AS - 17 Segment Reporting By: CA. ANIL MATHUR Jaipur

530 likes | 1.66k Vues

AS - 17 Segment Reporting By: CA. ANIL MATHUR Jaipur. Mandatory in nature Application from 1.4.01 to : * Enterprises listed/in the process of being listed in a recognised stock exchange in India. * Other enterprises with a turnover of more than Rs.50 crores for the accounting period

AS - 17 Segment Reporting By: CA. ANIL MATHUR Jaipur

E N D

Presentation Transcript

AS - 17 Segment Reporting By: CA. ANIL MATHUR Jaipur

Mandatory in nature • Application from 1.4.01 to : • * Enterprises listed/in the process of being listed in a recognised stock exchange in India. • * Other enterprises with a turnover of more than Rs.50 croresfor the accounting period • Application from 1.4.04 to : • Enlarged to cover following enterprises which fall in any one or more of above categories at any time during the accounting period categories : • 1. Enterprises listed in a recognised stock exchange in India or outside India. • 2. Enterprises in the process of being listed as evidenced by the BOD’s resolution . APPLICABILITY

3. Banks including co operative banks. • 4. Financial Institutions. • 5. Enterprises carrying insurance business. • 6. Other enterprises whose turnover for immediately preceding accounting year on the basis of audited financial statements exceeds Rs.50 crores and turnover excludes other income. • 7. Enterprises having borrowings including public deposits more than Rs. 10 crore at any time during the accounting period. • 8. Holding and subsidiary of any one of above enterprises • Other Points :- • Applicability to continue for 2 consecutive years even if ceases to be covered subsequently. • Previous year figure need not to be disclosed if in first accounting period after exemption coverage • Fact of non coverage to be disclosed.

Objective • To establish Principles for reporting financial information about • Different types of products / services • Different geographical areas • To help users of financial statements of the enterprise for • Understanding the performance • Assessing the risk & return • Making decisions

Scope • Applied in presenting general purpose financial statements . • Should be applied fully and not selectively • Applied in Consolidated financial statements also and should be presented only on the basis of these statements.

Definitions: Business Segment Distinguishable component of enterprises whose risk & return are different from other segment. . • Factors for Consideration • Nature of products/services. • Nature of production process. • Method used to distribute products/provide services. • Type/class of target customers. • Nature of regulatory environment, if applicable

Geographical Segment • Qua location of offices or Qua location of customer • Factors for Consideration • Similarity of economic and political conditions. • Operational relationship in various geographical areas. • Operational proximity. • Special operational risks in a specific area. • Exchange control regulations. • Currency risks. • Reportable Segment • A business / geographical segment required to be disclosed under this standard. • Enterprise Revenue • Revenue from sale to external customers as per the P&L A/C.

Segment Revenue • ER directly attributable to a segment. + • ER allocated to segment on a reasonable basis. + • Revenue from transactions with other segments. Excluding • Extraordinary items as per AS-5. • Interest & dividend income, provided the segmental operations are not of a financial nature. • Profit on sale of investments/extinguishment of debts, provided the segmental operations are not of a financial nature.

Segment Expenses • Expenses in a segment directly attributable to it. + • Enterprise expenses allocated to segment on a reasonable basis. + • Expenses from transactions with other segments. Excluding • Extraordinary items as per AS-5. • Interest expenses, provided the segmental operational are not of a financial nature. • loss on sale of investment /extinguishment of debt unless it is not involved in financial operations • Income-Tax expenses. • Head-office/Corporate office expenses. • Segment Results = Segment Revenue – Segment Expenses

Segment Assets • Directly attributable /allocated Assets • Where segment result includes interest/dividend income, the related asset should be included in segment assets. • Allowances/provisions reported as direct offsets in the Balance sheet should be reduced from the related asset. • Income tax assets are to be excluded. • Segment Liabilities • Directly attributable /allocated liabilities • Where interest expense is considered in segment result, corresponding liability is to be included in segment liabilities. • Income tax liabilities are to be excluded. • Segment Accounting Policies • Policies relating to preparation and presentation of financial statements and • those relating to segmental reporting.

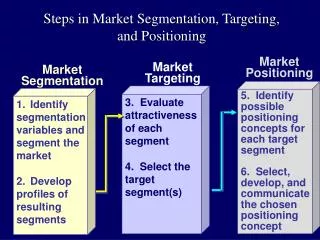

Identifying Reportable Segments Either Primary = Business Secondary = Geography Or Primary = Geography Secondary = Business Depending upon Dominant source & nature of risk & returns • Normally indicated by • Internal organisation & Management Structure • System of internal financial reporting to BOD/CEO

Exceptional Situations I II Risk and Returns strongly affected by both Product / Service and Geographically Internal Management Structure / Reporting System neither based on Product / Service nor Geographically Directors and Management to decide Primary and Secondary segment based on conditions discussion in earlier slide. Primary = Business Secondary = Geographically

Reportable Segment –A Segment whose Segment Revenue Segment Assets Segment Results Profit or Loss are 10 % or more of • the greater of • Segment Profit • (of Profit Segment) • Segment Loss • (of Loss Segment) Segment Assets Segment Revenue (and Not Enterprise Revenue )

Reportable Segment –B • Segments chosen by Management despite of small size • Smaller segments (below 10%) if external revenue of reportable segments construes less then 75% of total enterprise revenue – until 75% of total enterprise revenue is included in reportable segment. • Segment identified as reportable in immediately preceding year should continue as reportable segment • Preceding year figures should be restated if segment identified as reportable in current year was not reportable in preceding year.

Segment Accounting Policies • Follow policies adopted for preparation and presentation of enterprise financial statement. • Allocate joint segment assets and liabilities between segments only if the related revenue / expenses are also allocated.

Other Policies • Geographical segment : single country or group of them or a region within a country • Matrix Presentation : where both business segment and geographical segment are as primary segment. This is not required as per this AS but does not prohibit on the other hand. • NON Reporting : Disclosure required if Segment Information is not provided, even though same is applicable to the enterprise • Disclosure of Measurement :- In case entity can measure its segment profitability other than segment results measured without arbitrary allocations that will be encouraged but disclosure is required.

DISCLOSURE • Reporting for each Primary Segment • Segment revenue – classified as external / internal / inter-segment revenue. • Segment result. • Carrying amount of segment assets. • Carrying amount of segment liabilities. • Additions to segment tangible and intangible F/A • Total expenses for depreciation & amortisation of segment assets • Total significant non cash expenses which included in measuring segment result.

Only When Segments cash flow are not reported • Depreciation and amortisation of segment assets • Total significant non-cash expenses other than depreciation/amortisation above • Notes : • A reconciliation segment information and enterprise financial statement

SECONDARY SEGMENT INFORMATION Geographical Segment based on Assets IF Primary Business Segment Geographical Segment based on Customers 10% OR MORE OF CUSTOMER/ E .R. / ASSETS • Segment revenue from external customers based on geo. location of customer • Segment assets for each segment based on geo. Location • Additions to assets which is used for more than one period for each segment based on geo. location of assets • Segment revenue from external customer • Carrying amount of S/A • Cost incurred to acquire S/A which is used for more than one period • Where location of assets different from that of customers than • Segment revenue from external customer for Customer based geographical segment • Segment revenue from external customer • Carrying amount of S/A • Cost incurred to acquire S/A which is used for more than one period • Where location of assets different from that of customers than • Segment revenue from external customer for Customer based geographical segment

OTHER DISCLOSURE • Inter-segment transfers, their basis of pricing and change • Changes in accounting policies for segment reporting – fact and effect. • Composition of BS/GS, both primary and secondary, if not otherwise disclosed.