International Finance

140 likes | 289 Vues

The foreign exchange market plays a crucial role in international finance, allowing nations to value their currencies relative to one another. Exchange rates, determined by supply and demand, fluctuate continuously and affect trade dynamics. A strong dollar can negatively impact U.S. exports while benefiting importers. Currency speculation and purchasing power parity theories, like the Big Mac Index, help investors predict currency movements. Additionally, understanding balance of trade and payments is essential for grasping global economic interactions.

International Finance

E N D

Presentation Transcript

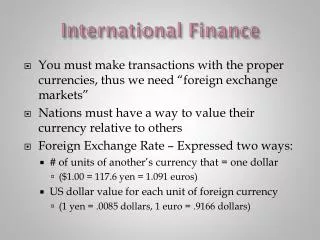

International Finance • You must make transactions with the proper currencies, thus we need “foreign exchange markets” • Nations must have a way to value their currency relative to others • Foreign Exchange Rate – Expressed two ways: • # of units of another’s currency that = one dollar • ($1.00 = 117.6 yen = 1.091 euros) • US dollar value for each unit of foreign currency • (1 yen = .0085 dollars, 1 euro = .9166 dollars)

What determines values? • Mostly, the forces of supply and demand • S and D for a currency are largely determined by S & D for goods and services • Example: If there is a large demand for goods from Japan, there will be a large demand for Yen. • Political or Economic Instability • High interest rates in a nation create a demand for that nation’s currency • Exchange rates float and are constantly changing – govts often intervene

Is it good to have a “strong dollar”? • Can have a negative effect on US exports, positive effect for countries selling to US • EX: 2 British pounds = 1 US dollar OR • 1 British pound – ½ US dollar • $100 US watch would sell for 200 pounds in Britain • If Dollar strengthens: • 3 pounds = 1 dollar OR 1 pound = 1/3 dollar • The same watch now costs 300 pounds in Britain and demand for it would decrease

Also, the quantity of British goods demanded in the US would increase • EX: British clothes costing 200 pounds would have originally cost 100 dollars in the US • After the dollar strengthened, the clothes would now cost $66.66 (200/3) • (pound went up by 33%, dollar denominated item will )fall by 33%

Currency Speculation • Investors buy and sell currencies in hopes of making a profit • PPP (Purchasing Price Parity) – exchange rate moves to a “correct” price so goods cost relatively the same in both countries • “Big Mac Index” – Theory of PPP • Big Mac in US costs $2.42, in Japan costs 294 yen • Exchange rate should be 294/2.42 = 121 • If rate is higher than 121, the Yen is undervalued, will rise against the dollar in the future

Balance of Trade • The difference between the dollar value of exports and the dollar value of imports • US has run a trade deficit in all years except one (75) since 1971 • About 25% of our trade deficit is due to oil

Is our trade deficit a problem? • Depends which economist you ask • Some believe we are “borrowing” from foreign nations to finance our consumption • As dollars flow out of our economy • They get more money for their products, can buy more US assets. • Others believe it is not a problem

Balance of Payments • An accounting record of all monetary transactions with other countries • Includes imports and exports, flows of investment funds in and out of the country, loans between nations, etc • Broken down into: • Current Account: goods, services bought and sold and income earned with foreign nations (business / work transactions) • Capital Account: flow of money or capital between nations (investments). Will often flow to nations where interest rates are high.