Option 4(b): Max MWh based Allocation of Default

50 likes | 238 Vues

Option 4(b): Max MWh based Allocation of Default. Shams Siddiqi, Ph.D. Crescent Power, Inc. (512) 263-0653 shams@crescentpower.net October 30, 2009. Option 4(b) Allocation of Defaults.

Option 4(b): Max MWh based Allocation of Default

E N D

Presentation Transcript

Option 4(b): Max MWh based Allocation of Default Shams Siddiqi, Ph.D. Crescent Power, Inc. (512) 263-0653 shams@crescentpower.net October 30, 2009

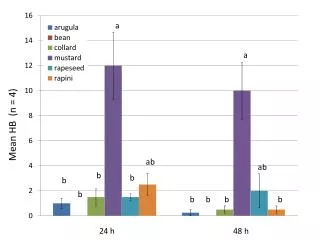

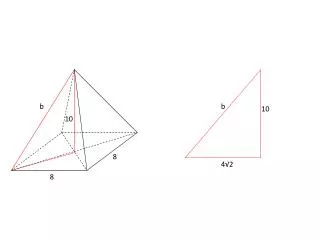

Option 4(b) Allocation of Defaults • 180 days after the default, ERCOT would allocate default amount using, for the calendar month (currently) 90 days month prior before to the date of default, on which ERCOT issues the Uplift Invoice and for each non-defaulting QSE and CRR Account Holder, the following (all amounts are in MWh): • Maximum of • RTM: Sum over all Settlement Points: its Adjusted Metered Load; OR • RTM: Sum over all Settlement Points: its Metered Generation (excluding energy from RMR Resources); OR • RTM: Sum of all Energy Trades where the QSE is the Buyer; OR • RTM: Sum of all Energy Trades where the QSE is the Seller; OR • DAM: Sum of all its Energy Offers (Three-part Supply Offers and Energy-Only Offers) cleared in the DAM; OR • DAM: Sum of all its Energy Bids cleared in the DAM; OR • DAM: Sum of all its RT PTP Obligations purchased in the DAM; OR • CRR: Sum of all its CRRs for that month sold in CRR Auctions plus cleared in the DAM plus its PTP Options clearing in RTM; OR • CRR: Sum of all its CRRs for that month allocated or purchased in CRR Auctions

Option 4(b) Allocation Equation • Max [∑p (RTMG1p*4), ∑p (RTAMLp*4), ∑p (RTQQESp), ∑p (RTQQEPp), ∑p (DAESp), ∑p (DAEPp), ∑p (RTOBLsource p), ∑p (DAOPTsourcep+DAOBLsource p+ RTOPTsourcep+OPTSsourcep+OBLSsource p), ∑p (OPTPsourcep+OBLPsource p)] • ∑QSE/CRRAHMax[∑p (RTMG1p*4), ∑p (RTAMLp*4), ∑p (RTQQESp), ∑p (RTQQEPp), ∑p (DAESp), ∑p (DAEPp), ∑p (RTOBLsource p), ∑p (DAOPTsourcep+DAOBLsource p+ RTOPTsourcep+OPTSsourcep+OBLSsource p), ∑p (OPTPsourcep+OBLPsource p)] • 1. Excluding RMR volumes

Features of Option 4(b) • All entities with Load or Generation share in Default allocation regardless of their level of activity in ERCOT markets • By using the Maximum of Load or Generation or Energy Trade sells or Energy Trade buys or DAM Purchases or DAM Sales or CRR Purchases or CRR Sales, Entities are not penalized for hedging using own portfolio and/or bilateral markets and/or ERCOT Day-Ahead and CRR markets