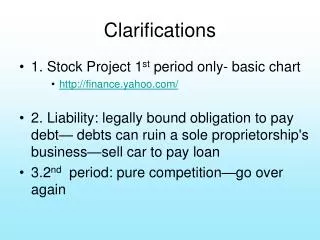

Clarifications

150 likes | 285 Vues

Clarifications. An uninformed investor is one who has no superior information Uninformed is not the same as uneducated or ignorant. An informed investor is one who has information other market participants do not. Clarifications.

Clarifications

E N D

Presentation Transcript

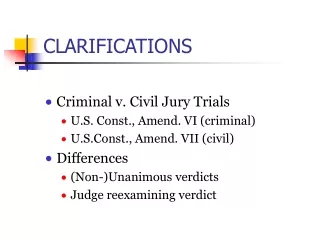

Clarifications • An uninformed investor is one who has no superior information • Uninformed is not the same as uneducated or ignorant. • An informed investor is one who has information other market participants do not.

Clarifications • An uninformed investor may be as educated and as sophisticated and knowledgeable and as highly able and trained as an informed investor. It is not superior ability, merit, education, training, birth, social position or any personal attribute that makes the informed investor informed, it’s the fact that they have superior information! :)

Clarifications • Uninformed investors can compute betas, they have access to all historical information, just not to current value relevant information that is not public. • Market efficiency does not imply there are no returns to information -- just that there are none to public information. There still are returns to private information.

Derivatives and SEC Enforcement • Today we examine the enforcement procedures of the SEC in the context of the use (and abuse) of financial derivatives. • Enforcement process has two thrusts: • Policing of companies for failure to disclose the extent of speculation in financial derivatives • Policing of brokerage firms selling financial derivatives to client firms without sufficient information regarding risks and losses.

Understanding financial derivatives • What are “financial instruments”? • Cash • Ownership interest in an entity • shares of stock • Contractual right to receive or deliver cash • Receivables and payables • Contractual right to receive or deliver another financial instrument

Understanding financial derivatives • What is a derivative security? • “…a financial agreement whose value is linked to, or derived from, the performance of an underlying asset.” • Changes in the value of the underlying asset indirectly affect the value of the derivative. • Examples: futures, forwards, swaps, and options.

Understanding financial derivatives • What is the purpose of derivative securities? • They can provide a hedge to the risks businesses face from unexpected changes in currency exchange rates, interest rates, commodity prices, etc. • They can be a speculative device that is essentially a bet that a particular rate or price will rise or fall.

Understanding financial derivatives • Hedging reduces exposure to risks that are not part of the “core” business. • An exporter wants to eliminate the risk that changes in currency rates will reduce profit. • A borrower wants to hedge the risk of rising interest rates. • A farmer wants to hedge against drops in crop prices before she can get it to market.

Understanding financial derivatives • Example of a Futures Contract • Farmer plans to sell corn crop in 6 months • Wants to protect against a drop in corn prices. • Purchase a futures contract to sell corn 6 months from now at a set price • Farmer is price protected against price drops • Notional amount of contract is the value of the corn at the agreed price Cost of the contract is much lower than the notional amount.

Understanding financial derivatives • Example # 2: Interest Rate Swaps • Builder provides adjustable rate mortgages to buyers. • Risk: loss of income if interest rates fall • Solution: Replace the variable payment stream with a fixed payment stream. Swap interest payments with a bank that likes the variability of interest. • Bank pays depositors based on variable rates

Understanding financial derivatives • The builder and bank “swap” interest payments. • Bank pays builder interest at a fixed rate and receives variable payments from homeowners • Result: builder protected against interest rate fluctuations • The notional amount of the contract is the total amount the builder lends to the homeowners. The cost of the contract is very small, but the potential gain or loss is quite large because the notional amount is large.

Understanding financial derivatives • What is the value of a derivative security? • Because the notional amount of derivatives can be very high • The cost of the initial derivative contract can be quite small • The notional amount can be quite large in comparison • This divergence makes derivatives very volatile or risky: small changes in the risk factor can cause large changes in dollar value of contract.

Understanding financial derivatives • The potential gain or loss in value of the derivative is huge. • If the underlying asset is volatile, the derivative is even more volatile because it is so leveraged. • For the interest rate swap, a 1% interest rate change can cause thousands of dollars per year change in cash flows. A very small investment, can produce returns (positive or negative) of several thousand percent.

Understanding financial derivatives • The current value is the amount received or obligated to pay if the derivative would be “unwound” at that moment. • Contracts are usually extremely complex • “value” is often calculated by one party to the contract (most often the seller) using sophisticated and proprietary formulas. • There may be no open market for these things!

Understanding financial derivatives • Derivatives can also be speculative. • The futures and swap examples above show the use of derivatives as a hedge to reduce risk. • Without underlying business transaction, the derivative increases risk exposure! • For instance in the corn price hedge, if no corn sale is involved, the derivative is simply a bet that the price will fall -- what was a risk reducer, becomes a risk seeking investment.