1 / 0

Economic Feasibility of Ethanol Production: Insights from Texas and South Africa

0 likes | 126 Vues

In Lecture 18, we explore the economic feasibility of ethanol production, focusing on two key studies. First, we'll examine the article on ethanol production in Texas, emphasizing the incorporation of risk in economic analysis. Secondly, the IAMA Journal article on South Africa will provide insights into bio-ethanol production from wheat. These readings, along with Chapter 13, will equip you with a comprehensive understanding of the economic factors and risks associated with agribusiness ventures in biofuels.

Télécharger la présentation

Economic Feasibility of Ethanol Production: Insights from Texas and South Africa

An Image/Link below is provided (as is) to download presentation

Download Policy: Content on the Website is provided to you AS IS for your information and personal use and may not be sold / licensed / shared on other websites without getting consent from its author.

Content is provided to you AS IS for your information and personal use only.

Download presentation by click this link.

While downloading, if for some reason you are not able to download a presentation, the publisher may have deleted the file from their server.

During download, if you can't get a presentation, the file might be deleted by the publisher.

E N D

Presentation Transcript

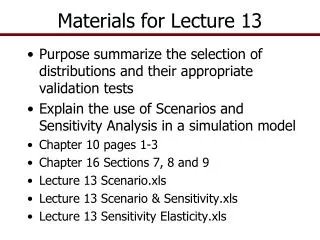

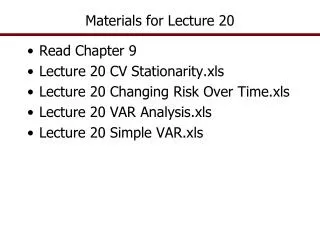

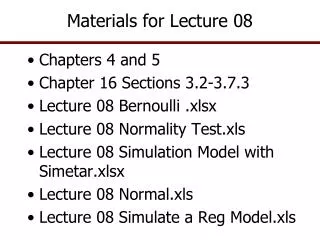

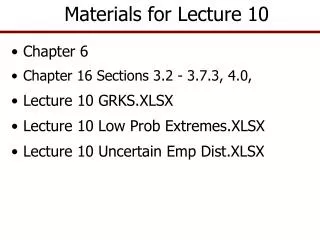

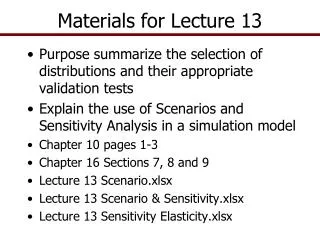

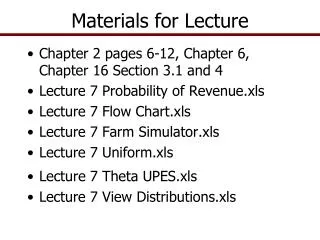

- Materials for Lecture 18 Read Chapter 13 Read three articles on web site J. Agribusiness Including Risk in Economic Feasibility Analysis: The Case of Ethanol Production in Texas IAMA Journal Article on economic feasibility of Bio-ethanol Production for Wheat in South Africa SJAE Use of Probabilistic Cash Flows Lecture 18 Project Feasibility.xlsx Lecture 18 Ethanol Feasibility.xlsx Lecture 18 Growth Functions.xlsx

- Project Feasibility Analysis It all started with a term paper Ice Plant article by Richardson and Mapp, Southern Journal of Agricultural Economics (SJAE) 1976 – used risk for a feasibility analysis The article demonstrated the methodology for risk based feasibility studies, and it was first to report Probability of Economic Success Probabilistic Cash Flows to meet cash needs Financial/Economic analyses have been used hundreds of times for a wide variety of firm based problems

- Project Feasibility Analysis In business most feasibility studies use Excel spreadsheet models This trend by business started in the mid-90s Excel is the language of business analysis Feasibility studies generally ignore risk – many do a “What if …” study for the Best Case and Worst Case scenarios Some analysts think they considered risk by including a 10 year “average” price Excel deterministic feasibility models are easily converted to stochastic feasibility models Just make the forecasted variables stochastic using the residuals from the forecast models or GRKS

- Project Feasibility Analysis Risks to consider for a feasibility analysis are: Price of raw inputs, as fuel and labor Price of the product or output Production risk Black Swan events Competition and market share over the life of the investment (business) Cost of the plant and product development Cost of production for the finished product Time to construct the plant and get it operational Project feasibility is where we put it all together in an analysis of Time, Money, and Economic Viability

- P(T) P(T) Project Project Management Management Time Time P(C) P(C) Bid Analysis Analysis Cost (money) Cost (money) P( ) P( ) Project Project Feasibility Feasibility Rate of Return Rate of Return Project Feasibility Analysis Project Feasibility: consider the Time, Money (Cost), and Economic Viability of the finished business Simulate the Time to complete or build the plant Simulate the Cost of developing the plant incorporating risk into the plant’s development costs Simulate the Economic Viability of the completed plant (business)

- Project Feasibility Analysis Proposed business with a new product Tasks and duration/costs Tasks Description Time (mo.) Costs ($1,000) 1 Plant Modification 3-5 300-325 2 Product Development 1-3 200-300 3 Distribution System 2-3 50-100 4 Marketing Program 3-4 100-150 Finance 100% of project costs @ 9% Marginal cost of production/unit Uniform(10,15), a scenario variable Fixed Costs/year $200,000 Inflation Uniform(0.04, 0.05) percent per year Demand Projections indicate that competition may grow over time Years Price/Unit Quantity Sold/Year 1-3 U(13.5,14) U(500K, 600K) 4-5 U(13,13.5) U(400K, 500K) 6-10 U(12.5,13) U(300K, 400K)

- Project Feasibility Analysis Setting the proposed project up in a Project Management framework gives us the “cost” and “time” to complete the project If these answers are acceptable to management the next questions is – Will the business be economically viable?

- Project Feasibility Analysis The stochastic final cost of building the plant, becomes input into the project analysis phase of the analysis

- Project Feasibility Analysis 10 Year analysis yields many potential reports Annual rate of return to assets Things look bad after 6th year

- Project Feasibility Analysis Scenario analysis of management control variables to see if the plant could be more profitable.

- KOVs for Multi-Year Analyses Multiple year investments require full consideration of returns over the planning horizon Net Present Value (NPV) Present Value of Ending Net Worth (PVENW) Ending Cash Reserves (Cash flow statement) P(insolvency) or P(debt/asset > 0.75) NPV is the present value of all earnings that leave the business plus the change in net worth minus beginning net worth NPV = -Beg Net Worth +∑{Dividends * (1/(1+r)^t) } + PVENW For a family owned business substitute family living for dividends PVENW value of ending net worth in current dollars PVENW = Ending Net Worth * (1/(1+r)^T) Where T is the number of years simulated, eg. 10

- Project Feasibility – Ethanol Plants in Texas Ethanol production is dependent on Inputs could be: corn, sorghum, wheat, potatoes, etc Fuel requirements are: natural gas and electricity Sale of co-product of DDGS Sale of ethanol Local communities want a plant because it hires more 35 people year around, farmers have dependable market for grain, and it generate jobs during the construction phase of 9 to12 months

- Project Feasibility – Ethanol Plants in Texas Develop a Feasibility Model for an Ethanol plant in Texas Location: High Plains due to feedlots and local corn/sorghum supplies Rail transportation facilities available to import corn and ship ethanol KOVs Net Present Value Annual cash flows Probability of cash flow deficits Probability investors get their money back or the P(Increase Real Net Worth)

- Project Feasibility – Ethanol Plants in Texas Stochastic variables Corn and sorghum prices DDGS price Ethanol price Electricity and natural gas prices Develop MVE distribution for these prices based on prices for the past 10 years Problem with stochastic prices Must use Texas prices and we have forecasts for National prices Texas Price = a + b National Price + e Simulate a stochastic national price and use to simulate a Texas price

- Project Feasibility – Ethanol Plants in Texas Develop a Financial Simulation Model : Income Statement, Cash Flow, and Balance Sheet Simulate 10 years using corn as the feed stock, repeat process using sorghum Assume a learning curve for management to bring the plant up to its full capacity Validation exercises 4 Ps Touring test with other economists Present results to local investors Present results to politicians

- Learning Curve or Demand Cycle A new business may need a few months or years to grow sales to their potential May take months or years to learn how to reach potential for a prod function In either case, assume a stochastic growth function and simulate it, if nothing else is available, use a Uniform distribution Example of a growth function for 8 years

- Learning Curve or Demand Cycle

- Life Cycle Costing A new concept in project feasibility analysis Explicitly consider externalities Such as cleanup costs at end of business Strip mining reclamation Removal of underground fuel tanks Removal of above ground assets Restoration of site Prevention of future environmental hazards Removal of waste materials 100 year liners for ponds

- Life Cycle Costing Steps to Life Cycle Costing Analysis Identify the potential externalities Determine costs of these externalities Assign probabilities to the chance of experiencing each potential cost Assume distributions with GRKS or Bernoulli Simulate costs given the probabilities Incorporate costs of cleanup and prevention into the project feasibility These terminal costs may have big Black Swans so prepare the investor

- Life Cycle Costing Bottom line is that LCC will increase the costs of a project and reduce its feasibility Affects the downside risk on returns Does nothing to increase the positive returns Need to consider the FULL costs of a proposed project to make the correct decision J. Emblemsvag – Life Cycle-Costing: Using Activity-Based Costing and Monte Carlo Simulation to manage Future Costs and RisksJohn Wiley & Sons Inc. 2003

- Life Cycle Analysis LCA is a tool for determining the impact of a new process or project on the environment and climate change LCAs are concerned with quantifying Energy Use and CO2 Balance Green House Gases (GHGs) Water use and indirect Land use Nutrient (N,P,K) use and other factors Thus far these are deterministic analyses – This will soon change

- Life Cycle Analysis For those interested in a good example of LCA see MS thesis in our Department by Chris Rutland

More Related