Lecture 9 : Dividends & Policy

820 likes | 991 Vues

Lecture 9 : Dividends & Policy. C. L. Mattoli. Learning outcomes (Chp. 14). On successful completion of this module you should be able to: outline the dividend types and explain how dividends are paid discuss the issues surrounding dividend policy decisions. Learning outcomes (Chp. 14).

Lecture 9 : Dividends & Policy

E N D

Presentation Transcript

Lecture 9 : Dividends & Policy C. L. Mattoli (C) 2009 Red Hill Capital Corp., Delaware USA

Learning outcomes (Chp. 14) On successful completion of this module you should be able to: • outline the dividend types and explain how dividends are paid • discuss the issues surrounding dividend policy decisions (C) 2009 Red Hill Capital Corp., Delaware USA

Learning outcomes (Chp. 14) • discuss the types of dividend policy that a firm can pursue • explain the difference between cash and shares dividends • explain why share repurchases are an alternative to cash dividends. (C) 2009 Red Hill Capital Corp., Delaware USA

Intro • So, now the company is in business. • It has taken in capital and spent it on projects. • Then, the cash flow is rolling in. • What should it do with that cash flow? • Of course, some money will need to be continually invested in the company for maintenance. (C) 2009 Red Hill Capital Corp., Delaware USA

Intro • More money will need to be invested for the company to grow. • Of course, we can raise additional capital, but we should first look at that internally-generated cash flow and decide what to do with it. • We can retain some or all of these cash flows to invest in new projects or otherwise (many technology companies, for example, invest in stocks of fledgling technology companies). (C) 2009 Red Hill Capital Corp., Delaware USA

Intro • We can also distribute some cash to shareholders as cash dividends. • People like to get cash; capital gains, on paper (not realized because to realize gains you have to sell out your investment) are nice, but cash is even nicer. • However, should not the corporation be able to better invest the shareholder’s money than the shareholders themselves? (C) 2009 Red Hill Capital Corp., Delaware USA

Intro • Cannot the shareholders create their own cash flows by selling some shares and realizing the capital gains that have resulted from the corporation retaining and reinvesting its money. • The corporation can also do the same thing in a share repurchase, buying shares in the market, paying cash to those who want to sell shares, instead of paying dividends. (C) 2009 Red Hill Capital Corp., Delaware USA

Intro • Just like in the case of capital structure, there is no current comprehensive theory of dividend decisions. There are only simplified theories and some suggestions. • In this lecture, we shall take a closer look at dividends and how they can be paid, and we study what goes in the dividend payout-retention decision process. • We shall explore some of the theories and considerations that go into the dividend decision. (C) 2009 Red Hill Capital Corp., Delaware USA

Dividend Example (C) 2009 Red Hill Capital Corp., Delaware USA

The Corporate Machine Business Projects Markets Securities Markets Investors in securities Businesses Reinvestment Dividends EPS Inventory PP&E Cash Funding Securities Issued Return on Corporate Investment Cash & Physical Assets Debt Equity Debt Equity Cash (C) 2009 Red Hill Capital Corp., Delaware USA

Paying Dividends (C) 2009 Red Hill Capital Corp., Delaware USA

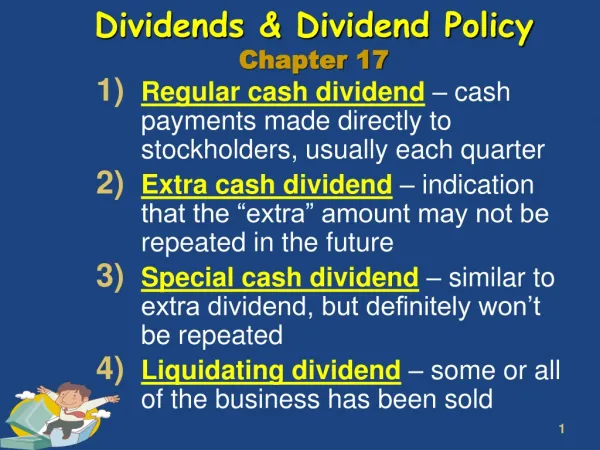

What is a Cash Dividend • First, we must deal with language issues, in talking about dividends. • A cash dividend usually refers to a cash payment by a company to its shareholders (SH) out of current after-tax earnings. • On the other hand, if a cash payment is made to SH from other than current of retained earnings, it is called a distribution or liquidating dividend. (C) 2009 Red Hill Capital Corp., Delaware USA

What is a Cash Dividend • Liquidating dividends are usually the result of liquidating some or all of a business. • Dividends can also be classified as: regular, extra, special dividends. • To SH, they are all dividends. • Typically, companies, in Australia, pay regular dividends twice a year: an interim and a final year’s dividend, approved at the company’s annual meeting after the end of a year. (C) 2009 Red Hill Capital Corp., Delaware USA

What is a Cash Dividend • In the US, for example, and some other countries, dividends are paid quarterly instead of semiannually. • Extra dividends are so named as to psychologically distinguish them as above what will be usual for dividend payments. • Special dividends are so named as to even farther distance them is SH’s minds from usual expectations. (C) 2009 Red Hill Capital Corp., Delaware USA

Declaration & Payment • The dividend decision resides in the board of directors of the company who, at a board meeting, will decide to declare a dividend. • The declaration will announce the per share payment amount and the date that the dividend will be paid to shareholders of record. • From declaration to distribution there are several steps and some technical details, as shown in the next few slides. (C) 2009 Red Hill Capital Corp., Delaware USA

Steps in cash dividends • First, the distribution of a dividend must be decided on by the board of directors and then declared. The announcement date is the date of directors’ meeting where the dividend is recommended : on this date the total amount of dividends to be paid is transferred from the retained earnings account to the dividends payable account. (C) 2009 Red Hill Capital Corp., Delaware USA

Steps in cash dividends • The record date is used to identify all shareholders on the Register of Members who are holders-of-record of shares on the proper date, so they can receive a dividend • The ex-dividend date is 4 days prior to the record date in a system where share transfer and settlement, once shares are sold in the secondary market, is 5 days. (C) 2009 Red Hill Capital Corp., Delaware USA

Steps in cash dividends • Payment date: The actual date of payment of the dividend is usually several weeks after the date of record. On the payment date, the total amount of dividends paid is debited from the dividend payable account and the cash account. • It is expected that the market price of a share will drop by approximately the declared dividend amount on the ex-dividend date. (C) 2009 Red Hill Capital Corp., Delaware USA

Stock Drop on Dividend X-date • That the price of the stock should drop on the ex-date is because it will be worth one cash flow less. • That it will drop by a number that might not exactly equal the amount of the dividend is due to taxes: what the dividend is really worth to people after tax. (C) 2009 Red Hill Capital Corp., Delaware USA

Record dates • There are a number of reasons that companies rely on record dates on which holders of record are included in corporate events. • We saw it earlier in rights and ex-rights dates. • It is also relied on for voting at shareholder meetings. (C) 2009 Red Hill Capital Corp., Delaware USA

Record dates • In all events, there is a certain date, the record date, on which the holders of record will be the ones who are included, and after that date, even if a person owns the shares, he will not be included. • First, for every type of these events, there is an announcement. In the announcement, a record date will be given. (C) 2009 Red Hill Capital Corp., Delaware USA

Record dates • Then, a person has to be on the record books of the company on that one date, in order to be eligible for whatever event is occurring. • The key to all of these events is that it takes several days between the time that shares are bought and when the new owner is recorded on the books of the company. • If there are T days for settlement, then, on T – 1 days before that record date, a buyer will not be included on the books in time to receive the benefit, whatever it is. (C) 2009 Red Hill Capital Corp., Delaware USA

Ex-dividend Date • It is Monday June 10, and the record date for a dividend is Friday June 14. • I sell my shares on Monday, on an exchange where it takes 5 business days for trades on the stock exchange to settle, i.e., the share transfer to be effected, and registration of the shares to change on the books of the corporation. (C) 2009 Red Hill Capital Corp., Delaware USA

Ex-dividend Date • Then, my name will still be in the corporate records on Friday June 14, it will only be changed on Monday June 17, and I will receive the dividend. • Based on that analysis, in order for someone to buy the stock with the right to the dividend (cum-dividend) a purchase must be made at least 5 (business) days before the dividend record date. (C) 2009 Red Hill Capital Corp., Delaware USA

Ex-dividend Date • In this case, they purchased my shares 1 day too late. They purchased from me on the ex-date, so they did not buy shares with the right to get the dividend still attached to my shares. • Had they bought shares on Friday June 7, they would have been on the record books on Friday June 14, and they would have been the one to receive the dividend. (C) 2009 Red Hill Capital Corp., Delaware USA

Cum- and ex-dividend shares • Cum-dividend shares are those that have a current entitlement to receive a dividend • Investors who own shares (and don’t sell them) before the ex-dividend day are entitled to a dividend • As we saw in the above example, if they sell shares on or after the ex- date, they will still receive that dividend check in the mail. (C) 2009 Red Hill Capital Corp., Delaware USA

Price on X • The day before an ex-date, the stock trades with a right to receive a dividend. • The next day it will no longer contain that right. • Thus, the price should drop from one day to the next to reflect the loss of value of the dividend. • So, if the stock was $50 on the day before ex-D, and D = $2, then, the price on the ex-date should be around $2 less, or $48. (C) 2009 Red Hill Capital Corp., Delaware USA

Dividend Policy (C) 2009 Red Hill Capital Corp., Delaware USA

Intro • As an investor, we look for future cash for present outlay of funds. • Cash dividends are one thing that we can get as SH’s. • Dividend policy is, then, really the decision to pay out cash from earnings, now, or reinvest and pay out cash later. • Arguments can be made on both sides, depending on assumptions. (C) 2009 Red Hill Capital Corp., Delaware USA

Irrelevance • MM showed that, under a number of specific assumptions, dividend policy affects neither the price of a firm’s shares nor a firm’s cost of capital, i.e. dividend policy is irrelevant. • It is based on the assumptions that: • If there are no taxes, then, shareholders will be focused on total return: capital gains plus dividend yield (C) 2009 Red Hill Capital Corp., Delaware USA

Irrelevance • A dividend decision is separable from an investment decision, which it really is not, since a company has a choice of paying out a cash dividend and letting investors invest that cash as they like or making a higher return for the investors by retaining earnings and investing in high return projects, whose return is higher than the investor could achieve on her own. • capital markets are perfect (i.e., no taxes, transaction costs and free and complete information) (C) 2009 Red Hill Capital Corp., Delaware USA

Homemade dividends • Assume either no taxes or taxes that are the same for both capital gains and dividends. • Assume that there are no transaction costs for buying or selling shares. • Then, SHcan make their own ‘dividends’ by selling shares (alternative means of cash inflow for investors). • They can neutralize dividendsby purchasingmore shares if dividends are paid by the company (C) 2009 Red Hill Capital Corp., Delaware USA

Homemade dividends • Irrelevance relies on the basic premise that the market value of a firm • depends on the PV of future cash flows from its assets • which in turn depends on investment decisions not on dividend decisions. • Both investors and managers have the same information regarding future investment opportunities (C) 2009 Red Hill Capital Corp., Delaware USA

Example: Irrelevant Firm has an annualFCF (free cash flow) of $150 million. • Free cash flow is after investment. • Shares outstanding are 110 million. • If the growth rate of FCF is 10% per year, and the required rate of return (RRR) is 15% what is the value of the firm? (C) 2009 Red Hill Capital Corp., Delaware USA

Example: Irrelevant Look at 3 cases: • Case 1(100% payout) - it pays a dividend of $150 million today: all FCF • Case 2 (New issue + high dividend) - issues $50m of shares and pays dividend of $200m: more than actual FCF • Case 3 (Total retention)- pays no dividend: retains all (C) 2009 Red Hill Capital Corp., Delaware USA

case 1 – moderate dividends The value represented by a share of stock is the discounted Future CF value Plus the value of the dividend paid now (at present) (C) 2009 Red Hill Capital Corp., Delaware USA

case 2 – high dividends However, since it is issuing new shares, and the market value of the Firm has not really changed since there has been no event to cause revaluation in the market, the original shareholders will have a total value of $3.3 billion – $50 million, so that (C) 2009 Red Hill Capital Corp., Delaware USA

case 3 – no dividends Since this year’s (present) FCF has been retained, it is part of the PV of the firm. Value of a share is DFCF of the company plus the additional right-now FCF. (C) 2009 Red Hill Capital Corp., Delaware USA

Conclusion • In all three cases, payout of all FCF, payout of more than FCF or no payout at all we get the same value of the firm. • Note: in each case we consider the PV of cash flows as the value of a share. (C) 2009 Red Hill Capital Corp., Delaware USA

Conclusion • Those values, in each case, are the sum of future year cash flows, as given in the CG model plus the current year’s cash flow, which, in two cases, is a cash dividend and, in the last case, just FCF. • Thus, the conclusion is that dividends don’t matter, at least under the non-realistic conditions that underpin the MM theory. (C) 2009 Red Hill Capital Corp., Delaware USA

In the Real World • Reasons that dividends might be relevant are usually based on things like: • Tax differentials: div. vs. cap. gain • Psychology: money is nice • Agency costs: disclosure • Information: news • We shall look at the effects in categories. (C) 2009 Red Hill Capital Corp., Delaware USA

Low Dividends. • In classical tax systems, there is usually a lower tax on capital gains than on income. • In the imputation system, that is not true for domestic SH but is still true for foreign SH’s. • In both systems, long term (more than a year of holding) cap gains tax is smaller than short term. (C) 2009 Red Hill Capital Corp., Delaware USA

Low Dividends. • In addition, taxes on cap gains only have to be paid when the shares are sold, while taxes on dividends must be paid once a year, franked or not. • Next, are issuance costs, which are quite high, to issue shares to grow instead of retaining earnings for growth. • Finally, there might be restrictive laws or covenants in debt. (C) 2009 Red Hill Capital Corp., Delaware USA

High Dividends • It is psychologically more reassuring to get cash than to wait for capital gains to materialize and be realized through sale (uncertainty resolution). • Some people, like retirees or trust funds either do not want to or cannot touch their principal investments, so rely on income. • Corporations get dividends from other corporations tax free. • Other investors are also tax exempt. (C) 2009 Red Hill Capital Corp., Delaware USA

Market value of franked dividends We can set out to determine the market value of dividends by comparing the capital loss, the price decline of the stock, on the dividend ex date. Thus, the day before the ex-date, the share price included a dividend, after the ex-date the dividend is paid in cash, and the share value will reflect that loss. But how much should it be? • The capital loss is measured by the dividend drop-off ratio, which is the capital loss on ex-date divided by the dividend. (C) 2009 Red Hill Capital Corp., Delaware USA

Market value of franked dividends • dividend drop-off ratio compares the decline in the share price on the ex-dividend day to the cash dividend • depends on the company tax rate and • a typical shareholder’s marginal tax rates on dividend income and capital gains • Let us look at the basic math of the situation……… (C) 2009 Red Hill Capital Corp., Delaware USA

Alternative cash flows • If an investor bought shares at price P(p), and he sells them on the day before the ex-dividend date, his after-tax cash flow is: CF(cd) = P(cd) – (P(cd) – P(p)) x T(cg) Where cd=cum dividend, and T(cg) is capital gains tax. Next, consider…………………….. (C) 2009 Red Hill Capital Corp., Delaware USA

Alternative cash flows • The same shareholder waits til the next day, after the stock is trading ex-dividend, and gets the dividend and sells the stock. Then, the cash flow after tax is: CF(xd) = P(xd) – (P(xd) – P(p)) x T(cg) + These cash flows should be the same (they are less than a day apart), so by equating the two equations to each other, we get……….. (C) 2009 Red Hill Capital Corp., Delaware USA

Dividend drop-off • Which just says that after tax CG (loss due to price drop) = (1-tg)(PCD – PXD) on ex-date should be the same as after tax dividend = D(1 – tp)/(1 – tc). • This should be true because people care about what they actually get (AT inc) (C) 2009 Red Hill Capital Corp., Delaware USA

Calculating the after-tax dividend • In general,we use the PT dividend to compute personal tax, then, we subtract off the franking tax credit (in the case of 100% franking, below). Then, we subtract personal tax due minus tax credit from franking to get AT dividend income, as: (C) 2009 Red Hill Capital Corp., Delaware USA