Follow These Few Tips Before Investing In Commodities

90 likes | 153 Vues

<br>There are physical commodities and then there are commodity futures. Alumina commodity has its own benefits. You need to understand each of them.

Follow These Few Tips Before Investing In Commodities

E N D

Presentation Transcript

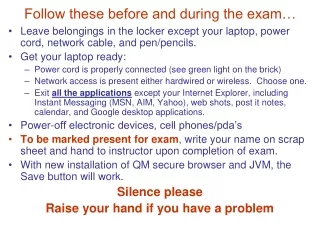

These Few Tips Will Help You Investing In Commodities the Right Way

Commodity market happens to be one of the most peculiar, unique and beneficial markets of all time and a lot of people get high returns investing in the commodity market. • Although the market has its own risk factors, investing the right way will provide you many future benefits that are higher than any other investments. What is commodity?

Commodities are basically raw materials which are used to make other products. There are many types of commodities such as – gold, live cattle, grains, alumina commodity, bitumen, natural gas, crude oil and many more other options. • Importantly, commodities are standardized across producers with the use of minimum quality standards, called basic grades.

. This allows them to be interchangeable and grants each type of commodity a value that can fluctuate with the movements of the global market. • There are many ways through which you can invest in commodities. • But you must make sure that you know in and out about the market before you put your money.

There are certain risks, and you must be well aware of each of them so that nothing comes as a surprise to you. Here are a few tips for you to invest in the commodity market – • The most important part is the amount of money you are ready to invest in. commodity market is all about the money. So before you go ahead and invest in a particular commodity, you first need to make sure how much money you are ready to invest in.

After you have decided how much money you are going to put, you need to decide which commodity you are going to investment in. • Hire someone who can help you decide which commodity is the best option for you to invest in. There are physical commodities and then there are commodity futures. Each and every commodity has its own benefits. You need to understand each of them.

Maintain a balanced allocation of assets. That is, don't put all of your eggs in one basket. You can reduce your risk of losing money by spreading your commodities investments over a variety of different commodities and commodity-related securities.