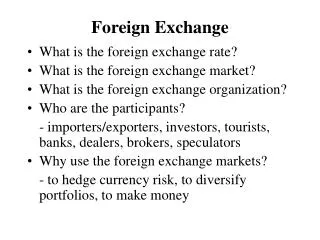

Understanding Foreign Exchange Markets and Participants

220 likes | 315 Vues

Learn about the intricacies of foreign exchange markets, types of participants, causes of exchange rate changes, and strategies to mitigate risks. Discover concepts like spot, forward, futures, and options markets. Understand factors like inflation rates, interest rates, balance of payments, fiscal policies, and more that influence foreign exchange rates.

Understanding Foreign Exchange Markets and Participants

E N D

Presentation Transcript

Finished last time with consideration of changes in value of a currency. Remember: • Depreciation means the decrease in the value of a currency. Depreciation is indicated because it takes more of that currency to buy another currency. • Appreciation means the increase in the value of a currency. Appreciation is indicated because it takes less of that currency to buy another currency.

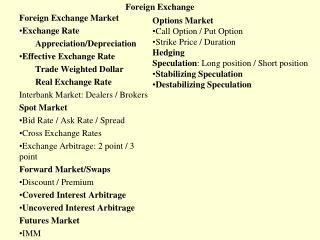

Types of Foreign Exchange Markets • Spot Market: foreign exchange market at a particular time and place. If I bought Euros from student in class, we would be engaging in a spot market, if limited to ourselves. • Forward Market: Contract to exchange a negotiated amount of currency at a negotiated exchange rate at some time in the future, such as 30, 90, or 180 days. Look at handout and notice forward rates between several currencies such as Japanese Yen (¥) and US$. • Futures Market: Contract to exchange some standard amount of currency at a future date. Japanese ¥ futures contracts are for standard amounts of ¥12,500,000. • Options Market: Contract for the option to buy or sell foreign currency at some time in the future

Types of Foreign Exchange Participants • Traders/brokers – typically associated with banks and financial institutions, deal in foreign exchange transactions in various spot, forward, futures markets • Speculators – buys currency under expectations of exchange rate changes that can be profitable • Hedgers – seek to offset existing foreign exchange positions • Arbitrageurs – buy and sell in multiple markets seeking to profit from exchange rate differences • Governments – seek manage exchange rates for domestic or international financial needs

Causes of Changes in Foreign Exchange Rates Two primary causes are emphasized:

Causes of Changes in Foreign Exchange Rates • Differences in inflation rates: Purchasing Power Parity concept that currency is exchanged from a relatively higher inflation country for currency from a relatively lower inflation country. The relatively higher inflation country’s currency depreciates due to increased quantity of the currency on the market, while the relatively lower inflation country’s currency appreciates due to decreased quantity of its currency on the market. These currency movements lead to price equalization between the two countries, purchasing power parity. Can be described as “Good Money driving out Bad Money” as people seek to move their currency from a currency losing value due to inflation to a currency not losing value. Research does not support the Purchasing Power Parity concept for currency changes.

Causes of Changes in Foreign Exchange Rates • Differences in interest rates: International Fisher Effect where differences in interest rates lead to exchange of a currency from a relatively low interest rate country for a currency from a relatively high interest rate country. The currency from the relatively low interest rate country depreciates due to increased quantity of the country’s currency on the market and the currency from the relatively high interest rate country appreciates due to the decreased quantity of its currency on the market. Can be thought of as “money moving to where it will earn the highest interest rate or the highest return” leading to depreciation of currency of low interest rate country as money moves to an appreciating currency of a higher interest rate country. Also little research support for this cause

Causes of Changes in Foreign Exchange Rates Others: • Balance of Payments: trade deficits due to increased quantity of country’s currency on the market can lead to depreciation of a country’s currency; trade surpluses due to decreased quantity of country’s currency on the market can lead to appreciation of a country’s currency. • Fiscal Policies: excessive government expenditures and budget deficits lead to depreciation. • Monetary Policies: loose monetary policy that allows growth in the money supply typically leads to inflation and currency depreciation. • Political and Economic Instability/Stability: internal political conditions can affect confidence in a country and its currency exchange rate. Instability typically leads to depreciation.

Business Concern is Foreign Exchange Rate Risk Foreign Exchange Rate Risk is a change in the exchange rate that can negatively or positively affect the profitability of an international business transaction. While a positive effect is desirable, a negative effect of an exchange rate change is to be avoided.

Businesses Seek to Reduce Foreign Exchange Rate Risk A positive or negative effect of a change in the exchange rate cannot be predicted with certainty. Business are more concerned with protecting themselves from negative changes, even if they forego possible positive changes. They prefer the certainty of knowing future profitability effects than the uncertainty of possible positive results.

Two possible actions to protect from foreign exchange risks will be considered: • Forward Contract • Asset – Liability Hedging • If Asset in foreign currency, match with Liability in that foreign currency, such as a short-term loan • If Liability in foreign currency, match with Asset in that foreign currency, such as a short-term bank deposit The following two examples will demonstrate the analyses and selection of one or the other of these two methods to reduce foreign exchange risk.

International Purchase Example Big Cattle USA buys from Canada Feeds Can$ 25,000,000 of corn feed. Payment will be made in 90 days. The present exchange rate is US$1.0259/Can$. The 90 day forward exchange rate is US$1.0239/CAN$. The deposit rate in Canada is .88% per annum. The prime lending rate in Canada is 3% per annum. Big Cattle cost of capital is 9% per annum. What is the best way for Big Cattle to protect itself from foreign exchange risk on this purchase of corn feed from Canada?

What could happen? • Value of transaction today in US$ CAN$ 25,000,000 X US$1.0259/CAN$ = US$25,647,500 • Appreciation of US$ CAN$ 25,000,000 X US$1.0249/CAN$ = US$25,622,500 • Depreciation of US$ CAN$ 25,000,000 X US$1.0269/CAN$ = US$25,672,500 Which will happen? Don’t know – leads to actions to prevent foreign exchange risk

90 Day Forward Contract CAN$25,000,000 X US$1.0239/CAN$ = US$25,597,500 payment in 90 days Need Present Value of this payment, must discount by Big Cattle’s cost of capital Forward Value = US$25,597,500 = US$25,034,230 (1+ cost of capital ) (1 + .09 ) fraction of year 4

Asset – Liability Hedging Big Cattle has an Accounts Payable, a Liability, and needs to match with an Asset, a 90 day bank deposit in Canada. The logic is that after 90 days, the deposit plus interest will be sufficient to make the CAN$25,000,000 payment. The amount to deposit in Canada: Value of payment = CAN$25,000,000 = CAN$24,945,121 (1 + deposit rate ) (1 + .0088 ) fraction of year 4 Amount of US$ to convert to CAN$ for the CAN$24,945,121 deposit Multiple today’s spot rate US$1.0259/CAN X CAN$24,945,21 = US$25,591,199

Which to choose? • Forward Contract = US$25,034,230 • Asset-Liability Hedging = US$25,591,199 • Choose Forward Contract - Costs Less • Lessons • Must make financial calculations to make choice • Must determine present value of forward contract by discounting using firm’s cost of capital • No method of foreign exchange risk protection is always better than another, can only be determined through financial analysis

International Sales Example Big Cattle sells cattle to Tough Beef of the United Kingdom, and will be paid £10,500,000 in 180 days. The spot exchange rate is US$1.5996/ £. The 180 day forward rate is US$1.5951/ £ . The bank deposit rate in the UK is .725% per annum. The prime lending rate in the UK is 4.1% per annum. Big Cattle’s cost of capital is 9% per annum.

What could happen? • Value of transaction today in US$ £10,500,000 X US$1.5996/ £ = US$16,795,800 • Appreciation of US$ £10,500,000 X US$1.4950/ £ = US$15,697,250 • Depreciation of US$ £10,500,000 X US$1.6545/ £ = US$17,372,250 Which will happen? Don’t know – leads to actions to prevent foreign exchange risk

180 Day Forward Contract £10,500,000 X US$1.5951/£ = US$16,748,550 received in 180 days Need Present Value of this received payment, must discount by Big Cattle’s cost of capital Forward Value = US$16,748,550 = US$16,027,321 (1+ cost of capital ) (1 + .09 ) fraction of year 2

Asset – Liability Hedging Big Cattle has an Accounts Receivable, an Asset, and needs to match with a Liability, a 180 day bank loan in the UK. The logic is that after 180 days, the received payment will be sufficient to pay off the 180 bank loan principal plus interest The amount to borrow in UK: Value of received payment = £ 10,500,000 = £10,289,074 (1 + lending rate ) (1 + .041 ) fraction of year 2 Amount of US$ received from the £10,289,074 bank loan Multiple today’s spot rate US$1.5996/ £ X £10,289,074 = US$16,458,403

Which to choose? • Forward Contract = US$16,027,321 • Asset-Liability Hedging = US$16,458,403 • Choose Asset-Liability Hedging – Receive more from the sale • Lessons • Must make financial calculations to make choice • Must determine present value of forward contract by discounting using firm’s cost of capital • No method of foreign exchange risk protection is always better than another, can only be determined through financial analysis

Other foreign exchange risk protection methods • Negotiate higher sales price, but may lose sale because buyer unwilling to pay higher price • Negotiate lower purchase price, but may not be able to buy if seller unwilling to lower price • Factor discounting: sell A/R asset to factor for reduced value to obtain payment now, avoid foreign exchange risk by transferring the risk to the factor • Negotiate price of transaction in own country’s currency, for U.S. companies in US$, but other party may not be willing and could lose sales or purchase