SPLIT CLOSINGS

120 likes | 281 Vues

SPLIT CLOSINGS. Presented by: Douglas G. Smith V.P. & Associate Sr. Underwriter. Many closings that take place in Michigan involve “split closings”.

SPLIT CLOSINGS

E N D

Presentation Transcript

SPLIT CLOSINGS Presented by: Douglas G. Smith V.P. & Associate Sr. Underwriter

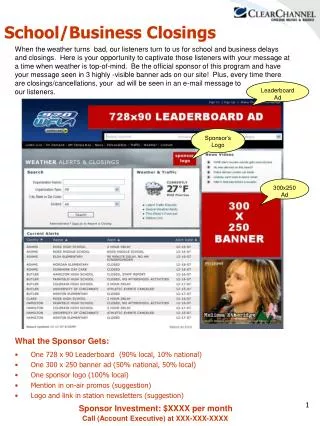

Many closings that take place in Michigan involve “split closings”. • Split closings involve one title company closing and insuring the seller’s side (and issuing the owner’s policy) and a different title company closing and insuring the buyer’s side (and issuing the loan policy). What is a split closing?

Escrow and settlement practices are not covered under the agency agreement, and the Company does not direct such practices. • Stewart Bulletin MI2012006 advises you of some recommended practices and procedures regarding the allocation of responsibilities in split closings, that may assist in avoiding potential problems and limit losses. Stewart Bulletin: MI2012006

The Settlement Agent is the title company for the buyer’s side and issues the loan policy. They undertake responsibility for: • Complying with the lenders closing instructions • Issuing a commitment for a loan policy and Closing Protection Letter (CPL) to the lender, and, typically a First Lien Letter. • Executing a HUD-1 and disbursing the proceeds of the loan according to the lender’s closing instructions and the provisions of the HUD-1. • [This includes the obligation to pay off the underlying mortgages/liens against the property, taxes, broker commissions, credit reports, appraisal fees, processing fees, flood cert’s, etc.] Settlement Agent

Additional responsibilities of the Settlement Agent include: • Marking-up the commitment and issuing a loan policy to the lender. • Causing the mortgage to be promptly recorded. • Requiring a copy of the deed from the Seller’s Agent. Settlement Agent

The Seller’s Agent is the title company for the seller’s side and issues the owner’s policy. They undertake responsibility for: • Issuing a commitment and owner’s policy to the buyer. • Executing a HUD-1 that functionally mirrors the HUD-1 of the Settlement Agent. • Causing the vesting deed to be promptly recorded. • Requiring a copy of the mortgage from Settlement Agent. • [owner and borrower should read the same.] Seller’s Agent

If the Settlement Agent receives a request from the Seller’s Agent to disburse Seller’s proceeds and Seller’s Broker’s (Listing Agent’s) commission to the Seller’s Agent, it is good practice to secure: • A written directive and hold harmless from Seller (Exhibit 1), and • An indemnity from Seller’s Agent (Exhibit 2) • (Unless they are a current Stewart Agent) • Note: It is advisable to reflect that those payments are paid to the Seller’s Agent on the HUD-1 and not to the Seller or Broker directly. Good Practices

If you are acting as the Settlement Agent and you receive a request from the Seller’s Agent to disburse proceeds for underlying mortgages, monetary liens or property taxes to the Seller’s Agent, instead of paying them directly, please be advised that you are not authorized by Stewart to do so as it may create potential liability for the Company under Stewart’s Closing Protection Letter and/or title policy of insurance. Good Practices

It is likely that the Settlement Agent’s disbursement to the Seller’s Agent of the Seller’s Agent’s title fees, deed recording fees and transfer fees as line items on the HUD-1 in the normal course of business should not create an issue. However, you should not provide a copy of the CPL to the Seller’s Agent without Underwriter approval. Good Practices

If the Seller’s Agent receives a request from the Settlement Agent to deliver the vesting deed to the Settlement Agent for recording, it is good practice to secure: • A written directive and hold harmless from the Buyer (Exhibit 3), • An indemnity from the Settlement Agent (Exhibit 4) • (Unless they are a current Stewart Agent) • A duplicate original or copy of the deed in your file. • Note: Do not mark up your commitment indicating that the deed has been recorded [or indicating that underlying mortgages/liens have been paid off]. Do not delete the gap exception. • Note: If you issue the owner’s policy before the deed is recorded, take exception for loss or damage resulting from failure to record the deed, all open mortgages (you must review title) and retain the gap exception. Good Practices

If you are acting as the Seller’s Agent, you should deny any request from the Settlement Agent to provide the Settlement Agent with a marked-up commitment, as a marked-up commitment may create potential liability under the Mutual Indemnity Agreement. • As the title company issuing the owner’s policy, you should not be taking on liability for failure to record the deed, failure to pay off underlying mortgages, liens, and taxes, and providing gap coverage unless all of those matters are satisfied prior to issuance of the policy. Good Practices

Contact Information: Doug Smith V.P. & Associate Sr. Underwriter 734-469-9461 (direct) 800-221-8710 ext. 9461 (toll free) doug.smith@stewart.com Questions?