ASM Phase II LFRM Offer Cap

160 likes | 322 Vues

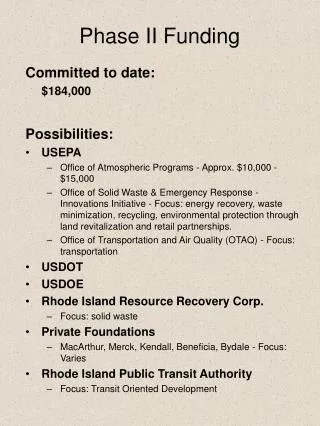

ASM Phase II LFRM Offer Cap. NEPOOL Markets Committee 25 May 2005 Marc D. Montalvo ISO-NE Markets Development. LFRM Offer Cap Outline. Proposed Cap Derivation of Cap Questions. Proposed LFRM Offer Cap. Single Offer Cap for all Zones Hard price cap set equal to the offer cap

ASM Phase II LFRM Offer Cap

E N D

Presentation Transcript

ASM Phase IILFRM Offer Cap NEPOOL Markets Committee 25 May 2005 Marc D. Montalvo ISO-NE Markets Development

LFRM Offer Cap Outline • Proposed Cap • Derivation of Cap • Questions

Proposed LFRM Offer Cap • Single Offer Cap for all Zones • Hard price cap set equal to the offer cap • Cap equals $17,000 MW-month

Offer Cap: Background Issues • All LFRM resources are also LICAP resources. • An LFRM resource is distinguished from a LICAP resource by the delivery requirements and penalty structure of the LFRM service. • A supplier would not logically take on an incremental LFRM obligation without the reasonable expectation of incremental compensation. • In any location the LFRM clearing price should be at least as great as the LICAP auction clearing price.

Need for the Offer Cap • Prices should be allowed to rise to a level indicative of the need for additional resources. • This price is greater than or equal to the carrying cost of a new entrant at long run equilibrium. • Under shortage conditions there is no competitive discipline on prices. • An administratively imposed cap constrains the price to protect buyers from otherwise unchecked prices while providing proper price signals to potential suppliers.

Constructing the Offer Cap • GOAL: Estimate the costs that an Increment of LFRM Supply would have to Recover to be willing to enter the market. • A supply offer in the LFRM market is composed of the following: • expected foregone energy revenues • expected foregone commitment costs • expected penalties • incremental O&M and/or capital investment • expected LICAP clearing prices • risk premium

Foregone Energy Revenues • The expected foregone energy revenues are a function of: • Incremental variable cost • LMP • LFRM threshold price. • The foregone energy revenues for an aero-derivative CT were estimated using historical data. • 2004 daily natural gas index prices at NE City Gate from Platts/Argus • Heat Rate = 10,500 Btu/kWh • 2004 LMPs • Strike Price = Gas Price x 14,500 Btu/kWh Heat Rate

Foregone Energy Revenues • Using the historical data, the foregone energy revenues for an aero-derivative CT offering into the LFRM market would have been on the order of $0.10 to $0.20 per kW-month. • Let the foregone energy revenues be $0.15/kW-month.

Foregone Commitment Costs • An aero-derivative CT does not have to be on-line to supply its reserve capability. • The expected foregone commitment costs (startup and no-load) for an off-line resource are zero. • The foregone commitment costs are $0.0/kW-month.

Penalty Exposure • The expected penalties for a new aero-derivative CT should be low given the expected high availability and startup performance. • Given the performance penalties proposal and assuming an EFORd of 5.0% and a failure to start rate of 5.0%, the expected penalties are estimated to be on the order of $0.60 to $0.70 per kW-month. • Assume that the value of expected penalties is $0.65/kW-month.

LICAP Clearing Prices • According to the LICAP demand curve, the LICAP clearing price will not exceed 2xEBCC or approximately $16/kW-month. • This price means that there is a general capacity shortage in the location. • If this were the case, the market would be calling for incremental capacity of any type. • If the incremental LICAP resource was able and chose to offer its supply into the LFRM market, it would incur no incremental capital costs to provide the LFRM service. • All of the costs associated with carrying the incremental capital investment could be recovered through the LICAP market.

Estimating the Cost of LFRM Incremental Supply • Let the benchmark LFRM technology be an aero-derivative CT. • The aero-derivative CT can provide either the ten or thirty minute LFRM service. • Modularity and available range of sizes (low granularity relative to local requirements) make these resources well suited to providing incremental supply. • From the LICAP case, an aero-derivative CT has an annual carrying cost in the $10 to $13/kW-month range. • If the LFRM clearing price exceeds the carrying cost of an aero-derivative CT plus the expected incremental cost of providing the LFRM service, an investor should be willing to build an aero-CT to meet the LFRM demand.

Incremental O&M and/or Investment • The incremental capital investment required to meet the LFRM obligation with a new aero-derivative CT is the annual carrying cost of the machine. • The incremental capital investment is $13/kW-month. • If the LICAP price were expected to be less than $13/kW-month, say $10/kW-month, the LFRM supply offer would reflect an Incremental Investment Component of $13 - $10 = $3/kW-month. • Assuming a LICAP price of $16/kW-month and an annual carrying cost of $13/kW-month, the expected LICAP Price recovers the entire annual carrying cost of the investment. • The incremental investment component to be recovered from LFRM is $0/kW-month.

Risk premium • The value of foregone energy revenues and penalties are estimates of the expected value. • The risk premium is an amount that the supplier would add to his offer to cover the probability that his expected value estimates are incorrect, i.e., underforecasted. • For the sake of this discussion, assume that the risk premium is equal to 10% of the expected value of foregone energy revenues and penalties, or $0.08/kW-month.

Summary of Offer Cap Derivation Foregone energy revenues $0.15/kW-month Foregone commitment costs $0 Expected penalties $0.65 Incremental O&M and Investment $0.0 LICAP clearing price $16.0 Risk premium $0.08 $16.88/kW-month Approximately $17/kW-month