Profit Maximization

440 likes | 840 Vues

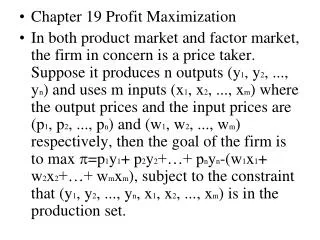

Chapter 22. Profit Maximization. The Profit Motive. The basic incentive for producing goods & services is the expectation of profit. Profit is the difference between Total Revenue & Total Cost. Chapter 22. 2. Motives To Produce. A.K.A. - Why run your own business? Expected Profit

Profit Maximization

E N D

Presentation Transcript

Chapter 22 Profit Maximization

The Profit Motive • The basic incentive for producing goods & services is the expectation of profit. • Profit is the difference between Total Revenue & Total Cost. Chapter 22 2

Motives To Produce • A.K.A. - Why run your own business? • Expected Profit • Social Status • Flexible hours • Control • Sense of mission/purpose Chapter 22 3

Profit Maximization • The objective of a for-profit firm is to maximize profit. • Each cost is an opportunity cost • the amount necessary to keep the owners of the resources from moving it to an alternative use. Chapter 22 4

Economic Profit • The difference between total revenues & total economic costs Chapter 22 5

Economic Costs • The value of all resources used in production • Includes: • Direct Costs of land, buildings, tools, ingredients & labor • Opportunity Costs for land, buildings, & tools • Cost of Debt – the interest paid on loans Chapter 22 6

Risk • The potential for profit is not a guarantee of profit. • remember the risk-return tradeoff. • There are many risks to starting a business. Chapter 22 7

Market Structure • The selling environment in which a firm produces and sells its product is called a market structure. • It is defined by three characteristics: • The number & size of firms in the market • The ease of entry and exit of firms • The degree of product differentiation Chapter 22 8

5 Market Structures • Perfect (or Pure) Competition • Monopolistic Competition • Oligopoly • Duopoly • Monopoly Chapter 22 9

Summary of Market Structures Chapter 22 10

Perfect Competition Characteristics • Many firms • Identical products – many substitutes • Low barriers to entry – easy to get into • Firm has no market power • Firm is a Price Taker • Advertising is unnecessary • Ex: Agriculture products. Chapter 22 11

Price Takers • With so many producers, no single producer has market power. They have no control over the price they charge, because their customer’s can easily get the same product from somewhere else. • The Demand curve the firm faces is flat. • No single firm could come close to satisfying the total demand for the product. Chapter 22 12

Firm’s Demand in Perfect Competition Chapter 22 13

Industry’s Demand in Perfect Competition Chapter 22 14

Production Decision • With no control over price, the firm has only one decision to make: How much to produce. • This is a short-term decision based on their existing plant & equipment, and the current price of their product. Chapter 22 15

Output & Revenues • Total Revenue = Price X Quantity • The more you produce, the more revenue you make Chapter 22 16

Output & Costs • To maximize profits, a firm must consider how increased production will affect costs as well as revenues. • Fixed costs must be paid even if no output is produced • Variable costs increases as production increases Chapter 22 17

Output & Costs • Total Costs = TFC + TVC Chapter 22 18

Output & Costs • Total Costs = TFC + TVC profit loss Chapter 22 19

Output & Costs Chapter 22 20

Basic Profit Maximizing Rule • Never produce a unit of output that cost more than it brings in. • The goal of the firm is to maximize profit, not revenue. Chapter 22 21

Marginal Revenue • MR = Price • Change in revenue Change in sales • Marginal means “extra” • This is the extra revenue for each extra item you sell. That is the price you sell it for. Chapter 22 22

Marginal Revenue & Marginal Cost • Marginal revenue (Price) is the extra income from selling an extra item. • Marginal cost is the extra costs to produce that extra item. • So, we consider them at the same time… Chapter 22 23

Short-Run Profit Maximizing Rules If: • Price > MC increase output (make more) • Price < MC decrease output (make less) • Price = MC maintain output • Profit maximizing point Chapter 22 24

Profit Maximizing Chapter 22 25

Adding Up Profits • Total Profit = TR – TC Or • Total Profit = (P-ATC) x Q Chapter 22 26

Goals: • The goal is to maximize total profit • Not to: • Maximize per-unit profit • Produce where ATC is at a minimum • It is about profit, not efficiency! Chapter 22 27

Profit Maximizing Chapter 22 28

Examples: AtMR=MC • Price = $3 • ATC = $2.25 • Q = 300 • TR = $900 • TC = $675 • Profit = $225 At Minimum ATC • Price = $3 • ATC = $2 • Q = 200 • TR = $600 • TC = $400 • Profit = $200 Chapter 22 29

Taking A Loss • Price < ATCPrice > AVC Chapter 22 30

Shutdown • Price < ATCPrice < AVC Chapter 22 31

Short-Run Supply Determinants • The quantity produced is affected by anything that changes Marginal Cost • Price of inputs (ingredients) • Technology • Expectations • Taxes & Subsidies Chapter 22 32

Short-Run Supply & Demand • The MC curve is the short-run Supply curve for the company • (from the breakeven point to maximum profit point) Chapter 22 33

Taxes and Supply • Some taxes alter short run behavior • Some taxes alter long run behavior Chapter 22 34

1. Property Taxes • Are a fixed cost • Raises Total Costs & reduces total profit • Increases Breakeven quantity • Raises FC • Does not change Profit Maximizing quantity. • Do not alter marginal costs Chapter 22 35

1. Property Taxes Chapter 22 36

2. Payroll Taxes • Are a variable cost • Raises Total Costs, reduces total profit & per-unit profit • Increases Breakeven quantity • Reduces Contribution Margin • Reduces Profit Maximizing quantity. • Increases marginal costs Chapter 22 37

2. Payroll Taxes Chapter 22 38

3. Profit (income) Taxes • Are neither a fixed or variable cost • Does not change Breakeven quantity • Does not change Profit Maximizing quantity. • Do not alter marginal costs • Might affect investment decisions • Profit doesn’t change – just where the profit goes. Chapter 22 39

4. Sales Taxes • Are neither a fixed or variable cost • Does not change Breakeven quantity • Does not change Profit Maximizing quantity. • Do not alter marginal costs • This is collected at the end of a sale. Chapter 22 40

3 & 4. Profit & Sales Taxes Chapter 22 41