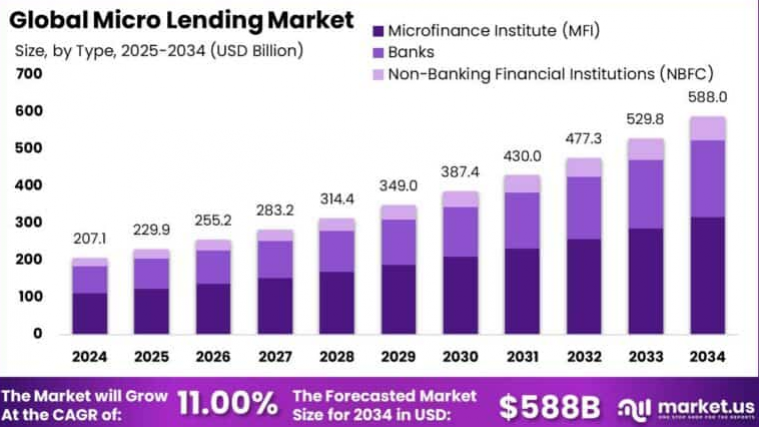

The Global Micro Lending Market size is expected to be worth around USD 588 Billion By 2034, from USD 207.1 Billion in 2024, growing at a CAGR of 11.00% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific led the global micro-lending market with over 45% share and USD 93.1 billion in revenue. China alone contributed USD 30.5 billion, growing at a CAGR of 8.2%, fueled by demand from small businesses and individuals.

Micro lending is the practice of providing small loans to individuals or small businesses that lack access to traditional banking services. These loans are typically offered by microfinance institutions (MFIs), non-banking financial companies (NBFCs), and digital platforms, aiming to promote financial inclusion and support entrepreneurship among underserved populations.

Read more - https://market.us/report/micro-lending-market/

In this context, we observe a notable shift in market behavior, where traditional financial service providers are entering the micro lending space through digital subsidiaries or partnerships with fintechs. This secondary market dynamic is being driven by a blend of competition and collaboration, aiming to create sustainable, scalable models that serve niche customer bases. Global fintech leaders are now offering white-label micro lending solutions, targeting banks and microfinance institutions that seek to upgrade their digital capabilities.

The demand analysis at this layer focuses more on how institutional demand—such as demand from venture capital, private equity, and banking institutions—is influencing the structure and evolution of the micro lending sector. The market is witnessing a strategic pivot toward embedded finance, where micro loans are offered as part of a broader ecosystem—like e-commerce platforms or ride-sharing apps. The adoption of technologies at this level is driven not only by customer-facing needs but also by the desire to streamline back-end operations, improve compliance, and scale rapidly.