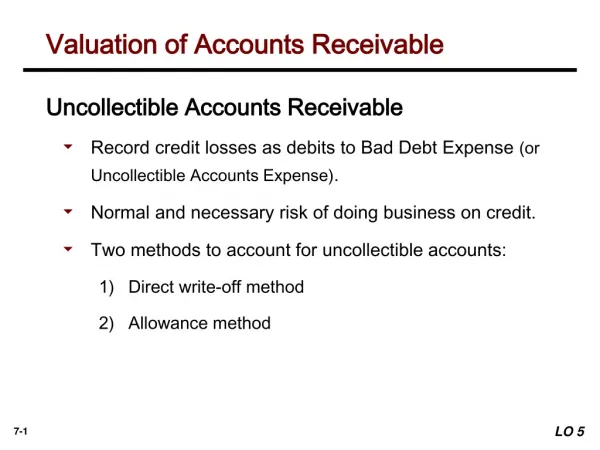

Uncollectible accounts - PowerPoint PPT Presentation

View Uncollectible accounts PowerPoint (PPT) presentations online in SlideServe. SlideServe has a very huge collection of Uncollectible accounts PowerPoint presentations. You can view or download Uncollectible accounts presentations for your school assignment or business presentation. Browse for the presentations on every topic that you want.