M A Y 2 0 0 7

240 likes | 324 Vues

M A Y 2 0 0 7. T E L E C O M S E C T O R : O V E R V I E W . Presentation to FIN 824 (SPRING QUARTER) Marc Reitter Siddhesh Sankulkar. T E L E C O M S E C T O R. Telecom Sector Overview: . 1. Sector Overview. 2. 2.

M A Y 2 0 0 7

E N D

Presentation Transcript

M A Y2007 T E L E C O M S E C T O R : O V E R V I E W Presentation to FIN 824 (SPRING QUARTER) Marc Reitter Siddhesh Sankulkar T E L E C O M S E C T O R

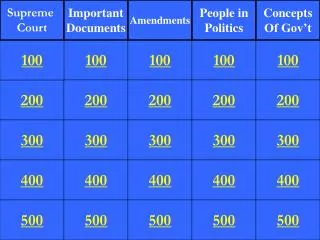

Telecom Sector Overview: 1 Sector Overview 2 2 Sector Weights – SIM v S&P 500 3 3 Size & Composition 4 Sector Performance 5 Economic Analysis 6-10 Financial Analysis 11-14 T E L E C O M S E C T O R Valuation Analysis 15-20 Domestic M&A Activity 21 Recommendation 22 1

Sector overview – defined S&P Telecom Sector • The Telecom sector is grouped into two primary segments: • Telecommunications Equipment • Wireless, Satellite & Network • Telecommunications Services • Cable & Satellite, Data Services, Wireless Communications • Telecom Industry Growth • The worldwide telecom industry is in a strong growth mode, and overall industry revenue is expected to climb to $1.3 Trillion in 2007. • Strong growth in wireless is leading the way as wireless service revenues are expected to grow at a compounded rate of nearly 10 percent over the next few years. T E L E C O M S E C T O R Source: Insight Research Corp. 2007 industry review 2

-.62% 2.10% 2.85% 10.54% -.79% 6.61% .52% 8.59% -3.96% 1.05% Sector weights – SIM vs. S&P 500 SIM overview: • Current holdings: • Current holdings: SIM overweight Telecom by 3.43% S&P 500 overview: T E L E C O M S E C T O R YTD Return 3

Sector overview – company analysis Size & composition • Telecom defined within the S&P 500: • Current SIM holdings: T E L E C O M S E C T O R Source: Yahoo Finance & Bloomberg 4

Sector overview – performance & strength Performance of S&P Telecom Services (SP50): Strength of S&P Telecom Services (SP50): T E L E C O M S E C T O R 5

Sector Overview Economic Analysis Telecom Sector Outlook is positive in the recent past and for the foreseeable future • In 2006, the U.S telecommunications market grew at its fastest rate since 2000. • TIA states that the U.S Market grew 9.3% in 2006 to total $923 billion in revenue. • Projected revenue for the U.S Market in 2007 is at $1025 billion at 11.05% • Major drivers of high growth rates are expansion of wireless communication and broadband access. • Wireline is losing ground to wireless and VoIP T E L E C O M S E C T O R 6

Sector Overview Economic Analysis United States market is looking good but the real growth is overseas • Growth is expected in VoIP, as the broadband-based phone technology is forecast to make up 34% of all U.S residential landlines by 2010, up from just 10% in 2006. • Overall, the international market grew 12.1 percent in 2006. Middle East/Africa was the fastest growing region, expanding at 21.6% • By 2010, the global market is expected to reach $4.3 trillion in revenue, up from $3 trillion in 2006. T E L E C O M S E C T O R 7

Sector Overview Economic Analysis ‘Non-voice’ revenues on the rise • While growth in voice traffic continues to stimulate the wireless market, data and multimedia applications will drive wireless revenues in the future. • The number of broadband subscribers increased from fewer than 5 million in 2000 to nearly 57 million in 2006. • Dial-up subscribers fell to 35 million from a peak of 47 million in 2006. • With nearly 80% of all households already online and the majority of online households already having a broadband subscription, overall subscriber growth and broadband subscriber growth will necessarily slow. T E L E C O M S E C T O R 8

Sector Overview Economic Analysis Key Economic Drivers • Sector growth is correlated with: • GDP (+) • Population Growth (+) • Unemployment Rate (-) Most pronounced • Wireline growth is more strongly correlated with above than wireless T E L E C O M S E C T O R 9

Sector Overview Economic Analysis Key Economic Drivers – Unemployment Rate (-) T E L E C O M S E C T O R 10

Sector Overview Financial Analysis SP-50 Income Statement Analysis T E L E C O M S E C T O R 11

Sector Overview Financial Analysis SP-50 Cash Flow Statement Analysis T E L E C O M S E C T O R 12

Sector Overview Financial Analysis SP-50 Income Statement Ratios SP-50 Cash Flow Statement Ratios T E L E C O M S E C T O R 13

Sector Overview Financial Analysis SP-50 Prospective Growth and Margin Data T E L E C O M S E C T O R 14

Sector Overview Valuation Analysis SP-50 Historical Sector Performance (5 Years) T E L E C O M S E C T O R 15

Sector Overview Valuation Analysis Price/Yr-Forward Earnings relative to S&P 500 T E L E C O M S E C T O R 16

Sector Overview Valuation Analysis Price/EBITDA relative to S&P 500 T E L E C O M S E C T O R 17

Sector Overview Valuation Analysis Price/Sales relative to S&P 500 T E L E C O M S E C T O R 18

Sector Overview Valuation Analysis Price/Book Value relative to S&P 500 T E L E C O M S E C T O R 19

Sector Overview Valuation Analysis Price/Cash Flow Adjusted to S&P 500 T E L E C O M S E C T O R 20

M&A activity A look at what is happening to the Industry in the US before we recommend 21

Sector Overview Recommendations • Hold current SIM overweight position of 3.43% • Divest holdings in Wireline companies which have no wireless component e.g. Windstream Corporation. • Invest more in US companies offering integrated telecom services i.e. wireless, wireline, broadband and video services. We see brightest prospects for the national carriers (AT&T, Sprint/Nextel, Verizon) which are able to market on a nationwide basis, offer nationwide calling plans, and carry most traffic on their own networks. They get to exploit both economies of scale and economies of scope. • Invest more in Wireless providers in emerging markets. General consensus of industry experts is that these providers will continue to realize double-digit subscriber and revenue growth in 2007, improving margins and profitability. T E L E C O M S E C T O R 22

Sector Overview Questions • Questions? T E L E C O M S E C T O R 23