Understanding Capital Budgeting Techniques: Evaluations, Rankings, and Sensitivity Analysis

280 likes | 412 Vues

In this lecture summary, we explored various capital budgeting techniques, including Internal Rate of Return (IRR), Net Present Value (NPV), and Profitability Index (PI). Key topics included the significance of ranking project proposals, the potential conflicts in their evaluations, and scenarios where specific methods might be justified. We also delved into sensitivity analysis to challenge single-point estimates, project monitoring practices, and the implications of capital rationing on project selection. Understanding these methods is crucial for accurate investment decision-making.

Understanding Capital Budgeting Techniques: Evaluations, Rankings, and Sensitivity Analysis

E N D

Presentation Transcript

Summary of Previous Lecture We covered the following topics; • Understand why ranking project proposals on the basis of IRR, NPV, and PI methods “may” lead to conflicts in ranking. • Describe the situations where ranking projects may be necessary and justify when to use either IRR, NPV, or PI rankings. • Understand how “sensitivity analysis” allows us to challenge the single-point input estimates used in traditional capital budgeting analysis. • Explain the role and process of project monitoring, including “progress reviews” and “post-completion audits.”

Chapter 13 (III) Capital Budgeting Techniques

Learning Outcomes After studying Chapter 13, you should be able to: • Understand the payback period (PBP) method of project evaluation and selection, including its: (a) calculation; (b) acceptance criterion; (c) advantages and disadvantages; and (d) focus on liquidity rather than profitability. • Understand the three major discounted cash flow (DCF) methods of project evaluation and selection – internal rate of return (IRR), net present value (NPV), and profitability index (PI). • Explain the calculation, acceptance criterion, and advantages (over the PBP method) for each of the three major DCF methods. • Define, construct, and interpret a graph called an “NPV profile.” • Understand why ranking project proposals on the basis of IRR, NPV, and PI methods “may” lead to conflicts in ranking. • Describe the situations where ranking projects may be necessary and justify when to use either IRR, NPV, or PI rankings. • Understand how “sensitivity analysis” allows us to challenge the single-point input estimates used in traditional capital budgeting analysis. • Explain the role and process of project monitoring, including “progress reviews” and “post-completion audits.”

Other Project Relationships Dependent(or Contingent) - A project whose acceptance depends on the acceptance of one or more other projects. For example, construction of new building for the new machinery to be installed. Mutually Exclusive - A project whose acceptance precludes the acceptance of one or more alternative projects. For example if the firm is considering purchasing a truck from two available options.

A. Scale of Investment B. Cash-flow Pattern C. Project Life Potential Problems under mutual exclusive projects; ranking of proposals using DCF methods may produce contradictory results in the form of; Ranking Problems

Examine NPV Profiles Plot NPV for each project at various discount rates. Project I NPV@10% Net Present Value ($) -200 0 200 400 600 IRR Project D 0 5 10 15 20 25 Discount Rate (%)

Fisher’s Rate of Intersection At k<10%, I is best! Fisher’s Rate of Intersection Net Present Value ($) -200 0 200 400 600 At k>10%, D is best! 0 5 1015 20 25 Discount Rate ($)

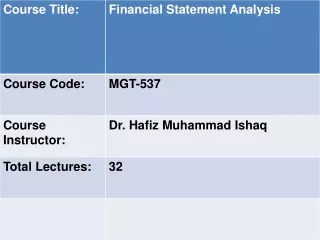

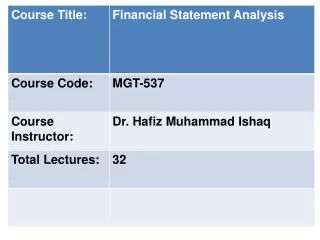

Capital Rationing Capital Rationing occurs when a constraint (or budget ceiling) is placed on the total size of capital expenditures during a particular period. For example a budget ceiling on investment projects where the firms have a policy of internally financing capital expenditures. Example: Mr. A from AB Corporation (ABC) must determine what investment opportunities to undertake for ABC. He is limited to a maximum expenditure of $32,500 only for this capital budgeting period.

A $ 500 18% $ 50 1.10 B5,000 25 6,500 2.30 C 5,000 37 5,500 2.10 D 7,500 20 5,000 1.67 E 12,500 26 500 1.04 F 15,000 28 21,000 2.40 G 17,500 19 7,500 1.43 H 25,000 15 6,000 1.24 Available Projects for ABC Project ICO IRR NPV PI

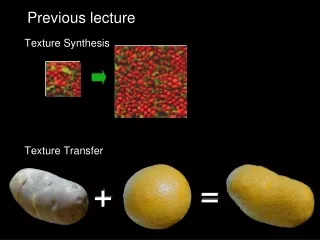

Allows us to change from “single-point” (i.e., changes in revenue, installation cost, final salvage, etc.) estimates to a “what if” analysis Utilize a “base-case” to compare the impact of individual variable changes E.g., Change forecasted sales units to see impact on the project’s NPV Sensitivity Analysis: A type of “what-if” uncertainty analysis in which variables or assumptions are changed from a base case in order to determine their impact on a project’s measured results (such as NPV or IRR). Single-Point Estimate and Sensitivity Analysis

Post-completion Audit A formal comparison of the actual costs and benefits of a project with original estimates. Identify any project weaknesses Develop a possible set of corrective actions Provide appropriate feedback Result: Making better future decisions! Post-Completion Audit

Two; There are as many potential IRRs as there are sign changes. Let us assume the following cash flow pattern for a project for Years 0 to 4: -$100 +$100 +$900 -$1,000 How many potential IRRs could this project have? Multiple IRR Problem*

NPV Profile -- Multiple IRRs 75 Multiple IRRs at k = 12.95% and 191.15% 50 Net Present Value ($000s) 25 0 -100 0 40 80 120 160 200 Discount Rate (%)

Summary In this chapter we covered following topics; • Payback period (PBP) method of project evaluation and selection, discounted cash flow (DCF) methods of project evaluation and selection – internal rate of return (IRR), net present value (NPV), and profitability index (PI). • Understand why ranking project proposals on the basis of IRR, NPV, and PI methods “may” lead to conflicts in ranking. • Describe the situations where ranking projects may be necessary and justify when to use either IRR, NPV, or PI rankings. • Understand how “sensitivity analysis” allows us to challenge the single-point input estimates used in traditional capital budgeting analysis. • Explain the role and process of project monitoring, including “progress reviews” and “post-completion audits.”