0 likes | 15 Vues

Learn how to enter bank transactions into an analysed cash book, post to the general ledger, and extract a trial balance for Byrne Ltd in January 2022, with specific analysis columns for sales, VAT, capital, purchases, wages, and insurance. The process involves recording cash sales, cash purchases, wage payments, capital investments, and insurance payments to maintain accurate financial records. Understand the importance of balancing accounts and preparing trial balances for effective financial management.

E N D

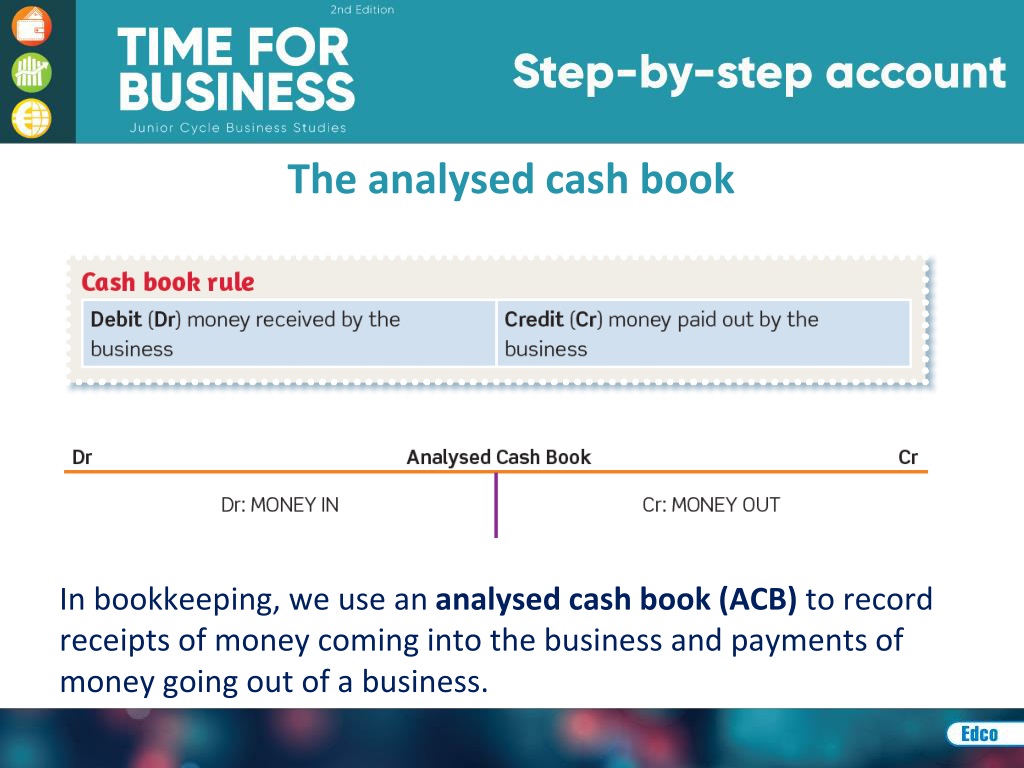

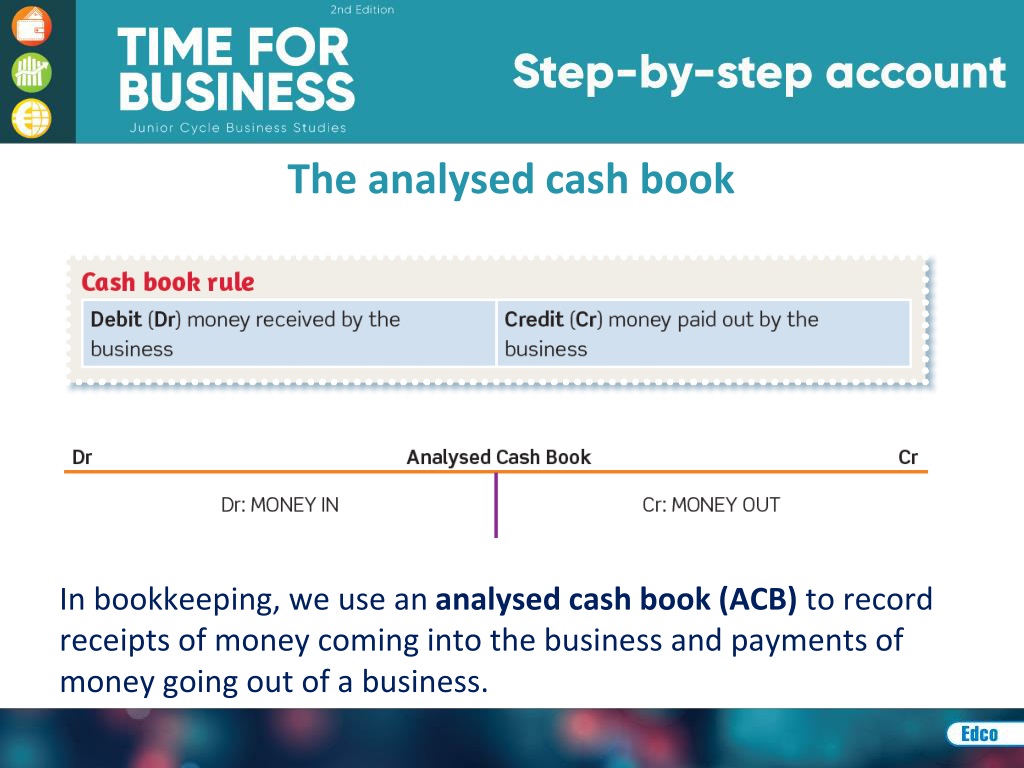

The analysed cash book In bookkeeping, we use an analysed cash book (ACB) to record receipts of money coming into the business and payments of money going out of a business.

Question: Analysed Cash Book, Ledgers and Trial Balance Byrne Ltd had the following bank transactions. You are required to enter these in the analysed cash book, post to the (general) ledger and extract a trial balance as at 31/1/22. Use the following analysis columns in the analysed cash book: Dr: Sales, VAT, Capital Cr: Purchases, VAT, Wages, Insurance Bank transactions: 3 January 2022 Cash sales lodged, Receipt no. 1, €20,000 plus VAT €4,600 7 January 2022 Cash purchases, cheque no. 1, €7,500 plus VAT €500 8 January 2022 Paid wages, cheque no. 2, €2,000 12 January 2022 Shareholders invested €50,000 and this was lodged 18 January 2022 Paid insurance, cheque no. 3, €3,500

Analysed cash book for Byrne Ltd for January 2022 Dr Cr 2022 € € € 2022 € € € € € € 1 03/01 4,600 GL 7,500 1 GL 24,600 20,000 07/01 Purchases Sales 8,000 500 12/01 GL 2,000 2 GL 50,000 Capital 50,000 Wages 2,000 08/01 Insurance 3 GL 3,500 3,500 18/01 Balance c/d 31/01 61,100 2,000 3,500 74,600 500 74,600 7,500 20,000 4,600 50,000 Balance b/d 61,100 01/02

21 LEARNING OUTCOME 2.12 Income PREPARING AN ANALYSED CASH BOOK FOR A BUSINESS • The analysed cash book for a business is prepared and balanced in the exact same way as an analysed cash book for a household or individual. • The key differences are that: Transactions are likely to be bank only (most business transactions are electronic). Transaction values are likely to be larger. Sales and purchases are subject to Value Added Tax (VAT), which has to be calculated and shown in analysis columns.

21 LEARNING OUTCOME 2.12 Income PREPARING AN ANALYSED CASH BOOK FOR A BUSINESS (EXAMPLE)

21 LEARNING OUTCOME 2.12 Income OPENING AND CLOSING BALANCES • The first entry in the analysed cash book is the opening bank balance. This is the closing balance from the previous month. The opening balance is recorded on the debit side of the account, as it is money the business has in the bank. For example, if the closing bank balance in May is €500, then the opening bank balance for June is €500.

21 LEARNING OUTCOME 2.12 Income OPENING AND CLOSING BALANCES If the closing balance for May was minus €500, then the business is starting June with an overdraft of €500. • This is recorded on the credit side of the account. • The balance at the end of the account shows the amount in the bank at the end of the period in question.

CASH BOOK, LEDGER AND TRIAL BALANCE 2.12 Example 1: MiniZone Simple Cash Book Cash Book of MiniZone Debit In Out Credit Date Details F € DATE Details F € 1/6 Balance b/d 15,000 7/6 Purchases GL2 4,500 15/6 Sales GL1 5,000 18/6 Wages GL3 3,500 31/6 Balance c/d 12,000 20,000 20,000 1/7 Balance b/d 12,000 • MiniZone is left with €12,000 at the end of the month. • The €12,000 will be the opening cash the following month. 9

21 LEARNING OUTCOME 2.12 Income BALANCING AN ACCOUNT Textbook -Page 278

21 Income Homework • Workbook – page 138 Question 1 11