An Indexed Annuity is a Fixed Annuity

160 likes | 307 Vues

An Indexed Annuity is a Fixed Annuity. It retains all the benefits of a traditional fixed annuity: Your principal is guaranteed. Your interest credits are guaranteed. Your money grows tax-deferred. You can receive a guaranteed income for life; no matter how long you live.

An Indexed Annuity is a Fixed Annuity

E N D

Presentation Transcript

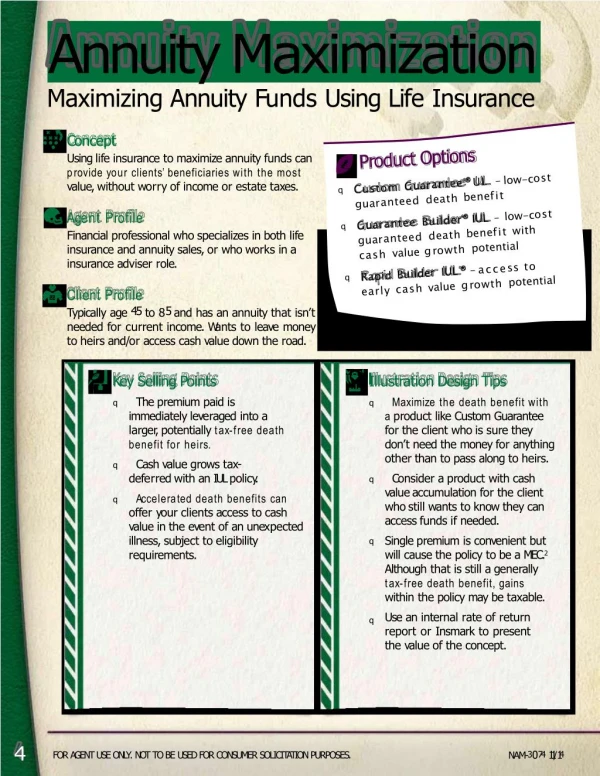

An Indexed Annuity is a Fixed Annuity It retains all the benefits of a traditional fixed annuity: • Your principal is guaranteed. • Your interest credits are guaranteed. • Your money grows tax-deferred. • You can receive a guaranteed income for life; no matter how long you live. • You may avoid the costs and delays of probate by properly designating your beneficiaries. • You have access to your money through penalty free withdrawal provisions (see policy for details). The important difference between a traditional fixed annuity and an Equity Indexed Annuity is the way your interest is credited inside the plan.

How is an Indexed Annuity Different from a Traditional Fixed Annuity? “A traditional fixed annuity credits your account with a stated interest rate each year, an Indexed Annuity links your interest to the performance of a leading market index.”

“I want the POTENTIAL to grow my money faster.” Investments Mutual Funds Bonds Variable Annuities Stocks “I want the SAFETY of knowing my money is always protected.” Savings Accounts Money Markets CDs Indexed Annuities can help you win the financial tug of war! Potential Safety

The Challenge: Investments Mutual Funds Bonds Variable Annuities Stocks RISK The Challenge: Savings Accounts Money Markets CDs LOW YIELDS Indexed Annuities can help you win the financial tug of war! Potential Safety

The POTENTIAL to grow your money without the risk normally associated with investments like Mutual Funds Bonds Variable Annuities Stocks The SAFETY and protection similar to other savings vehicles such as Savings Accounts Money Markets CDs An Indexed Annuity can benefit you by providing: Potential Safety

Indexed Annuities give you the potential to exceed traditional fixed interest rates without exposing your principal or past gains to market risk.

The Indexed Annuity Basics • You participate in any period of gain. If the market goes up, your money grows. • You are protected from any period of loss. You get to sit the bad years out. • All your gains are LOCKED in; they can never be taken from you. • All gains compound TAX-DEFERRED.

Annuity Account Value Monthly Average of the S&P 500 Index Participate in any period with a gain. If the market goes up – your money grows START POINT

Annuity Account Value Monthly Average of the S&P 500 Index Don’t participate in any period with a loss. In other words – you sit the bad years out START POINT

Annuity Account Value Monthly Average of the S&P 500 Index START POINT

Annuity Account Value Monthly Average of the S&P 500 Index Gains are locked in each period They can never be taken from you. START POINT

Annuity Account Value Monthly Average of the S&P 500 Index • Participate In Any Period With A Gain • Don’t Participate In Any Period With A Loss • All Gains Are Locked In Each Period • All Gains Compound Tax Deferred ACCUMULATED VALUE START POINT “The Floor” Minimum Guarantee

Take the next step today! • Would you like the potential to exceed traditional fixed rates? • Would you like to keep your principal and earnings safe from risk? • Can you benefit from tax-deferral? • Would you like access to your money when needed through penalty free withdrawals? • Would you like the option to later convert your retirement funds into a guaranteed income you could never outlive?

Take the next step today! As your agent, we will work together to evaluate your situation and select an appropriate product to address your personal needs.