Understanding Budgeting: Key Concepts and Strategies for Financial Success

110 likes | 230 Vues

Today, we'll focus on budgeting, a critical tool for effective financial management. In our session, we'll define budgeting, explore income sources beyond paychecks, and categorize expenses into fixed, variable, and periodic types. You will learn about the importance of distinguishing between needs and wants, as well as discretionary spending. We'll also cover the importance of cash flow worksheets for tracking monthly income and expenses. Remember, maintaining a balanced budget is vital for achieving financial stability and growth.

Understanding Budgeting: Key Concepts and Strategies for Financial Success

E N D

Presentation Transcript

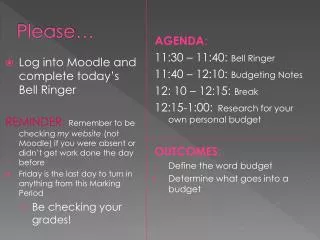

Please… • Log into Moodle and complete today’s Bell Ringer REMINDER:Remember to be checking my website (not Moodle) if you were absent or didn’t get work done the day before • Friday is the last day to turn in anything from this Marking Period • Be checking your grades! AGENDA: 11:30 – 11:40: Bell Ringer 11:40 – 12:10: Budgeting Notes 12: 10 – 12:15: Break 12:15-1:00: Research for your own personal budget OUTCOMES: Define the word budget Determine what goes into a budget

Budgeting • What is a budget? • Financial plan that compiles and compares a person’s income against all of their expenses in order to analyze spending and meet goals

Budgeting • Income – • Any money you receive. What are other sources of income besides your paycheck? • Interest, dividend payments, gifts, lottery awards, side jobs, etc. • Expenses • Costs of items that are needed or wanted

Budgeting • Fixed Expenses • Same amount every month • Examples? • Variable Expenses • Fluctuate in amount – you usually have some control • Examples? • Periodic or Occasional Expenses • Don’t pay every month and can be fixed or variable • Examples?

Budgeting • A household cash flow worksheet is another important tool in building a budget. • This worksheet takes budget building to the next level, showing exactly where monthly income goes every month

Budgeting • Needs • Goods and services to keep your life stable • Examples? • Wants • Goods and services that are not essential to daily living but make you happy • Examples?

Budgeting • Discretionary spending • Spending money on something you want versus something you need and should be used and evaluated often in order to help keep your balance in control.

Budgeting So how do I find the balance: • Income should be greater than expenses for a net gain. • This occurs when you are living within your means and allows for you to put more in savings. • Expenses greater than income cause a net loss. • You are living outside of your means and you need to either trim expenses or increase income.

Budgeting • Consistency is key to successful budgeting. • Maintaining a balanced budget will help you to monitor and evaluate to determine your overall success. In the long term it improves overall net worth.

Budgeting • Net worth is when your assets are greater than your liabilities • Assets = anything that you own that has positive value. Growing assets increase net worth. • Liabilities = something that you owe. They have negative economic value.