Optimize Your Financial Close Process

450 likes | 466 Vues

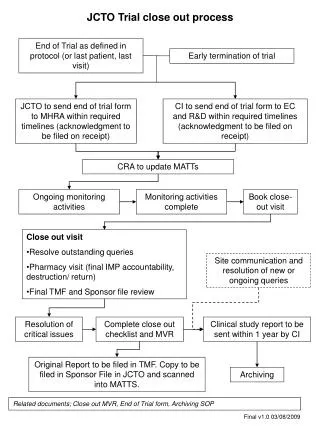

Discover the importance of financial close efficiency and the significant cost savings for world-class companies. Learn common challenges, consequences, and the solution of automating manual processes in Oracle EBS for a faster and error-free financial period close.

Optimize Your Financial Close Process

E N D

Presentation Transcript

Optimize Your Financial Close Process Grant Chen Oracle Solutions Director UC4 Software, Inc.

Importance of Financial Close “The Hackett Group’s studies show that “world-class companies spend 45 percent less” on their closing and reporting efforts than other companies, which on average saves $5.5 million per $1 billion in revenue. These savings come, in part, from needing fewer people and systems to scrub data.” • Galen Gruman, CIO • How IT Executives Can Help Speed Up Financial Reporting,CIO Magazine, March 15, 2007 • http://www.cio.com/article/print/41039

Sound Familiar? • Does your organization have execution errors, and costly recovery efforts due to human error in processing? • Do you have unreliable processing and reporting delays? • Does critical business information fail to reach management in a timely and accurate fashion, delaying key business decisions? • Do technical and functional employees spend a disproportionate amount of time “baby sitting” processes? • Are you having difficultly scaling your manual processes to support future company growth?

Agenda • Common issues • Consequences • Common (but misguided) Alternatives • Solution • Solution Success Stories

Current Business Landscape “A business process spans multiple people, departments, applications & servers. How do you provide overall visibility management & control?”

CommonChallenges • Visibility Over Entire Business Process • Lack of Control • Care & Feeding of Critical Processes • Finance Period Close • Payroll • Invoicing • Project Accounting • Sending Accurate Information to Partners • Potential Performance Bottlenecks • Business/IT Alignment

Common Challenges • Failure to Detect Errors • Delayed Error Notification • Delayed Response Between Departments • Integration of Applications • Data Corruption • Bottlenecks During Heavy Periods • Coordination of Requests Beyond Core Application • Missing Service Level agreements • Number of Steps Required to Complete Task

Oracle EBS Issues • Oracle Workflow directs users to complete tasks, not automation • Still must use Concurrent Programs (CPs) to complete job tasks • Many CPs must be handled manually • Concurrent manager is Oracle myopic • Integration still relies on user initiation and intervention

Common (but Misguided?) Alternatives • Throw more people at the problem • Customize application code • Write additional custom code(each customization costs $10k on average) • Customize Workflow • “Live with” Concurrent Manager • Stagger CP schedules around manual jobs

Consequences • Lost Revenue • Delays in customer billing • Missed supplier discounts • Misstated Financials • Increased Costs • Increased staff • Custom development and subsequent maintenance • Lack of timely and accurate data

Solution: Automation Manual:slow anderror prone Automated:faster withreduced errors

Targets for Automation in Oracle EBS • Manually submitted processes(typically non-SRS concurrent requests) • Parent/child/subchild tracking • Workload management of requests(both scheduled and ad hoc) • Integration with other applications • Output Verification and Notification • Standardized and repeatable processes

Pain Points – OEBS • Number of Operating Units • Number of Sets of Books • Strict Reporting Requirements (operations/consolidations) • Interfaces – Internal/External • Disparate Systems

What are Financial Period Close Challenges? • Pain: Sheer volume of similar manual processes with the resulting probability of errors • Company ABC example: • 5 Legal Books (Sets of Books) • 10 Operating Units • 5 Modules/OU – AP, AR, FA, INV & PO • Organization has 250 Period Close Process Flowsto Complete

Oracle Applications Period Close Process • Accounts Payable • Purchasing • Accounts Receivable • Assets • General Ledger

Accounts Payable • Run the “Payables Invoice Validation” CP. • Query for incomplete payment batches . • Run the “Update Matured Future Dated Payments Status” CP. • Resolve all unaccounted transactions submit the “Payables Accounting Process”. • Run the “Unaccounted Transactions Report” • Rerun the “Payables Accounting Process”. • Open the next A/P period.

Accounts Payable (Continued) • Run the “Unaccounted Transactions Sweep Program”. • Close the current A/P period. • Run the “Payables Transfer to General Ledger Program”. • Import and post the Payables Journal entries. • Reconcile Payables activity for the period using the following reports: • “Accounts Payable Trial Balance” report to reconcile your accounts payable liability in your general ledger. • “Posted Invoice Register” report • “Posted Payments Register” report • Run the “Mass Additions Create Program”.

Purchasing • Run the “Receipt Accrual – Period End Process” concurrent program. • Use the “Purchase Price Variance Report”. • Use the “Invoice Price Variance Report” to review the accuracy of purchase order prices. • Review the “Uninvoiced Receipts Register”. • Close the Purchasing period • Open the next Purchasing period.

Accounts Receivable • Open the next A/R period. • Run the “Revenue Recognition” process. • Run the General Ledger Interface process. • Review “Unposted Items Report” for any unposted A/R transactions. • Run the “AR Reconciliation Report” to automatically reconcile customer receipts, transactions, and account balances. • Close the current A/R period

Fixed Assets • Run depreciation for the prior period. • Process transactions (additions/retirements/movements/capitalization’s) • Run Depreciation without closing book • If changes are identified, rollback depreciation and make the needed changes are made. • Run Depreciation and close period which closes current period and opens next period. • Reconcile Asset balance to GL Asset accounts

What are the Key Benefits? • Standardization of Oracle Processes across all OU’s – Best Practices • Automation of Oracle Processes across all OU’s – Accurate & More Frequent Reporting • Reduced Process Cycle Time – Timelier Reporting • System and Process Integration • Audit Traceability • Conditional Logic Processing • Output Scanning and Notification

Solutions Only Product in our spaceValidated forOracle 11i E-Business Suite

Oracle Applications Extension (OAE) • Pre-built OEBS Solution • Shipping Since Mid-1997 • Validated by Oracle • Non-Invasive to Oracle Applications • Pre-built OEBS Features • Little to no Scripting Required • Register Oracle Applications Jobs Easily • Register Default Parameters • Pass Dynamic Parameters to Concurrent Requests • View Concurrent Request Output Files • Better Resource Utilization • UC4 Automation Solutions

Business Value$ • Provide key decision makers with relevant and timely information and set materiality levels from an enterprise-wide perspective • Improve operational and systematic efficiencyin business processing • Apply standard automated processesacross the organization • Allow resources to focus on higher valuejob functions

Customer Objectives Streamline & Automate Period Close Move to Production Results Achieved Reduced Manual Input Reduction of Input Errors Eliminate Period Close Reruns Resource Re-assignment Reduced Period Close Time from 6.5 Days to 13 hrs~ 75% Reduction Automations Performed GL Import and Post GL Open & Close AR Open & Close Purchasing Open & Close Inventory Open & Close AR - GL Transfer Monitoring MRP Child Processes Financial Statement Generator Customer Success: Sun Microsystems

Customer Objectives Streamline and Automate interfaces from Oracle E-Business Suite to Siebel CRM Replace “Home Grown” Scheduling System Results Achieved “Lights Out” Operations for CRM Interfaces Automated use of First Logic data cleansing tools Automated interfaces to Data Warehouse 14 Month ROI Automations Performed Automation of month-end close incorporating: Siebel Informatica Business Objects Oracle Financials AR Interface to GL AP Interface to GL Inventory Interface to GL Importing and Posting JEs from Sub-Ledgers Customer Success: Symantec

Customer Objectives Streamline and Automate interfaces into and out of Oracle E-Business Suite Reduce Latency and Errors Improve time to deliver orders Results Achieved Enhanced Notification “Lights Out” Operations for Interfaces Automations Performed Automation of Interfaces into and out of Oracle E-Business Suite (Orders, Shipments, Invoicing) For each operating unit in APAC (5), NA (1), and Europe (10): AR Interface to GL AP Interface to GL Inventory Interface to GL Importing and Posting Journal Entries from Sub-Ledgers Customer Success: Vivendi Universal Games

Customer Objectives Streamline and Automate Project Accounting Reduce Latency and Errors Reduce Expenses Projects to Financials Integration Results Achieved Shortened close process from 5 FTE’s over 36 hrs to 1 FTE and 6hrs - weekly Resource Reassignment Scaled from 10 OU’s to 23 w/o additional PA support staff Enhanced Notification Automations Performed Automation of Project close process for 52 week PA Periods over 19 OU’s Monitoring PRC child processes Error Notification AR Interface AP Interface GL Interface FA Interface Payroll Interface Customer Success: AECOM

Who is UC4 Software? • Creators of innovative, feature-rich, proven software for application infrastructure and IT workload automation • AMAP HQ in Bellevue, WA • Global office locations • 1600+ customers worldwide • 130+ Oracle EBS customers • Most Visionary in Market – Gartner Group • Key Partnerships: Oracle, SunGard HE, SAP, Quest, Hotsos, Solution Beacon • AppWorx Corporationis now UC4 Software