Macroeconomic Theory

780 likes | 1.06k Vues

Macroeconomic Theory. Chapter 4 Monetary Policy. ‘reaction function’. ‘reaction function’ is what the CB uses to respond to shocks to the economy and steer it toward an explicit or implicit inflation target. Tasks of the reaction function are:

Macroeconomic Theory

E N D

Presentation Transcript

Macroeconomic Theory Chapter 4 Monetary Policy

‘reaction function’ • ‘reaction function’ is what the CB uses to respond to shocks to the economy and steer it toward an explicit or implicit inflation target. Tasks of the reaction function are: • To provide a ‘nominal anchor’ for the medium run, which is defined in terms of an inflation target. • To provide guidance as to how the CB’s policy instrument, the interest rate, should be adjusted in response to different shocks so that the medium-run objective of stable inflation is met while minimizing output fluctuations • CBs in the last two decades in OECD economies and in many transition and developing countries have shifted toward inflation-targeting regimes of this broad type.

why low inflation-targets have been adopted.We begin by asking two questions: • What is wrong with inflation? • What is the ‘ideal’ rate of inflation? is it zero, positive or negative? • we shall see the role played by the following six key variables in CB policy making: • the CB’s inflation target • the CB’s preferences • the slope of the Phillips curve • the interest sensitivity of aggregate demand • the equilibrium level of output • the stabilizing interest rate.

Inflation, disinflation, and deflation • In the medium-run equilibrium, inflation is equal to the CB’s inflation-target, if the CB seeks to stabilize unemployment around the ERU. • In the IS/LMversion of the model, in the medium-run equilibrium, inflation is equal to the growth rate of the money supply set by the CB • The Phillips curves are therefore indexed by lagged inflation (πI= π−1) and shift whenever π−1 changes: π = πI+ α(y − ye) = π−1 + α(y − ye).

With linear Phillips curves, the sacrifice ratio is constant and independent of the CB’s preferences. • Although the time path of unemployment is affected by the choice between a policy for (cold turkey) and a more gradualist policy, the cumulative amount of unemployment required to achieve a given reduction in inflation does not depend on the degree of inflation aversion of the CB. • However, with non-linear Phillips curves, this is no longer the case: when the Phillips curves become flatter as unemployment rises, a ‘cold turkey’ policy of disinflation favored by a more inflation-averse CB entails a higher sacrifice ratio than does a ‘gradualist’ policy favored by a less inflation-averse CB.

Rising inflation • rising inflation reflects a situation in which workers’ real wage aspirations are systematically frustrated: • the real wage is typically on the PS curve, not on the WS curve. If there are lags in price setting as well as in wage setting, then the aspirations of neither workers nor firms are fully satisfied (the real wage lies between the PS and WS curves). • This reflects distributional conflict as different social groups (wage setters/employees and price setters/employers) seek to protect their interests. • for disinflation to be costless, expectations of inflation must be formed using the Rational Expectations Hypothesis, the commitment of the government and CB to a policy of low inflation at equilibrium unemployment has to be believed by the private sector and there must be no lags in the adjustment of wages and prices.

For countries experiencing episodes of moderate inflation up to double digit rates per annum, these conditions do not appear to have been met

Very high inflation and hyperinflation • Hyperinflation has traditionally been defined as referring to a situation in which inflation rates rise above 50% per month • Situations of very high and hyperinflation are normally the result of governments being unable to finance their expenditure through normal means (borrowing or taxation) and they therefore resort to monetary financing. This is known as seignorage. • There is some evidence that the deterioration in the economic environment is associated with very high inflation. Very high inflation is typically associated with very poor performance: investment, consumption, and output are all depressed. • The length of wage contracts becomes very short and there is increasing recourse to the use of foreign currency for transactions. • It requires that the causesof the unsustainable fiscal stance be addressed and that the CB be prevented from financing the deficit through the creation of money but as is often the case in macroeconomics, this is easier said than done.

Volatile inflation • When inflation is high it also seems to be more volatile. Volatile inflation is costly because it creates uncertainty and undermines the informational content of prices. • Unexpected changes in inflation imply changes in real variables in the economy: if money wages and pensions are indexed by past inflation and there is an unanticipated jump in inflation, real wages and pensions will drop. Equally, the real return on savings will fall because the nominal interest rate only incorporates expected inflation. • Volatile inflation masks the economically relevant changes in relative prices and therefore distorts resource allocation. In short, volatile inflation has real effects on the economy that are hard to avoid.

Constant inflation—what level is optimal? • Imagine that we move from a situation in which prices are rising at 3% per year to a rate of 10% per year. • We assume that this change is announced well in advance and that the tax system is indexed to inflation so that all the tax thresholds are raised by 10% p.a. The same is assumed to be true of pensions and other benefits. The consequence of this change will be that all wages, benefits, and prices will now rise at 10% p.a. and the nominal interest rate will be 7% points higher. All real magnitudes in the economy remain unchanged. • The economy moves from a constant inflation equilibrium with π = 3%p.a. to a constant inflation equilibrium with π = 10% p.a. The real interest rate and the levels of output and employment remain unchanged.

At high inflation, people wish to hold lower money balances they wish to economize on their holdings of money so for equilibrium in the money market, the real money supply must be lower than in the initial low inflation equilibrium. Since MS/P = L(i, y) = L(r + πE, y), • at equilibrium output with low inflation, πL, we have: MS/Phigh = L((re+ πL), ye) • and at equilibrium output with high inflation, πH, we have: MSlPlow = L((re+ πH), ye). • This highlights the fact that even in our simple example the shift from inflation of 3% to 10% p.a. is not quite as straightforward as it seems at first. After the move to 10% inflation, money wages, prices, the nominal money supply, and nominal output will rise by 10% each year. But at the time of the shift, there has to be an additional upward jump in the price level to bring down the real money supply (MS/P) to its new lower equilibrium level ((MS/P)low) consistent with the demand for lower real money balances when inflation is higher.

What are the real costs of people economizing on money balances when inflation is high? These costs are sometimes referred to as ‘shoe-leather’ costs. • Other costs (so-called menu costs) arise because of the time and effort involved in changing price lists frequently in an inflationary environment. These costs are estimated to be quite low • We note here an apparent paradox: if the rate of inflation does not matter much, why should governments incur the costs of getting inflation down from a high and stable level to a Low and stable one? • One response is that it seems empirically to be the case that inflation is more volatile when it is higher and as noted above, volatile inflation brings additional costs.

Another reason is that the initiation of disinflation policies frequently begins with high and rising inflation. In this case, since costs will be incurred in stabilizing inflation, it may be sensible for the government to go for low inflation as part of a package that seeks to establish its stability-oriented credentials. • Once we relax our assumption that indexation to inflation is widespread in the economy and that adjustment to higher inflation is instantaneous because all parties are fully informed and can change their prices and wages at low cost, it is clear that the costs of switching to a high inflation economy are likely to be more substantial. • The continuous reduction in individuals’ living standards between wage adjustments gives rise to anxiety. • Distributional effects are also likely to occur: unanticipated inflation shifts wealth from creditors to debtors. It is also likely to make the elderly poorer since they rely on imperfectly indexed pensions and on the interest income from savings.

Can we infer from this analysis that the optimal rate of inflation is zero or even negative? In thinking about the optimal inflation rate, we are led first of all to consider the following: • The return on holding high-powered money (notes and coins) is zero so with any positive inflation rate, the real return turns negative. • The negative real return leads people to waste effort economizing on their money holdings. If we follow the logic of this argument then with a positive real rate of interest, for the nominal interest rate to be zero, inflation would have to be negative. This was Milton Friedman’s view of the optimal rate of inflation: the rate of deflation should equal the real rate of interest, leaving the nominal interest rate equal to zero.

Deflation • Is deflation optimal? • If inflation is negative (e.g. −2% p.a.), prices and wages will be 2% lower in a year’s time than they are now. In a world of perfect information, there would only be benefits from this as we have already seen-shoe leather would be saved. • In spite of these arguments, there are two main reasons why deflation is not viewed as a good target by CBs. • The first reason relates to the apparent difficulty in cutting nominal wages. If workers are particularly resistant to money wage cuts, then a positive rate of inflation creates the flexibility needed to achieve changes in relative wages.

The second reason stems from the need for the CB to maintain a defense against a deflation trap. A deflation trap can emerge when weak aggregate demand leads inflation to fall and eventually become negative. For this to happen, two things are necessary: (i) the automatic self-stabilizers that operate to boost aggregate demand when inflation is falling fail to operate sufficiently strongly and (ii) policy makers fail to stop prices falling. • Attempts to use monetary policy to stimulate the economy result in the nominal interest rate falling. A nominal interest rate close to zero (as low as it can go) combined with deflation implies a positive real interest rate. This may be too high to stimulate private sector demand.

Continued weak demand will fuel deflation and push the real interest rate up, which is exactly the wrong policy impulse. This will tend to weaken demand further and sustain the upward pressure on the real interest rate. • Once deflation takes hold, it can feed on itself and unlike a process of rising inflation, it does not require the active cooperation of the CB for the process to continue

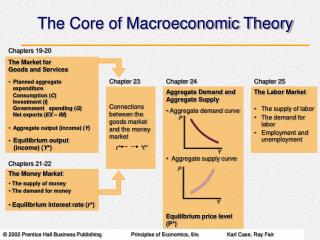

Monetary policy paradigms • The first paradigm, the money supply model or LM paradigm, characterized by the following propositions: (1) The ultimate determinant of the P and π is MS; (2) the instrument of monetary policy is MS; (3) the mechanism through which the economy adjusts to a new equilibrium with constant inflation following a shock is that embodied in the IS/LMmodel plus the inertia-augmented (or expectations-augmented) Phillips curve. • The second paradigm, the interest rate reaction function or MRparadigm, characterized as follows: (1) the ultimate determinant of the P and π is policy; (2) the instrument of policy is the short-term nominal interest rate; (3) the mechanism through which the economy adjusts to a new equilibrium with constant inflation following a shock is encapsulated in an interest rate rule.

The monetary policy rule in the 3-equation model • We pin down the role played by the following six key variables in CB policy making: (1) the CB’s inflation target, πT (2) the CB’s preferences, β (3) the slope of the Phillips curve, α (4) the interest sensitivity of aggregate demand (i.e. the slope of the IS curve), a (5) the equilibrium level of output, ye (6) the stabilizing interest rate, rS. • In order to make the discussion of monetary policy rules concrete, we shall: (1) Define the CB’s utility function in terms of both output and inflation. This produces the policy maker’s indifference curves in output-inflation space.

(2) Define the constraints faced by the policy maker: these are the Phillips curves. (3) Derive the optimal monetary rule in output-inflation space: this is the MR line. Hidden in this relationship is the policy instrument, r, that the CB will use to secure the appropriate level of aggregate demand and output. (4) We can also derive the interest rate rule, which tells the CB how to adjust the r in response to current economic conditions.

The CB’s utility function • We assume that CB has two concerns: the rate of inflation, π, and the level of output, y. • The rate of inflation • We assume that CB has a πTand that it wants to minimize fluctuations around πT, i.e., it wants to minimize theloss function: (π − πT)2 • This particular loss function has two implications: • First, the CB is as concerned to avoid inflation below πT as it is above πT. If πT= 2% the loss from π = 4% is the same as the loss from π = 0%. In both cases (π − πT)2 = 4. • Second, it attaches increased importance to bringing π back to πT the further it is away from πT; the loss from π = 6% is 16, compared to the loss of 4 from π = 4%. The CB’s marginal disutility is increasing as π − πTgrows.

Output and employment. • Assume the CB’s target is yeand it seeks to minimize the gap between yand ye. The CB’s loss as a result of y being different from its yeis: (y − ye)2. • the CB understands the model and realizes that inflation is only constant at y = ye. • If y < yethen this represents unnecessary unemployment that should be eliminated. • If y > ye, this is unsustainable and will require costly increases in unemployment to bring the associated inflation back down. • Adding the two loss functions together, we have the CB’s objective function: L = (y − ye)2 + β(π − πT)2,(CB loss function) where βis the relative weight attached to the loss from inflation.

β is a critical parameter: a β > 1 means the CB places less weight on deviations in employment from its target than on deviations in inflation, and vice versa. • The loss function is simple to draw: with β = 1, each indifference curve is a circle with (ye, πT) at its centre (see Fig. 5.1(a)). The loss declines as the circle gets smaller. When π = πTand y = ye, the circle shrinks to a single point (called the ‘blisspoint’) and the loss is at a minimum, which is zero. • With β = 1, the CB is indifferent between inflation 1% above (or below) πTand output 1% below (or above) ye. They are on the same loss circle.

If β > 1 (inflation avert), the CB is indifferent between (say) inflation 1% above (or below) πTand output 2% above (or below) ye. They are on the same loss curve. This makes the indifference curves ellipsoid with a horizontal orientation, Fig. 5.1(b). • A CB with less inflation aversion (β < 1) will have ellipsoid indifference curves with a vertical orientation (Fig. 5.1(c)). The indifference curves are steep reflecting that the CB is only willing to trade off a given fall in inflation for a smaller fall in output than in the other two cases. • If the CB cares only about inflation then β = ∞and the loss ellipses become one dimensional along the line at π = πT.

Figure 5.1 β = 1 β > 1 β < 1

The Phillips curve constraint • Assume that the CB can control y by using monetary policy to control aggregate demand, yD. However, it cannot control inflation directly -only indirectly viay. As discussed before, output affects inflation via the Phillips curve: π = π−1 + α.(y − ye). • This is shown in Fig. 5.2. For simplicity assume that α = 1, so that each Phillips curve has a slope of 45◦. Assume that π−1 = πT= 2%. The CB is in the happy position of being able to choose the bull’s eye point B or (πT , ye) at which its loss is zero. • Suppose, that inflation is 4%. The bull’s eye is no longer obtainable. The CB faces a trade-off: if it wants a level of output of y = ye next period, then it has to accept an inflation rate above target, i.e. π = 4 = πT(point A).

If it wishes to hit πT it must accept a lower level of output (point C). Point A corresponds to a fully accommodating monetary policy in which the objective to hit the ye (β = 0), and point C corresponds to a non-accommodating policy, in which the objective is to hit the inflation target (β = ∞). • The CB can do better by minimizing its loss function by choosing point D, where the PC (πI= 4) line is tangential to the indifference curve of the loss function closest to the bull’s eye, output = y1 which will in turn imply an inflation rate of 3%.

Deriving the monetary rule, MR • For simplicity, we use the form of the loss function in which β = 1 so that we have loss circles as in Fig. 5.2 above. This implies: L = (y − ye)2 + (π − πT)2. • Using the simplest version of the Phillips curve in which α = 1 so that each PC has a 45◦ slope as in Fig. 5.2: π = π−1 + y − ye . • In Fig. 5.3, the points of tangency between successive Phillips curves and the loss circles show the level of output that the CB needs to choose to minimize its loss at any given level of π−1. Thus when π−1 = 3, its loss is minimized at C; or when π−1 = 4 at D. Joining these points (D,C, B) produces the MR line that we used in Chapter 3. We can see from Fig. 5.3 that a one unit rise in π−1 implies a half unit fall in y, for example an increase in π−1 from 3% to 4% implies a fall in y from y2 to y1.

We can derive the monetary rule explicitly as follows. By choosing y to minimize L we can derive the optimal value of y for each value of π−1. Substituting the Phillips curve into L and minimizing with respect to y, we have: ∂L/∂y= 2(y − ye) + 2(π−1 + (y − ye) − πT) = 0 = (y − ye) + (π−1 + (y − ye) − πT) = 0. Since π = π−1 + y − ye , ∂L/∂y= (y − ye) + (π − πT) = 0 =⇒(y − ye) = −(π − πT). (MR equation) • The monetary rule in the Phillips diagram shows the equilibrium for the CB: it shows the equilibrium relationship between the π chosen indirectly and y chosen directly by the CB to maximize its utility (minimize its loss) given its preferences and the constraints it faces.

This shows the monetary rule as an inverse relation between πand y with a negative 45◦ slope (Fig. 5.3). Specifically, it shows that the CB must reduce yD and y, below yeso as to reduce πbelow πTby the same percentage. Thus this could be thought of as monetary policy halfway between: (i) completely non-accommodating when the CB cuts output sufficiently to bring π straight back toπTat the cost of a sharp rise in unemployment; (ii) a completely accommodating one, which leaves π (and y) unchanged. If the monetary rule was flat at πTwe would have a completely non-accommodating monetary policy; if it was vertical at ye, we would have a completely accommodating monetary policy.

The monetary rule ends up exactly halfway between an accommodating and a non accommodating policy because of the two simplifying assumptions. • By relaxing these assumptions, we learn what it is that determines the slope of the monetary rule. • The first factor that determines the slope of the monetary rule is the degree of inflation aversion of the CB is captured by βin the CB loss function: L = (y − ye)2 + β(π − πT )2. If β > 1, the CB attaches more importance to the inflation target than to the output target. This results in a flatter monetary rule as shown in Fig. 5.4. Given these preferences, any inflation shock that shifts the PC upward implies that the optimal position for the CB will involve a more significant output reduction and hence a sharper cut in inflation along that PC than in the neutral case. Using the same reasoning, β < 1 implies that the monetary rule is steeper.

The second factor that determines the slope of the monetary rule is the responsiveness of inflation to output (i.e. the slope of the PC): π −π−1 = α(y −ye). • If α > 1 so the PCs are steeper, any given cut in y has a greater effect in reducing inflation than when α = 1. As we can see from Fig. 5.5, this makes the MR line flatter than in the case in which α = 1: MR0 is the old and MR1 the new monetary rule line obtained by joining up the points D, C, and B. Steeper PCs make the MR line flatter.

Let us now compare the response of a CB to a given rise in inflation in the case where the PCs are steep with the case where they have a slope of one. Our intuition tells us that steeperPCs make things easier for the CB since a smaller rise in unemployment (fall in output) is required to achieve any desired fall in inflation. • In the left hand panel of Fig. 5.6 we compare two economies, one with flatter PCs (dashed) and one with steeper ones. The MR line is flatter for the economy with steeper PCs: this is MR1. Suppose there is a rise in inflation in each economy that shifts the PCs up: each economy is at point B. We can see that a smaller cut in aggregate demand is optimal in the economy with the steeper PCs (point D).

Fig. 5.6 Identical PC two different preferences Inflation averse

In the right hand panel, we compare two economies with identicalsupply sides (same PC) but in which one has an inflation-averse CB (the oval-shaped indifference ellipse) and show the CB’s reaction to inflation at point B. The more inflation-averse CB always responds to this shock by cutting aggregate demand (and output) more (point D). • Derivation of the general form of the CB’s monetary rule. • By choosing the interest rate in period zero, the CB affects y and πin period 1. We assume it is only concerned with what happens in period 1. This is the reason that its loss function is defined in terms of y1 and π1. If we let βand αtake any positive values, the CB chooses yto minimize: L = (y1− ye)2 + β(π1− πT)2 (5.2) subject to: π1 = π0 + α(y1− ye)(5.3)

By substituting (5.3) into (5.2) and differentiating with respect to y1 (since this is the variable the CB can control via its choice of the interest rate), we have: ∂L/∂y1 = (y1− ye) + αβ(π0 + α(y1− ye) − πT) = 0. (5.4) • Substituting equation (5.3) back into equation (5.4) gives: (y1− ye) = −αβ(π1− πT). (monetary rule, MR) • Now it can be seen directly that the larger is αor the larger is β the flatter will be the slope of the monetary rule. In the first case (larger α) this is because any reduction in aggregate demand achieves a bigger cut in inflation. In the second case (lager β), this is because, whatever the labor market it faces, a more inflation-averse CB will wish to reduce inflation by more than a less ‘extreme’ one.

Using the IS-PC-MR graphical mode • Given the determinants of the slope MR slope, the role of each of the six key inputs to the deliberations of the CB is now clear. (1) the CB’s inflation target, πT: this affects the position of the MR; (2) the CB’s preferences, β: this determines the shape of the loss ellipses and affects the slope of the MR; (3) the slope of the PC,α: this also affects the slope of the MR line; (4) the interest sensitivity of yD, a: this determines the slope of the IS; (5) the equilibrium level of output, ye: this determines the position of the vertical PC and affects the position of the MR line; (6) the stabilizing interest rate,rS: the CB adjusts r relative to rSso it must always analyze whether this has shifted, e.g. as a result of a shift in the IS or due to a change in the equilibrium level of output, ye.

On the basis of the previous discussion, the IS-PC-MRmodel can be used to analyze a variety of problems. An example to clarify the CB’s decision and to highlight the role played by the lag in the effect of monetary policy on yD and y. The example shows that the CB is engaged in a forecasting exercise: it must forecast next period’s PC and IS curve. We assume that the economy starts off with ye and πT of 2% as shown in Fig. 5.7. • We take a permanent positive aggregate demand shock, the IS moves to IS’. As y is above ye, π will rise above πT; in this case to 4%. This defines next period’s PC (PC(πI= 4)) along which the CB must choose its preferred point: point C. The CB forecasts that the IS curve is IS’, i.e. it judges that this is a permanent shock and by going vertically up to point C’in the IS diagram, it can work out that the appropriate interest rate to set is r’. As the PC shifts down with falling inflation, the CB reduces the interest rate and the economy moves down the MR line to point Zand down the IS’curve to Z’.

This example highlights the role of the stabilizing real interest rate, rS: following the shift in the IScurve, there is a new stabilizing interest rate and, in order to reduce inflation, the interest rate must be raised above the new rS, i.e. to r’. • The CB is forward looking and takes all available information into account: its ability to control the economy is limited by the presence of inflation inertia. In the ISequation it is the interest rate at time zero that affects output at time one: y1 − ye = −a(r0− rS). This is because it takes time for a change in the interest rate to feed through to consumption and investment decisions. In Fig. 5.7 in order to choose its optimal point Con the PC (πI= 4), the CB must set the interest rate now at r’. However, it is interesting to see what happens if the CB could affect y immediately, i.e. if y0− ye = −a(r0− rS).

In this case, as soon as the IS shock is diagnosed, the CB would raise the interest rate to rS’. The economy then goes directly from A’to Z’in the ISdiagram and it remains at Ain the Phillips diagram, i.e. points Aand Zcoincide. Since the aggregate demand shock is fully and immediately offset by the change in the interest rate, there is no chance for inflation to rise. • This underlines the crucial role of lags and hence of forecasting for the CB: the more timely and accurate are forecasts of shifts in aggregate demand, the greater is the chance that the CB can offset them and limit their impact on inflation. Once inflation has been affected, the presence of inflation inertia means that the CB must change the interest rate and get the economy onto the MRline in order to steer it back to the inflation target.

A Taylor Rule in the IS-PC-MR model • Interest rate rules: • We now show how to derive an interest rate rule, which directly expresses the change in the interest rate in terms of the current state of the economy. We then show how it relates to the famous Taylor Rule. We bring together the three equations: π1 = π0 + α(y1− ye) (Phillips curve) y1− ye = −a(r0− rS) (IS) π1− πT= −1/αβ (y1− ye). (MR) • From these equations, we want to derive a formula for the interest rate, r0 in terms of period zero observations of inflation and output in the economy. If we substitute for π1. • Using the Phillips curve in the MR, we get: π0 + α(y1− ye) − πT= −1/αβ (y1− ye) π0− πT= −α + 1/αβ(y1− ye)

and if we now substitute for (y1 − ye) using the IS, we get the interest-rate rule: r0− rS= 1/(a(α + 1/αβ)) (π0− πT). (Interest rate rule) We can see that r0− rS= 0.5 π0− πT if a = α = β = 1 • Two things are immediately apparent: • First, only inflation and not output deviation is present in the rule • Second, all the parameters of the 3-equation model matter for the CB’s response to a rise in inflation. If inflation is 1% point above the target, then the interest rate rule says that the real interest rate needs to be 0.5% higher. Since inflation is higher by 1%, the nominal interest rate must be raised by 1 + 0.5, i.e. by 1.5% in order to secure a rise in the realinterest rate of 0.5 percentage points.

For a given deviation of inflation from target, and in each case, comparing the situation with that in which a = α = β = 1, we can see that a more inflation-averse CB (β > 1) will raise the interest rate by more; • when the IS is flatter (a > 1), the CB will raise the interest rate by less; • when the Phillips curve is steeper (α > 1), the CB will raise the interest rate by less. • Let us compare the interest rate rule that we have derived from the 3-equation model with the famous Taylor Rule, r0− rS = 0.5.(π0− πT) + 0.5.(y0− ye), (Taylor Rule) • The Taylor Rule states that if output is 1% above equilibrium and inflation is at the target, the CB should raise the interest rate by 0.5 percentage points relative to stabilizing interest rate.

Interest rate rules and lags • The interest rate rule derived from the 3-equation model is similar to Taylor’s rule. However, it only requires the CB to respond to inflation. This seems paradoxical, given that the CB cares about both inflation and output (equation 5.2). It turns out that to get an interest rate rule that is like the Taylor rule in which both the inflation and output deviations are present, we need to modify the 3-equation model to bring the lag structure closer to that of a real economy. • As before we assume that there is no observational timelag for the monetary authorities, i.e. the CB can set the interest rate (r0) as soon as it observes current data (π0 and y0). We continue to assume that the interest rate only has an effect on output next period, i.e. r0 affects y1. The new assumptionabout timing that is required is that it takes a year for output to affectinflation, i.e. the output level y1 affects inflation a period later, π2. This means that it is y0 and not y1 that is in the Phillips curve for π1.

The empirical evidence is that on average it takes up to about one year for the response to a monetary policy change to have its peak effect on demand and production, and that it takes up to a further year for these activity changes to have their fullest impact on the inflation rate. • The “double lag” structure is shown in Fig. 5.8 and emphasizes that a decision taken today by the CB to react to a shock will only affect the inflation rate two periods later, i.e. π2. When the economy is disturbed in the current period (period zero), the CB looks ahead to the implications for inflation and sets the interest rate so as to determine y1, which in turn determines the desired value of π2. Since the CB can only choose y1 and π2by its interest rate decision, its loss function is: L = (y1− ye)2 + β(π2− πT)2. • Given the double lag, the three equations are: π1 = π0 + α(y0− ye) (Phillips curve) y1− ye = −a(r0− rS) (IS) π2− πT= − 1/αβ (y1− ye). (MR)