCE FULL OFFSET DEFICIT CLERK REVENUE REMITTANCE RESIDUAL DEFICIT CLERK REVENUE REMITTANCE Year-End Settle Up 1/12 of budgeted surplus Monthly CHAPTER 2008-111 GR Revenues Collected Year-End Settle Up Monthly NET CHAPTER 2008-111 GR Revenues Year-End Settle Up Monthly NET CHAPTER 2008-111 GR REVENUES (if actual CHAPTER 2008-111 GR Revenue covers Actual Deficit) Residual Deficit Clerk will receive monthly payments from the trust fund to cover remaining deficit after “CHAPTER 2008-111 GR REVENUES.” Clerk of Court Clearing Trust Fund TRUST FUND CHAPTER 2008-111 GR REVENUES generate approximately $10 million in additional revenue monthly.