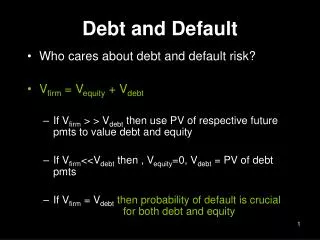

Debt and Default

260 likes | 432 Vues

Debt and Default. Who cares about debt and default risk? V firm = V equity + V debt If V firm > > V debt then use PV of respective future pmts to value debt and equity If V firm <<V debt then , V equity =0, V debt = PV of debt pmts

Debt and Default

E N D

Presentation Transcript

Debt and Default • Who cares about debt and default risk? • Vfirm = Vequity + Vdebt • If Vfirm > > Vdebt then use PV of respective future pmts to value debt and equity • If Vfirm<<Vdebt then , Vequity=0, Vdebt = PV of debt pmts • If Vfirm = Vdebtthen probability of default is crucial for both debt and equity

Predicting Default • What does it mean to “default?” • Average default rates in US over past 20 years are 1.2% for one year and 5.9% for five years (Moody’s). $178B

Moody’s RiskCalchttp://riskcalc.moodysrms.com/ “Moody's RiskCalc™ has been designed to act as an early warning system to monitor changes in the credit quality of non-financial corporate obligors with publicly traded equity. Our models are used in the credit evaluation of private and publicly-owned corporate borrowers. They provide probability of default that assist financial institutions with measuring, monitoring and managing portfolio credit risk.” What are the various determinants of Moody’s RiskCalc?

L/A = .558 EBIT/Interest = 2.21

Inv/CGS = .137 or 50 days

The Movie Industry $5.39/ticket $4.35/ticket

Country Cinema and City Screens • Each has approximately 2800 screens • Revenue = 65% tickets, 30% candy, 5% video games Country Cinema versus City Screens?

ratios in debt covenants • "Consolidated Cash Flow" means, for any period, the sum of Consolidated Operating Income of the Borrower, and its Subsidiaries, plus to the extent deducted in determining such Consolidated Operating Income (i) depreciation and amortization, and (ii) any aggregate net income during such period arising from the sale, exchange or other distribution of capital assets, provided, however, that the total amount so included pursuant to this clause (ii) shall not exceed 5% of Consolidated Operating Income for such period, provided further, however, that, in calculating Consolidated Cash Flow for any such period, any acquisition or disposition of assets that shall have occurred during such period will be deemed to have occurred at the beginning of such period; provided further, however, that (x) for purposes of determining the ratio of Consolidated Funded Debt to Consolidated Cash Flow and the ratio of Consolidated Senior Funded Debt to Consolidated Cash Flow, all Off-Balance Sheet Lease Payments made during the relevant period which has been deducted in computing Consolidated Net Income shall be added back in computing Consolidated Cash Flow and (y) with respect to any Off-Balance Sheet Property which was acquired or ground-leased by any entity acting in the capacity of landlord (or in any functionally similar capacity to a landlord) under any Off-Balance Sheet Lease within the 12-month period ending on the date of determination of Consolidated Cash Flow, Consolidated Cash Flow shall include Theatre-Level EBITDA for such Off-Balance Sheet Property and shall be determined with respect to such Off-Balance Sheet Property on the basis of actual Theatre-Level EBITDA within such period and projected Theatre-Level EBITDA for the remainder of such period (with such projections being based on the average Theatre-Level EBITDA of comparable theater properties of the Borrower which were operated during the entire 12-month period). • "Consolidated Operating Income" means, for any period, Consolidated Net Income for such period plus, to the extent deducted in determining the amount thereof, (i) the aggregate amount paid, or required to be paid, in cash by the Borrower and its Subsidiaries in respect of income taxes (including deferred taxes) during such period plus (ii) Interest Expense. • "Consolidated Net Income" means for any period, the net income (or deficit) of the Borrower and its Subsidiaries for such period in question (taken as a cumulative whole) after deducting, without duplication, all operating expenses, provisions for all taxes and reserves (including reserves for deferred income taxes) and all other proper deductions, all determined in accordance with GAAP on a consolidated basis, after eliminating material inter-company items in accordance with GAAP and after deducting portions of income properly attributable to outside minority interests, if any, in Subsidiaries; provided however, that there shall be excluded (a) any income or deficit of any other Person accrued prior to the date it becomes a Subsidiary or merges into or consolidates with the Borrower or another Subsidiary, (b) the net income in excess of an amount equal to 5% of Consolidated Net Income for such period before giving effect to this clause (b) (or deficit) of any Person (other than a Subsidiary) in which the Borrower or any Subsidiary has any ownership interest, except to the extent that any such income has been actually received by the Borrower or such Subsidiary in the form of cash dividends or similar distributions, and provided that the resulting income is generated by lines of businesses substantially similar to those of the Borrower and its Subsidiaries taken as a whole during the fiscal year ended December 31, 1998, (c) any restoration to income of any contingency reserve, except to the extent that provision for such reserve was made out of income accrued during such period, (d) any deferred credit or amortization thereof from the acquisition of any properties or assets of any Person, (e) any aggregate net income (but not any aggregate net loss) during such period arising from the sale, exchange or other distribution of capital assets (such term to include all fixed assets, whether tangible or intangible, all inventory sold in conjunction with the disposition of fixed assets and all securities) to the extent the aggregate gains from such transactions exceed losses from such transactions, (f) any impact on the income statement resulting from any write-up of any assets after the Effective Date, (g) any items properly classified as extraordinary in accordance with GAAP, (h) proceeds of life insurance policies to the extent such proceeds exceed premiums paid to maintain such life insurance policies, (i) any portion of the net income of a Subsidiary which is unavailable for the payment of dividends to the Borrower or a Subsidiary, (j) any gain arising from the acquisition of any debt securities for a cost less than principal and accrued interest, (k) in the case of a successor to the Borrower by permitted consolidation or merger or transfer of assets pursuant to Section 5.12, any earnings, of such successor or transferee prior to the consolidation, merger or transfer of assets, (1) any earnings on any Investments of the Borrower or any Subsidiary except to the extent that such earnings are received by the Borrower or such Subsidiary as cash, provided that earnings which would otherwise be excluded from Consolidated Net Income pursuant to the preceding provisions of this clause (1) shall be included in Consolidated Net Income but only to the extent that such earnings are attributable to the net income of any Person (other than a Subsidiary) in which the Borrower or any Subsidiary has any ownership interest and such net income is not otherwise excluded from Consolidated Net Income by virtue of clause (b) of this definition and (m) the Restructuring and Impairment Charges for 1998.

Rev. increased 5% 3.2% increased attendance 0% increase in ticket prices 6.5% increase in concessions/ticket Rev. increased 20.4% 14.5% increased attendance 3.4% increase in ticket prices 4.2% increase in concessions/ticket 8% of increase due to increased international revenues Recent Operations(from MD&A) Country CinemaCity Screens

revenue – cost relation EBITDA .03 .26 EBIT .04 .14 • for a 1% change in revenue, b1 is the % change in cost • b1 = 1 means margins are constant • b1 < 1 means economies of scales/scope • b1 is smaller for decreasing revenue than for increasing revenue (costs are “sticky”) the margin changes by the factor (1+gtb1)/(1+gt), where gt is the rev growth rate.

What Happened? • Country Cinema (aka Carmike Cinemas) defaulted and filed for bankruptcy protection in August 2000 • City Screens is AMC Entertainment • Revenue declined rapidly as Megaplexes attracted more movie-goers and summer 2000 had no blockbusters • interest increased on additional borrowing from Revolving Credit • City Screens suffered only minor revenue decline due to increased ticket prices and international growth • Country Cinema closed 25% of its theaters, incurred $4M in professional fees plus .8M/month. Equity fell to 29 cents/share and delisted. Debt sold at 50% discount.

…and what happened to City Screens? (AMC Entertainment: AEN)

.6% change in revuene -3.8% change in EBITDA

-10% revenue -50% EBITDA

dredging the value portfolio • the financial health score (0-9). get 1 point for • profitability: NI>0, CFO>0 and DROA>0. • acctg quality: CFO>NI. • leverage: DLTdebt/ave.TA<0, D current ratio>0, No equity issuance. • efficiency: Dgross margin>0, Dasset turnover>0 low score is a sum between 0-1(3% of sample) high score is sum between 8-9 (10% of sample) source: Piotroski 2000

…and the payoff? sample is 14043 firm-years of highest 20% Bk/Mkt firms each year (i.e. value stocks) between 1976 and 1996. Returns are for 1 year, starting 5 months after fiscal year.

Credit Ratings and Default Predictions http://www.bondsonline.com Key Industrial Ratios investment grade junk

Is there information in rating changes? Investment Grade Junk Source: Dichev and Piotroski (1999). Boyz II Men - Motownphilly