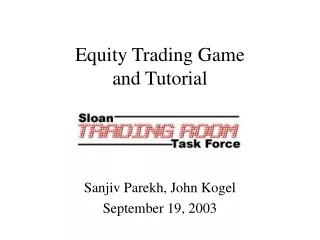

Equity Trading Game and Tutorial

180 likes | 198 Vues

Participate in equity trading games learning simulation in the Sloan Trading Room Task Force. Understand trading mechanics and strategies with real-time simulations.

Equity Trading Game and Tutorial

E N D

Presentation Transcript

Equity Trading Gameand Tutorial May 7, 2004 Directors: Sanjiv Parekh, John Kogel Assistant Directors: J.P. Carlucci, Andrew Lisy, Juthica Mallela, Raja Surapanani, Sarika Singh

Welcome • Sloan Trading Room Task Force was established in 1997 by Prof. Andrew Lo. • Trading room is used for research, trading games and simulations, and finance classes. • Types of trading games include: equity, fixed income, derivatives, and foreign exchange. • Information: http://mitsloan.mit.edu/trader • Email Us: taskforce@mit.edu

Agenda • Today’s Game: 2 Stocks • Trading Interface • Trading Mechanics: Bid-Ask • Accessing Private Information • Two Practice Games • Questions and Answers • The Final Game

Case Scenario • Two Stocks • ABC Company • CRA Corporation • Two periods: Year 1 and Year 2 • 0% interest rate, no cost to borrow money • Dividend paid at end of each period

Private Information and Prices • Different parties may have private information in the market. This information may give you an advantage in trading. • Bid and Ask prices may reflect what private information other traders have • If you know what the stock should be worth, take advantage of wrong prices through arbitrage

Game Setup • Dividend results rely on the state of the economy and firms • The ABC Company has 3 different possible states in each period • The CRA Corporation has 4 different possible states in each period

Stock Fundamentals • Realized events determine each stocks’ realized dividends • Realized dividends determine each stocks’ price • Events are all equally likely • Traders will receive private information about which event is realized

ABC Payoff Tree • Dividend in Period 2 depends on events realized in Period 1 and Period 2 • Starting out, probability of each event is equal

ABC Payoff Tree Private Information: Period 1: not z, Period 2: not z • Use your Private Information to calculate the new expected stock price Min: 0 Max: 24 E [Price] = 9

ABC Payoff Tree in Period 2 • Event y occurred, resulting in $12 dividend. • Private Information still holds • What is the expected value of ABC now? Min: 0 Max: 12 E [Price] = 6

Trading Mechanics • Traders who want to sell stocks at a certain price post an Ask • Traders who want to buy stocks at a certain price post a Bid • Only Market Makers have the ability to post Bids and Asks

The Bid-Ask Spread ASK 158 7/8 Market maker sells Market taker buys BID 158 1/8 Market maker buys Market taker sells

Stay Within the Spread Ask sell buy 159 160 Bid sell buy 159 160 $$$ $$$ • Do not trade outside the spread • Be the market maker with unsophisticated traders in the market

Being the Market Maker Ask 90 89* Bid 80 81* MARKET New Ask Makes the Market (Market Maker) New Bid Makes the Market (Market Maker) • Bid-Ask spread goes from 10 to 8 once the new bid and the new ask make the market

Being the Market Maker Ask 90 91 Bid 80 79 MARKET Ask does NOT Make the Market Bid does NOT Make the Market

Terminology • Going Long: buy the stock • You think the stock price will go up • Going Short: sell the stock • You think the stock price will go down • Selling more units than you have, known as short selling, ends up with negative number of units. • In this game, you can short sell as much as you want • Have to cover short position at end by buying back the stock. Done automatically in the game.

Trading Interface You can borrow or lend at a 0% interest rate Seconds remaining for current trading period. Realized payouts displayed here Traders in the FTS markets determine prices Individual endowments Stock Names

Logging In Enter any trading name (at least 3 characters) Type in the actual names of each trader on the team DO NOT PRESS CONNECT UNTIL ASKED TO DO SO