Insider Trading: Basics, Debate, and Legal Perspectives

580 likes | 654 Vues

Explore the fundamentals of insider trading, the classic debate surrounding it, and the legal considerations at state and federal levels. Learn about key cases, rules, and implications of insider trading.

Insider Trading: Basics, Debate, and Legal Perspectives

E N D

Presentation Transcript

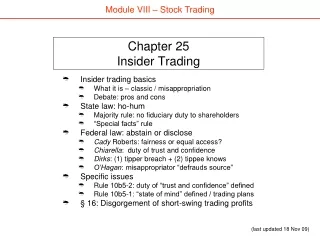

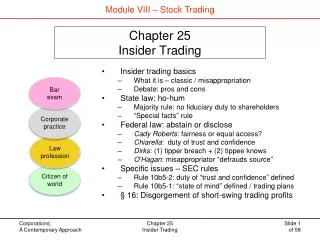

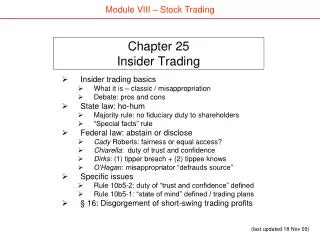

Chapter 25Insider Trading Insider trading basics What it is – classic / misappropriation Debate: pros and cons State law: ho-hum Majority rule: no fiduciary duty to shareholders “Special facts” rule Federal law: abstain or disclose Cady Roberts: fairness or equal access? Chiarella: duty of trust and confidence Dirks: (1) tipper breach + (2) tippee knows O’Hagan: misappropriator “defrauds source” Specific issues Rule 10b5-2: duty of “trust and confidence” defined Rule 10b5-1: “state of mind” defined / trading plans § 16: Disgorgement of short-swing trading profits Module VIII – Stock Trading (last updated 18 Nov 09)

What is insider trading? Good news, bad news Outsider trading

Insider trading Good news Stock market Buy from existing shareholders Insider • Buy “call options” • option to buy stock • at mkt (let’s say $25) • profit = new price (let’s • say $35) less exercise • price ($25) Corporation Non-public, material information

Insider trading Bad news Stock market Sell to existing shareholders Insider • Buy “put options” • option to sell stock • at mkt (let’s say $25) • profit = exercise price • ($25) minus new price • (let’s say $15) Corporation Non-public, material information

Outsider trading Good or bad news shareholders Investors / shareholders Insider Corporation Non-public, material information (such as takeover plans by Corp) Target Company

Pros Sends “soft information” to markets – thus protecting proprietary info Encourages insiders to own company stock Compensates insiders for developing “good news” Cons Unfair to those without information Discourages investors from entering market Adds to trading “spreads” in markets Constitutes theft of corporate intellectual property Distorts company disclosures as insiders manipulate company info Evaluate insider trading

Fraud (tort of deceit) Material misrepresentation Intentional (Def aware of truth) Reliance (Pl relies reasonably) Misrepresentation is cause of loss Damages Goodwin v. Agassiz (Mass 1933) Good news Stock market / Goodwin Buy from existing shareholder (impersonal market) Agassiz & McNaughton Corporation Secured options to land (geologist’s theory - leads to mineral strike)

Goodwin v. Agassiz (Mass 1933) Good news Stock market / Goodwin • Fiduciary duty (to shareholders) • Majority rule – no duty in impersonal markets • “Special facts” –personal dealings on the basis of highly material facts • “Strict / Kansas” rule – face-to-face transaction, not necessarily special facts Buy from existing shareholder (impersonal market) Agassiz & McNaughton Corporation Secured options to land (geologist’s theory - leads to mineral strike)

"The contention that directors also occupy a position of trustee toward individual stockholders in the corporation is plainly contrary to repeated decisions of this court [and other courts]" "Purchase and sales of stock dealt in on the stock exchange are commonly impersonal affairs. An honest director would be in a difficult situation if he could neither buy nor sell on the stock exchange shares of stock in his corporation ..." Supreme Judicial Court of Massachusetts:

“Bad news” Lower earnings Diamond v. Oreamuno (NY 1969) Investors / shareholders Sell to new investors Oremuno / Gonzalez Corporation Non-public, material information (IBM puts squeeze on earnings)

Arguments for: Distinguishes “good” companies from “bad” companies Agent can’t take from principal, even if principal not harmed Arguments against: Recovery screwy: Good news: Recovery goes to non-trading Shs who held stock, not those who sold stock Bad news: Recovery goes to all Shs, does not fully compensate Shs who bought Possible multiple liability (see Rule 10b-5) Corporate recovery

Federal law of insider trading(duty to abstain or disclose) Theory under Rule 10b-5 Chiarella: duty of trust and confidence Dirks: tipper-tippe liability O’Hagan: misappropriation liability

Section 10(b) / Rule 10b-5 Securities Exchange Act of 1934 Act § 10 It shall be unlawful for any person ... (b) To use or employ, in connection with the purchase or sale of any security ... any manipulative or deceptive device or contrivance in contravention of such rules and regulations as the Commission may prescribe • Fraud (tort of deceit) • Material misrepresentation • Intentional (defendant aware of truth) • Reliance (plaintiff relies reasonably) • Misrepresentation is cause of loss • Damages

Is silence fraudulent? Conventional wisdom: • Must disclose latent, not patent, defects. • Fiduciaries (confidential relationship) must give full disclosure But: • Unequal access to information not significant factor • Courts over time less likely to require disclosure!! Krawiec (UNC-CH) & Zeiler (Georgetown) – 2004(466 contract cases / 200 years)

“Bad news” Cady Roberts (SEC 1961) Investors / shareholders Sell to new investors (sell short) Gintel (director) Curtiss-Wright Non-public, material information (directors vote to cut dividends) What is theory?

Parity of information We hold that Gintel’s conduct violated clause (3) [of Rule 10b-5] as a practice which operated as a fraud or deceit on the purchasers If purchasers had available material information known by a sellting insiders, their investment judgment would be affected. Sales by an insider must await disclosure. Gintel has been fined $3000 by the NYSE .. And the protection of investors will be served if Gintel is suspended from the NYSE for 20 days. Chair WiIliam Cary (“race to bottom”)

Chiarella v. US (US 1980) shareholders Pandick Press Chiarella Shareholders Insider Acquiror Inc Non-public, material info (takeover plans) Target Company

Duty "... silence in connection with the purchase or sale of securities may operate as fraud actionable under § 10(b) ... But such liability is premised upon a duty to disclose arising from a relationship of trust and confidence between parties to a transaction.” .... duty to disclose ... guarantees that corporate insiders, who have an obligation to place the shareholder's welfare before their own, will not benefit personally through fraudulent use of material, nonpublic information. Justice Lewis Powell (corporate lawyer)

Dirks v. SEC (US 1983) Investors / shareholders Clients dump stock Secrist Equity Funding Non-public, material information (massive accounting fraud) Dirks

Duty, again ... a tippee assumes a fiduciary duty to the shareholders of a corporation not to trade on material nonpublic information only when the insider has breached his fiduciary duty to the shareholders by disclosing the information to the tippee and the tippee knows or should know that there has been a breach. Whether the "tip" was a breach of the insider's fiduciary duty [depends on] whether ... the insider receives a direct or indirect personal benefit that will translate into future earnings. Justice Lewis Powell (very influential)

Hypos Investors / shareholders #2 #1 Secrist Spouse Equity Funding Non-public, material information (massive accounting fraud)

SEC v. Stewart (2003) Stock market #2 #1 #1 #1 Martha Stewart (at airport to Mx) Sam Wachtal (CEO) Imclone Non-public, material information (FDA likely to disapprove drug) Faneuil (broker’s asst)

Outsider Trading (Misappropriation) “Fraud on source”? “in connection with” trading? Rule 10b5-2: Fiduciary relationship Rule 10b5-1: Insider awareness

Section 10(b) / Rule 10b-5 Securities Exchange Act of 1934 Act § 10 It shall be unlawful for any person ... (b) To use or employ, in connection with the purchase or sale of any security ... any manipulative or deceptive device or contrivance in contravention of such rules and regulations as the Commission may prescribe

US v. O’Hagan (US 1997) Shareholders Option sellers Dorsey & Whitney O’Hagan Grand Met Non-public, material info (plan to make tender offer to Pillsbury shareholders) Shareholders Pillsbury

Duty to source The "misappropriation theory" holds that a person commits fraud "in connection with" a securities transaction, and thereby violates § 10(b) and Rule 10b-5, when he misappropriates confidential information for securities trading purposes, in breach of a duty owed to the source of the information. See Brief for United States 14. Justice Ruth Bader Ginsberg [civil rights lawyer]

ICW trading [The "in connection with the purchase or sale of [a] security"] element is satisfied because the fiduciary's fraud is consummated, not when the fiduciary gains the confidential information, but when, without disclosure to his principal, he uses the information to purchase or sell securities. The securities transaction and the breach of duty thus coincide. Justice Ruth Bader Ginsberg [civil rights lawyer]

“Insider trading”(in the United States) • Classic insider trading: • Fraudulent silence under Section 10(b) • Duty of trust and confidence to “abstain or disclose” • Actionable silence in confidential relationships • Tipping: • Tippee knows or should know that • Tipper breached duty for direct/indirect personal benefit • Necessary to extend prohibition • Misappropriation (outsider trading): • Duty of trust and confidence to source • Fraud on source “in connection with” securities trading • Maintain integrity of securities markets

SEC rules • Rule 10b5-1: state of mind when trading “on the basis” of material, nonpublic information • “aware” (“conscious knowledge”) • Pre-existing trading plans OK • Rule 10b5-2: duty to source in business/personal relations • Agree to maintain confidentiality • Practice of sharing known confidences • Spouse, parent, child, sibling – unless dysfunctional family • Regulation FD: no special access for stock analysts

Q&A: The In's and Out's of Insider Trading The Wall Street Journal October 4, 2002

1. You work as CFO in Up-N-Rising, a bakery franchiser, that is opening high-end bakery shops throughout the country. The numbers have been good, until this month when you notice an internal report showing a 25% fall in royalties from pastry sales. Question: You sell some of your stock. Insider trading? Yes. This is classic insider trading. Only question is whether drop in pastry sales is “material” State of mind – use versus knowledge – resolved by Rule 10b5-1 (“aware”) Insider trading quiz

2. You are outside counsel to Up-N-Rising. The CFO at Up-N-Rising calls you and tells you about this quarter’s 25% fall in pastry sales - resulting in a 15% drop in earnings . She asks whether the company should disclose this in a press release. Question: You sell Up-N-Rising short. Insider trading? Yes. You are temporary insider (see fn 14 - Dirks case) and owe a duty under 10b5-2. Drop in royalties is “material” Duty to source in business/ personal relation (Rule 10b5-2) Agree to maintain confidentiality Practice of sharing known confidences Insider trading quiz

3. You are a friend of Ralph, who you know is sales manager for Up-N-Rising. Ralph tells you that “something” is happening at the company and you might want to consider selling your Up-N-Rising holdings, if you have any. Ralph says no more. Question: You sell your Up-N-Rising stock? Insider trading? Probably. You received a tip (duty to inquire). If “something” is material, nonpublic Elements of illegal tipping Breach of duty by tipper (personal benefit) Tippee knows or reason to know of violation Insider trading quiz

4. You are a member of a golf foursome. One of the foursome says, “I think something’s happening at Up-N-Rising. You’d probably do well to short it.” He says no more. Question: You may no further inquiries and buy Up-N-Rising put options. Insider trading? No. Probably no duty to inquire. Materiality: What does “something happening” mean? Awareness: What are you aware of with “something”? Who was the source of information? Insider trading quiz

Insider trading quiz Jeffrey Haas, a professor of securities law at New York Law School: “If not from a company insider, you’re probably stupid to just listen and trade on it” … You don't have a duty to find out where it came from.“ Nancy Grunberg, former assistant director of SEC enforcement: "The SEC would want to know -- unless it was on a piece of paper that fell out of the sky -- whether you asked about the source of the information before you acted on it."

5. New scenario. You are the CFO of KK Donuts and have been cogitating on what to do with all the company’s extra cash. You talk with the company’s CEO and investment banker, who agree buying Up-N-Rising would be a good move. You begin to form a takeover team. Question: You buy Up-N-Rising stock. Insider trading? Yes – actually “outsider trading.” You cannot misappropriate your company’s info. “Material” Duty to source “Awareness” Insider trading quiz

6. You are the spouse of the CFO of KK Donuts, who tells you that she will be out of town for the next few days. “We’re looking at buying Up-N-Rising.” You know that this is only going to complicate your life. You wish there were a silver lining. Question: You buy Up-N-Rising stock. Insider trading? Yes: both (1) tip and (2) duty Tipper personal benefit? WSJ: “Prosecutors have an easy time. Courts say it’s enough that person's reputation among colleagues enhanced for being good tipper.” Recipient had duty to source Rule 10b5-2: “duty” presumed in close family relations, unless no expectation of confidentiality Insider trading quiz

7. You are the head of strategic planning at KK Donuts. You are no fool. You figure that when KK Donuts announces it is acquiring Up-N-Rising, the stock prices of competitors of Up-N-Rising will likely fall. The Up-N-Rising acquisition is moving apace. Question: You sell short the stock of Up-N-Rising’s competitors. Insider trading? Well, maybe Clearly no duty to outside companies But perhaps duty to source? Current academic “state of art” issue What were source’s confidentiality expectations ECMH: trading in competitor affects target’s stock price Reach of insider trading prohibition? Insider trading quiz

8. You are an outside “public relations” consultant to KK Donuts. The company's CEO calls and tells you KK Donuts may be buying Up-N-Rising to expand into the high-end French bakery business. Given the current political climate, you are asked if this would be good for public relations. You have no confidentiality agreement. Question: You buy Up-N-Rising stock. Insider trading? Yes (probably) Rule 10b5-2 Defines duty to source “Persons … have history, pattern or practice of sharing confidential information … so recipient had reason to know communicator expected confidentiality.” Insider trading quiz