Monetary Policy and Inflation

170 likes | 385 Vues

Monetary Policy and Inflation. Steven Barnett (May 2010). Summary and Outline. Inflation poses a major risk Too high and rising Broad-based Not just meat prices Also excess demand Monetary tightening must continue Control inflation expectations Monetary conditions loosened considerably

Monetary Policy and Inflation

E N D

Presentation Transcript

Monetary Policy and Inflation Steven Barnett (May 2010)

Summary and Outline • Inflation poses a major risk • Too high and rising • Broad-based • Not just meat prices • Also excess demand • Monetary tightening must continue • Control inflation expectations • Monetary conditions loosened considerably • Tightening will reduce overheating

Optimistic Projection: Inflation hits double-digits. Assumes (i) no spending increase; and (ii) further monetary tightening

II. Tightening should continue • Inflation expectations are rising • Official statements & interviews • Inflation going to 20+ percent • Impact of fiscal policy (wage increase) • Expected inflation critical for monetary policy • Self-fulfilling • Could become very costly • Spiral out of control • Rapid dollarization is possible • Disinflation is painful

We model inflation expectations as backward looking. Actual inflation expectations, however, are significantly higher…

…so the ‘true’ real interest rate is much lower than this chart suggests. Meaning monetary policy is even looser than appears in the chart.

Lending rate is (i) low in real terms; (ii) low relative to onshore US$ rates (given inflation differentials); and (iii) high onshore US$ rates highlight role of structural problems in the banking system…

…as do high onshore US$ deposit rates. Decline in real deposit rates is dangerous—risk of dollarization and could trigger bank or currency run.

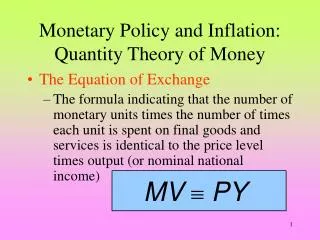

How to Tighten Monetary Policy • Further hike in policy interest rate • Fight inflation by cooling economy • Promote financial stability • Drain excess liquidity from banks • Allow currency to appreciate • Little to no intervention in fx auctions • Will allow market to drive appreciation • So it happens naturally • Central bank should not resist

Output is above potential output Economy is overheating. Demand is driving inflation!

Overheating has started • Economy is starting a major boom • Export earnings are surging (up 64%) • Private demand also surging • Consumer good imports up 64% • Investment imports up 38% (OyuTolgoi will drive up) • Manufacturing production up 20% • Economy is already overheating • Fiscal plans would fuel massive overheating • Monetary policy would need to subtract more

Fiscal or monetary stimulus will hurt, not help, the economy • Policy loosening worsens overheating • Domestic supply cannot respond • Domestic firms raise prices (e.g., inflation) • Fiscal stimulus benefits foreign firms • Imports surge to meet increase in demand • Real currency appreciation makes imports cheaper • Workers demand higher wages (wage-price spiral) • Long-run damage is even greater

Monetary Tightening Works By: • Squeezing private sector • Higher interest rates lower investment • Reduces overheating and thus inflation pressure • Nominal appreciation of the currency • Real appreciation will happen one way or another • Nominal is much less costly than inflation • Helps switch demand to imports • Reduces overheating by hurting domestic firms • Export firms shrink because they are less competitive • Same with import competing firms

Awful Policy Mix • Fiscal Loosening + Monetary Tightening • Hurts domestic private sector • Government grows at the expense of private business • Helps foreign firms • High costs in short and long run • Monetary policy can also do so much • Fiscal plans cannot be offset with monetary policy • Inflation will skyrocket • Repeat of the boom-bust cycle