Retroactive Payroll Processing (576)

110 likes | 368 Vues

Retroactive Payroll Processing (576). SAP Best Practices. Purpose, Benefits, and Key Process Steps. Purpose To calculate the when there is a change of earnings for the past, payroll results need to be recalculated to correct tax and earnings amounts

Retroactive Payroll Processing (576)

E N D

Presentation Transcript

Retroactive Payroll Processing (576) SAP Best Practices

Purpose, Benefits, and Key Process Steps • Purpose • To calculate the when there is a change of earnings for the past, payroll results need to be recalculated to correct tax and earnings amounts • The system performs a retrocalculation of payroll results when you make a retroactive master data change that affects an employee's past earnings • If you change the master and time data of an HR master record for a pay period for which the payroll has already run, the existing payroll results must be rechecked during the next regular payroll run and then included in the payroll again. The system automatically performs retroactive accounting for the payroll past. • Benefits • Automated calculation of retroactive changes • Key Process Steps • Retroactive Employee Master Data Change • Run US Payroll • Run Simulations and production runs for FI/CO Posting and 3rd Party Remittance • Pre-DME, DME Management and check processing • Third Party Remittance • Posting to FI/CO activities • Payroll journal reporting

Required SAP Applications and Company Roles • Required SAP Applications • SAP enhancement package 5 for SAP ERP 6.0 • Enterprise roles involved in process flows • Payroll Administrator

Detailed Process Description • Retroactive Payroll Processing • Retroactive employee master data change • Employee master data change must be entered into the system for a previous payroll period for which payroll has already been run. When payroll is run the system will automatically calculate the retroactive difference. All the payroll processing steps are the same as Scenario 566 except the only difference being the expected retroactive amount is generated • Run Payroll • After all employee master data changes are entered into the system for the relevant payroll period, the payroll is released in order to execute and run payroll for the pay period selected. If any errors occur, they must be corrected before you can exit the payroll. Prior to exiting payroll, a simulation of the third party remittance and finance posting is recommended. • DME Activities • Once payroll has been run without errors, the Pre- data medium exchange (DME) program is run for all employees in order to execute a bank transfer or check payment. The DME – Payment workbench is run for employees who have elected to be paid using direct bank transfer. For employees who are paid by check, the Check payment program will need to be executed.

Detailed Process Description • Subsequent Payroll Activities • Third Party Remittance Processing • This business process allows you to complete tasks related to vendor remittances for employee deductions. They are: • Generating bank transfer and check payments to third parties, such as tax authorities and benefits providers • Reconciling payments made in FI with payables data stored in HR.

Detailed Process Description • Subsequent Processing • Posting to FI activities • The payroll results contain information that is relevant for Accounting. For this reason, they must be evaluated for posting to Accounting. The Posting to Accounting component performs this task. It is the interface between Payroll and Accounting. It helps to: • Group together posting-relevant information from the payroll results • Create summarized documents • Perform the relevant postings in the Accounting components • Payroll Reporting • In order to facilitate reconciliation of payroll payments various reports can be run such as the wage type reporter, payroll journal, garnishments report, and the payroll reconciliation report

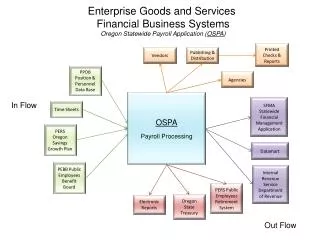

Process Flow Diagram Retroactive Payroll Processing Payroll and Post Payroll Processing (566) Check Retroactive Status Indicator Check Employee Retroactive Accounting Limit Change Retroactive Accounting Limit for Payroll Area Payroll Administrator

Diagram Connection Legend <Function> Hardcopy / Document External to SAP Financial Actuals Business Activity / Event Budget Planning Unit Process Manual Process Process Reference Existing Version / Data Sub-Process Reference Process Decision System Pass/Fail Decision