Overview of Business Income Taxes and Flow-Through Entities in the U.S.

70 likes | 182 Vues

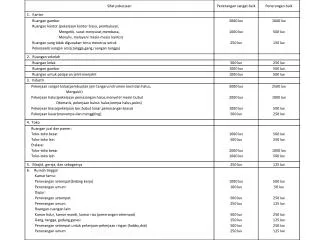

This overview discusses various business income taxes, including General Corporation Tax, Banking Corporation Tax, and Unincorporated Business Tax. Flow-through entities such as S-corporations, partnerships (including LLCs and LLPs), and sole proprietorships are highlighted. In tax year 2005, there were 303,270 firms paying these taxes, resulting in a total liability of $4.2 billion. The data is sourced from the U.S. Department of Treasury during a conference on business taxation and its global competitiveness, based on IRS statistics.

Overview of Business Income Taxes and Flow-Through Entities in the U.S.

E N D

Presentation Transcript

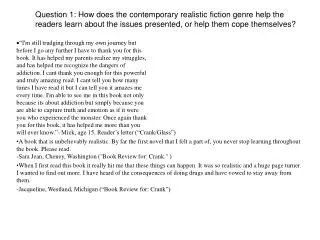

Business income taxes are General Corporation Tax, Banking Corporation Tax and Unincorporated Business Tax.Flow-through entities are S-corporations and unincorporated businesses. # of firms paying taxes in TY05: 303,270 Total liability: $4.2 billion

Note: Flow-through entities include S-Corporations, partnerships (including LLCs & LLPs) and sole proprietorships.Source: US Dept of Treasury, “Treasury Conference on Business Taxation and Global Competitiveness: Background Paper,” July 23, 2007, p. 14 – based on IRS data.