Property Finance by EBRD

170 likes | 189 Vues

Learn about the EBRD's involvement in the property sector, financing instruments, geographic distribution of their portfolio, and how to best attract financing from EBRD.

Property Finance by EBRD

E N D

Presentation Transcript

Property Finance by EBRD Oxana Selska, Senior Banker 25 September 2009 Ekaterinburg

EBRD is: • Established in 1991 • Operates in 30 countries from central Europe to central Asia • 2,750 signed projects • €44.39 bln commitments • Total project value €140.47 bln Cumulative commitments €44.39 billion As of 30 June 2009

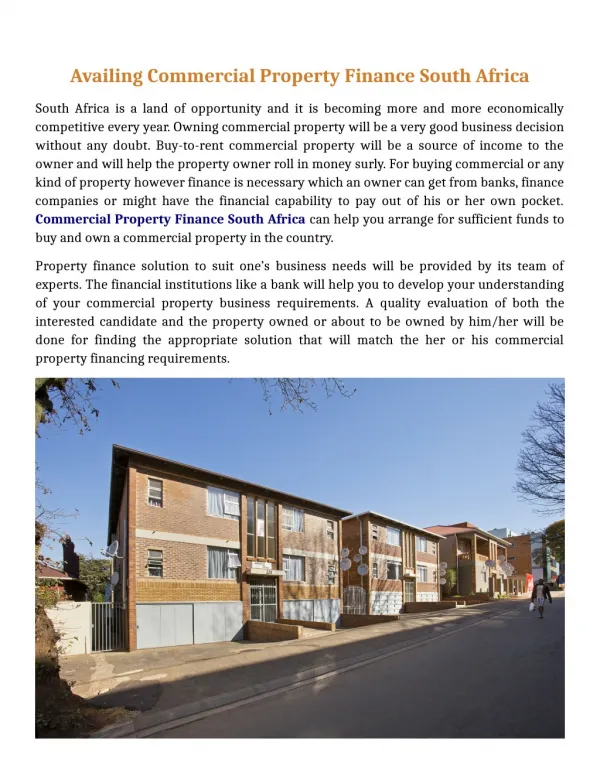

EBRD Involvement in the Property Sector • Total commitments as of 30 June 2009: • €1.82 billion to 107 projects (including equity participation in funds) • €6.5 billion total project value

Project makes economic sense - no “soft loans” Substantial equity contributions by the project sponsor, incl. cash For commercial projects, need for private investment Usual need for a B lender Limited re-financing EBRD: general project features

Senior, subordinated debt, convertible Syndication Denominated in major currencies Tailor-made security package EBRD Financing Instruments Equity / Mezzanine Debt • Common stock or preferred shares • Minority positions only • Flexible exit strategies • Mezzanine loans

EBRD Portfolio – Geographic Distribution As of 30 June 2009

Current Portfolio by type of financing As of 30 June 2009

Property Commitments by sector As of 30 June 2009

EBRD Real Estate • PARTNERS: • Real Estate Developers • Real Estate Funds • Operators • FINANCIAL INSTRUMENTS: • Senior Debt • Mezzanine / Quasi-Equity • Equity • TYPE: • Office Buildings • Retail / Shopping centres • Warehouses • Mixed-use facilities • Hotels and resorts • Property Funds, Joint-Ventures • Residential

What is on the Market with EBRD • Investments in • Developers • GRDC • GTC • Trigranit • BSR • Tourism & Hospitality • Jadranka Hotels • (Croatia) • Commercial Real Estate • IKEA Mega Mall (Russia) • BD Logistics (Russia) • Raven Russia Novosibirsk (Russia) • Saratov Shopping Centre (Russia) • GTC Regional Retail(Romania) • 19 Avenue Office (Serbia) • Kashirka Mall (Russia) • Chisinau Shopping Mall (Moldova • East Gate – Tirana Shopping Mall (Albania) • Europolis Sema Park (Romania) • Equity Funds • Marbleton Fund • Europolis I, II, III • Heitman I, II, IV • Accession Fund • Global • Polonia • BPH • Bluehouse II • Arka Property Fund • Russia Developer Fund

Typical EBRD financing to real estate • Financing tailored to the needs and risk nature of each project • Long-term (7-10 years) • Local / foreign currency • Target gearing varies • Competitive pricing • Clear and fair distribution of risks and returns between different financing partners • Alignment of each financing feature (timing of disbursement / repayment, level of return, etc.) with the underlying risk nature • Financing predominantly for new developments; acquisition financing limited to date

Structuring solutions • Project Finance can work for large developments • Ring-fenced projects, often with developers/property managers • Equity component can reduce loan pricing • Project completion mitigation (turnkey contracts, sponsor support agreed) • Separation of property assets • Arm’s length leases, separate companies • Financial investors alongside developers/property managers 12

Financing structures Debt Project Finance EBRD Sponsor • A-loan (maximum 35% of total project costs) • Limited recourse to sponsor • Security on real estate • Majority ownership + property management control Debt / Equity Project Company Equity • May be divided into operating and real estate entities Co-financing Banks Minority equity partner(s) • Possible EBRD equity (a small % of debt amount) • B-lender or parallel lender Note: details are simplified for case study 13

Financing structures Equity Finance Sponsor OrdinaryEquity / Portage Equity / Mezzanine Ordinary Equity Project Company EBRD Majority ownership and management control • EBRD exit through a put to Sponsor with pricing in a range depending on performance of the Company. • Alternative is full risk equity or secured debt after certain “Project Completion” financial targets are met by Project Company or mezzanine financing. • EBRD risk can be limited to specified (such as political risk) events with guarantee from Sponsor to apply in other cases. Minority partner Note: details are simplified for case study 14

How to best attract EBRD financing? General principles, applicable to all sectors • Sound integrity • Energy efficient projects • Transparency / early dialogue • Proven track record and market knowledge • Equity cash exposure • Clear business plan • Robust creditworthiness • Equity investors – key driver: ROE • Lenders - key driver: Project cash flows / DSCR

How EBRD can help Direct support • Advice in structuring the project • As an active or impartial shareholder, in equity investments • As an involved lender, in loans Help to secure additional financing • Preferred creditor status to attract commercial lenders • Investors Political comfort Due diligence “stamp”

Property and Tourism team contact Sergei Gutnik, Senior Banker, Property&Tourism EBRD Moscow Tel: + 7 495 787 1111 E-mail: gutniks@ebrd.com