Happy Friday! 11/22/13

190 likes | 372 Vues

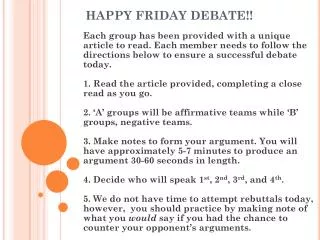

Happy Friday! 11/22/13. Today’s Agenda: Moneypower.org quiz Credit Student Video If time: Pros and Cons of credit. Credit. Definition – the ability to obtain goods or services before paying for them, based on the promise to pay later. Forms of credit.

Happy Friday! 11/22/13

E N D

Presentation Transcript

Happy Friday! 11/22/13 • Today’s Agenda: • Moneypower.org quiz • Credit • Student Video • If time: • Pros and Cons of credit

Credit • Definition – the ability to obtain goods or services before paying for them, based on the promise to pay later.

Forms of credit • Each time a person uses credit, he or she is borrowing money. • Credit can be the use of a credit card or it can be the acquisition of a loan from the bank. • How well a person uses credit determines how much credit they will be offered. • Using credit can have many advantages but it can also be very risky!

Advantages of Credit • Provides a way to make big purchases. • Provides a way to purchase something now and defer payment for a while. • Useful in an emergency. • Allows consumers to take advantages of opportunities such as sales. • If used properly, it can help a person to establish good credit, which may save them money in the future (lower interest rates, etc.)

Disadvantages of Credit • May reduce one’s ability to make future purchases – if money made is always being used to pay past debt, it is hard to get ahead. • May cause individuals to borrow more than they can afford to pay back. • Credit card rates are compounding interest rates (debt can add up quickly!) • A poor credit history can follow a person and make it more difficult to acquire future loans.

Important Vocabulary • Annual fee: A fee charged to the cardholder by the card issuer. Cardholders pay this fee in order to obtain the credit card in question. • Finance charge: The amount of interest charged on the account for a particular billing cycle. • Minimum payment: The smallest amount of money that must be paid by the cardholder for the billing cycle. • Billing cycle: The days between the last statement and the current statement. • APR: The annual percentage rate of the finance charge. This yearly interest rate will be a fixed or variable rate. • Grace period: The time period during which a cardholder may pay off his or her balance without incurring a finance charge. • Late payment fee: A fee charged to cardholders for being delinquent with their payments. • Credit limit: The amount a card “holds;” in other words, what is available to be borrowed.

Important Vocabulary (continued) • Classic card: A credit card that usually comes with a low credit limit. Also known as the basic card. • Gold card: A credit card that offers the cardholder more benefits and a higher credit limit (usually $2,000 to $5,000) than a classic card. • Platinum card: A credit card typically issued to people with higher incomes. The credit limit is usually more than $5,000. • Rebate card: In using a rebate card, the cardholder earns points or money which may be applied later in the purchase of certain goods and services. • Secured card: A credit card that is secured by the cardholder's opening of a savings account with the issuer. It is intended to help people who are looking to rebuild their credit. • Unsecured cards: Credit cards that are not secured by collateral. Most cards issued are unsecured. • Cash advance: Money the cardholder obtains, by using his or her credit card, from the card issuer. • Prime rate: The lending rate set by the Fed. This is usually the lowest possible interest rate and is reserved by commercial banks for their best clients.

Types of Loans • Student/Education loans • Vehicle loans • Personal loan • Mortgage

Student Loans • Student/Education loans • Tend to have very low interest rates. • Repayment usually starts after the person has graduated or completed the education/training.

Vehicle Loans • Vehicle loans • Tend to have relatively low interest rates • A down payment on the car is usually expected. • Based on?

Personal Loan • Personal loan • Loan taken out for the expensive purchases of life • Home improvements • Weddings • Vacations

Home Loans • Mortgage • Loan to purchase a home • Interest rates vary with the state of the overall economy. • There are many options, including fixed-rate mortgages, variable rate mortgages, and interest-first mortgages.

Credit Card or Loan? • Credit Cards: • Generally, have higher interest rates than loans. • Provide immediate access to funds. • Generally, easier to get than loans if you have a bad credit history. • Loans: • Take time to set up. • Generally, have lower interest rates than credit. • More difficult to get if you have a poor credit history.

Your Credit Score • How FICO® Credit Scores Work (taken from myFICO.com): • When you apply for credit – whether for a credit card, a car loan, or a mortgage – lenders want to know what risk they’d take by loaning money to you. • A financial company created called Fair Isaac created a mathematical way to assess how risky it is for a lending institution to lend money to any given person. • FICO® scores are the credit scores most lenders use to determine your credit risk. • You have three FICO® scores, one for each of the three credit bureaus – Experian, TransUnion, and Equifax. Each credit score is based on information the credit bureau keeps on file about you. As this information changes, your credit scores tend to change as well. • Your 3 FICO® credit scores affect both how much and what loan terms (interest rate, etc.) lenders will offer you at any given time. • Taking steps to improve your FICO® scores can help you qualify for better rates from lenders.

What’s in Your Credit Score? • This breakdown is used to determine a person’s credit rating. The credit bureau will mathematically figure out the risk and assign a number between 300 (lowest) and 850 (highest). The better your credit rating, the more likely you are to receive a loan and the better the interest rate you will receive!

How to Improve Your Credit Score • Tips from MyFICO.com: • Pay your bills on time. • If you have missed payments, get current and stay current. The longer you pay your bills on time, the better your credit score. • Be aware that things that affect your credit negatively stay on your report for seven years. • If you are having trouble making ends meet, contact your creditors or see a legitimate credit counselor. This won't improve your credit score immediately, but if you can begin to manage your credit and pay on time, your score will get better over time.

How to Improve Your Credit Score • Keep balances low on credit cards. High outstanding debt can affect a credit score. • Pay off debt rather than moving it around. In fact, owing the same amount but having fewer open accounts may lower your score. • Don't close unused credit cards as a short-term strategy to raise your score. Note that closing an account doesn't make it go away. A closed account will still show up on your credit report, and may be considered by the score. • Don't open a number of new credit cards that you don't need, just to increase your available credit.

How to Improve Your Credit Score • If you have been managing credit for a short time, don't open a lot of new accounts too rapidly. • Re-establish your credit history if you have had problems. Opening new accounts responsibly and paying them off on time will raise your credit score in the long term. • Apply for and open new credit accounts only as needed. • Have credit cards - but manage them responsibly. Someone with no credit cards, for example, tends to be higher risk than someone who has managed credit cards responsibly.

Videos • Pizza Cravings • A Student's Story