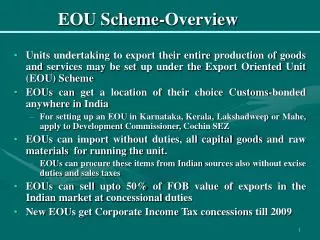

EOU Scheme-Overview

180 likes | 365 Vues

EOU Scheme-Overview. Units undertaking to export their entire production of goods and services may be set up under the Export Oriented Unit (EOU) Scheme EOUs can get a location of their choice Customs-bonded anywhere in India

EOU Scheme-Overview

E N D

Presentation Transcript

EOU Scheme-Overview • Units undertaking to export their entire production of goods and services may be set up under the Export Oriented Unit (EOU) Scheme • EOUs can get a location of their choice Customs-bonded anywhere in India • For setting up an EOU in Karnataka, Kerala, Lakshadweep or Mahe, apply to Development Commissioner, Cochin SEZ • EOUs can import without duties, all capital goods and raw materials for running the unit. • EOUs can procure these items from Indian sources also without excise duties and sales taxes • EOUs can sell upto 50% of FOB value of exports in the Indian market at concessional duties • New EOUs get Corporate Income Tax concessions till 2009

Approvals for EOUs • EOUs are given approval for manufacture of goods, including re-furbishing, as well as for rendering of services including bio-technology, BPO, Call Centres, IT enabled Services. An EOU may also engage in mining, agriculture, aquaculture, floriculture, or horticulture. • Trading by EOUs is not permitted • Minimum Investment for approval as an EOU should be Rs.10 million in plant &machinery. • Software /services/ handicrafts/ agriculture/ floriculture/ aqua-culture/ animal husbandry/ information technology are exempted from this size restriction.

Approvals for EOUs • Licences are required for • Manufacturing arms and ammunition, atomic substances, narcotics/psychotropic substances, and tobacco products • Establishing EOUs in Bangalore and Cochin city limits (unless it is a non-polluting sector EOU, or is located in an industrial estate within the city) • Approvals for licensable activity and services are given by the Board of Approvals in the Commerce Ministry • Applications are to be routed through the Development Commissioner • Approval (called Letter of Permission (LOP))for non-licensable manufacturing activity is given locally by the Development Commissioner • Relevant forms are available at http://www.cepz.com/eouforms

EOU Scheme Features • EOUs may export all products except prohibited items of exports • EOUs may import without duty all types of goods, including capital goods required for its activities, unless they are prohibited for import • Even second hand plant & machinery can be imported. • Capital Goods can be purchased, loaned, sourced from foreign/domestic leasing companies or brought free of cost. • EOUs get upto 5 years for utilization of imported capital goods, and upto 3 years for other items.

EOUs & FDI • 100% FDI in manufacturing EOUs is permitted under the automatic route of the Reserve Bank of India • i.e. first bring in the money, and then inform Reserve Bank of India’s local office in Form FC(RBI)within 30 days of receipt • Also under the automatic route for EOUs are • External Commercial Borrowing upto USD 50 million, with maturities of 3 years or more, for funding and running the unit. • Use of brand names/trademarks, if royalty is upto 2% on exports and 1% on domestic sales, without technology transfer • Foreign technology tie-ups, if lump sum payment does not exceed USD 2 million, and if royalty is upto 5% on domestic sales and 8% on exports, even for wholly owned subsidiaries

EOUs and Foreign Exchange • EOUs may freely repatriate investment & returns abroad • EOUs need to bring export proceeds to India only within 360 days of export • And even then, upto 100% may be retained in foreign currency in the unit’s EEFC Account • EOUs may invoice sales to other EOUs etc in foreign exchange • EOUs may invoice sales to Indian entities other than EOUs also in foreign exchange sourced from from their EEFC account or abroad

Tax Concessions for EOUs New EOUs are entitled under to Corporate Income Tax exemption on physical exports out of India till 2009 • Central Sales Tax is reimbursed on purchases from local manufacturers • Supplies from local manufacturers are free of Central Excise Duty • In case duties are paid, Terminal Excise Duty is reimbursed • EOUs in manufacturing sector get exemption from State Sales Tax on inputs (excepting fuel)

EOU Scheme & DTA entities • Existing Indian entities can open a new EOU under the same legal entity • But the EOU division must maintain separate accounts, including separate Bank accounts • DTA units can also convert to EOU scheme • Units working with EPCG /Advance Licencing can also convert to EOU scheme • Their pending licence obligations will be subsumed into the EOU scheme. • But to be eligible for Corporate Income Tax concessions under section 10B, it has to be ensured that old assets do not exceed 20% of total assets of the EOU

EOUs & Customs Department • EOUs have to get their premises bonded by the local Customs/ Central Excise Department, and function under their supervision • They can get a location of their choice so bonded. • All duty-free items have to be brought here first. • One single multi-purpose bond with the Customs /Central Excise Department, called the B 17 Bond, suffices for all operations. • While there is no physical control, there is record-based control • EOU has to maintain proper account of the import, consumption and utilisation of all imported/locally procured materials and exports made and submit them periodically to the Customs. • Duty foregone under the EOU scheme with interest is recoverable in case of fraudulent activity (along with prosecution & penalties)

Export Obligations of EOUs EOUs have only to be foreign exchange positive FE Inflows> FE Outflows where • FE Inflows = Export earnings (Direct Exports+ Exports through Third Parties + Inter-unit Sales + Exports to EOU/SEZ/STP/EHTPs) • FE Outflows = Foreign Exchange outgo on imports of Raw materials/consumables + FE payments of commission/ royalty/ fees/ dividends/ interest on ECB + share of amortised value of capital goods imported • Imported capital goods are amortized over 10 years; only amortized amount is included in NFE calculation • Values are included in the calculation even if the imports are not actually paid for.

EOU Scheme- Duty-free Supplies from Indian Market Supplies from Indian manufacturers to EOUs are classified as deemed exports, and the suppliers are eligible for • Advance Licence for import of intermediate inputs • Deemed Export Duty Drawback • Discharge of export performance obligation on the supplier EOUs may obtain, on production of a suitable disclaimer from the suppliers, the duty drawback and refund of Terminal Excise Duty

EOUs’ Access to Indian Market Sales to the Indian Market • EOUs can sell duty-free to other EOU /SEZ /STP /EHTPs etc • EOUs can sell on full duties in the DTA against foreign currency (from EEFC account or from abroad) • This also counts for NFE. • Apart from the above, • EOUs can sell upto 50% of FOB value of physical exports to the DTA at concessional duties • EOUs can sell over and above that at full duties, subject to NFE being positive

EOU Sales to other EOUs • EOU’s Sales are duty-free to Indian entities like • SEZ /EOU /EPZ /STP /EHTP units, • Advance Licence Holders, • Bonded Warehouses & • Educational institutions, defence establishments, other agencies notified by Government of India as eligible for duty-free imports. • These sales count for computation of NFE. • But they do not count as physical exports. • They can be invoiced in foreign currency or in Indian currency.

EOUs & Subcontracting EOUs can subcontract up to 50% of production or part of production process to units in the EOU or Indian manufacturers. • EOUs may temporarily take to the job worker’s premises jigs, moulds, tools, fixtures, tackles, instruments, hangers, patterns & drawings for job work • EOUs can even subcontract to units abroad • EOUs can import raw materials & components free of cost for job-working and return. EOUs can undertake job-work for export on behalf of local manufacturers.

EOU Scheme: Exit Policy Units can de-bond without paying duties capital goods they have used for 10 years Software units can de-bond on duty-free basis after 3 years. Units can wind up their operations on meeting their export obligations by • Exporting back any imported capital goods and other material, or transferring them to another SEZ/EOU unit, or • Destroying the items in Customs presence, or • Donation on gratis basis to educational institutions, or • De-bonding on payment of duty on capital goods under the EPCG Scheme as a one time option, or • De-bonding all duty-foregone items by paying duties at current rates on unutilised raw materials (imported value) and on capital goods (on depreciated value only) and selling them in the DTA.

EOU Scheme: Exit Policy In case of failure to achieve positive NFE, duty foregone under the EOU scheme with interest is recoverable in proportion to the shortfall in NFE If the unit has not met positive NFE, de-bonding shall also be subject to payment of penalties under the Foreign Trade (Development & Regulation) Act, 1992, and under the Customs Act, 1960

EOU Scheme: Who can operate • To run manufacturing activities foreign companies need to set up an Indian Company • The Indian Company has to have independent legal status, distinct from the parent foreign company. • The Company may be a wholly-owned subsidiary, or a joint venture company in financial collaboration with an Indian company in India. • A Company registered in India can start an EOU unit without starting a new legal entity: separate accounts suffice. • To run manufacturing activities foreign companies need to set up an Indian Company • The Indian Company has to have independent legal status, distinct from the parent foreign company. • The Company may be a wholly-owned subsidiary, or a joint venture company in financial collaboration with an Indian company in India. • A Company registered in India can start an EOU unit without starting a new legal entity: separate accounts suffice.

How to Contact • For more details of Indian EOUs, see website http://eouindia.com • For details of EOUs with the Development Commissioner, CSEZ, see www.cepz.com/sez/heou/index.htm • especially the “How To Apply” section at http://www.cepz.com/eouhowtoapply • Contact CSEZ office at Cochin mail@csez.com Phone in at ++91-484-2413222 at Bangalore adcblr@csez.com Phone in at 080-25714874