Coordinated Interaction

400 likes | 588 Vues

Coordinated Interaction. Presentation to the Competition Commission of India US Chamber of Commerce October 27, 2010. Coordinated Interaction. Definition: Firms recognize their interdependence and jointly coordinate on a less competitive outcome Implicit (no communication)

Coordinated Interaction

E N D

Presentation Transcript

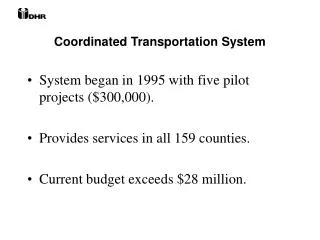

Coordinated Interaction Presentation to the Competition Commission of India US Chamber of Commerce October 27, 2010

Coordinated Interaction • Definition: Firms recognize their interdependence and jointly coordinate on a less competitive outcome • Implicit (no communication) • Explicit (communication, typically illegal in the US) • For coordination to work, for each firm, the benefits of achieving the coordinated outcome must exceed the costs

When Are the Costs to Coordination High? • If “price” and product quality have many dimensions • Agreement must be complex • Explicit communication may be necessary, which brings substantial antitrust risk • If complex pricing structures are necessary to address a complex economic environment • Structures may need to be simplified to make coordination feasible, but the firms lose substantial profits • Change in pricing structure can bring antitrust risk

When Are the Benefits to Coordination Small? • If cheating is likely to occur • Firms have disagreements over what outcome to coordinate on • Coordination feasibly can cover only a limited number of the dimensions of “price” and product quality • Cheating is hard to detect • Cheating is hard to punish • If non-participant firms can defeat an attempted price increase through supply response

Key Questions in Merger Review • Will the merger decrease the costs or increase the benefits of coordination? • If there is no coordination currently, could the merger make coordination significantly more likely? • If there is coordination currently, could the merger make coordination more stable or move the coordination to a higher price level?

Case Study #1 Would the Costs of Coordinating or the Difficulty in Detecting Cheating Prevent Coordination?

Case Study #1: Consumer Appliance Merger • Industry • There are three branded manufacturers: Companies A, B, and C • Other manufacturers make “private label” products • Manufacturers sell to retailers (at a wholesale price); retailers sell to final consumers (at a retail price) • Company A sought to acquire Company B

FTC’s Concern • With only two major branded manufacturers remaining after the merger, coordination between them would become more likely • Non-branded manufacturers would not be able to constrain a post-merger coordinated wholesale price increase by the branded manufacturers

Questions to Analyze • How difficult would it be for firms to find a mutually beneficial outcome to coordinate on? • More difficult to agree when the “dimensionality” of the coordination problem is large • More difficult to agree when the firms are relatively “asymmetric” • How easy is it for firms to cheat on any such coordinated outcome? • Easier to cheat if there are many ways to discount • Easier to cheat if discounts are unobserved

The Dimensionality of the Coordination Problem • Many (1000+) SKUs • Suggests that successful coordination would have to address 1000 different wholesale prices • But, is the effective dimensionality smaller? • Are groups of SKUs, for example those targeted at the same retail price point, effectively the same product or carry the same wholesale price? • Do customers (retailers) pay a flat wholesale price or does “price” have many dimensions? • Do SKUs’ wholesale prices move very closely together?

Products Have Different Attributes (And Thus Costs) Even Within the Same Retail Price Point

Products’ Wholesale Prices Differ Even Within the Same Retail Price Point

“Price” Has Many Dimensions and Discounts are Unobservable • Many types of discounts • On-invoice discounts • Volume rebates • “Push money” • Floor sample discounts • Point of purchase discounts • Over and above advertising discounts • Warranty allowances • Upfront money • Dealer relations • Other • Substantial differences across customers in the types and amounts of discounts received • Discounts are individually negotiated and not observable

Outcome • An agreement would be costly to achieve • Complexity of products, pricing, and price movements • Asymmetries between firms • Cheating would be hard to detect and punish • Pricing not transparent • Many ways to provide secret discounts • FTC cleared the transaction

Case Study #2 Does the Merger Eliminate, or Create, a Maverick?

Case Study #2: Arch Coal • Industry • Mines producing coal for electric utilities • Five producers (Arch, Triton, Peabody, Kennecott, and RAG) • Transaction • Arch would acquire both Triton mines, then immediately sell one to Kiewit • Still five producers after the transaction (with Kiewit replacing Triton) • Post-merger HHI of about 2100-2300 with a change of 50-225, depending on the unit of measure

FTC’s Concerns • The transactions would increase the likelihood that suppliers could coordinate to restrict output • Eliminate Triton, which was a “maverick” • Place excess capacity under the control of suppliers more likely to engage in coordination • Arch CEO had made statements that about the need for suppliers to act with restraint

Questions to Analyze • Were industry conditions conducive to coordination? • Was Triton a “maverick”? • Would Kiewit be any less of a maverick than Triton?

Pre-Merger Industry Conditions • Some industry conditions not conducive to coordination • Product not homogenous across suppliers • Suppliers’ cost structures differed • Price not transparent (sealed bidding) • Prevalence of long-term contracts • But, others were conducive • Some information on mine production available (but not current and not completely reliable) • Low elasticity of demand • Prices easily adjusted for product differences (reduces dimensionality of the coordination problem) • Barriers to entry

Pre-Merger Industry Conditions • No history of coordination and the industry was seen as competitive • Arch had previously restricted its production in times of “over-supply” (i.e., low prices) • But, competitors had not followed in this strategy Court concluded that coordination was feasible, but had not occurred historically and would not be easy

Triton • High cost mine • Sold at a high price when demand exceeded other supply from other mines • Did not bid aggressively for long-term contracts • Not undercutting as a maverick would Court found that Triton was not a maverick

Kiewit and RAG • Kiewit planned to increase production from the Triton mine • Kiewit and RAG would have the profit incentive and ability to defeat an attempted coordinated price increase by the three other suppliers Court found that Kiewit and RAG were more likely than Triton to be mavericks

Outcome • Court found that the transactions would not lead to an increase in the likelihood of coordination • Conditions not very conducive for coordination • Triton was not a maverick • Kiewit and RAG would have the incentive and ability to constrain a coordination attempt by the other three suppliers

More Detail on Analyzing the Competitive Significance of a Potential Maverick • Auction/Bid data • Do the merging parties’ bid more aggressively when the maverick is also bidding? • When the maverick bids, do the merging parties frequently lose the bid? • Price announcements • Does the maverick fail to follow other rivals’ price change announcements? • Does the failure to follow result in an increase in the maverick’s volume of sales? • Costs • Does the maverick have a lower cost structure compared to rivals? • Does the maverick’s costs depend on different inputs than rivals’ costs?

Maverick Takes Sales from Rivals When Rivals’ Prices Increase

16 16 14 14 12 12 10 10 Price Price 8 8 6 6 4 4 2 2 0 0 0 2 4 6 8 10 12 14 0 2 4 6 8 10 12 14 Months Months 16 14 12 10 Price 8 6 4 2 0 0 2 4 6 8 10 12 14 Months Announced Actual Rivals’ Price Increases Rolled Back When the Maverick Does Not Go Along

Maverick Would Have the Incentive and Ability to Defeat Coordination • Excess Capacity • Is the maverick’s excess capacity sufficient to replace the reduction in volume by the hypothetical cartel post-transaction? • Would it be profitable for the maverick to expand production by at least that amount? • Has the maverick utilized excess capacity in response to a reduction in supply by rivals in the past? • E.g., cost increase limited to other rivals, unexpected shortfall in rival’s production (e.g., plant outage, natural disaster)

Maverick’s Excess Capacity Is Sufficient to Replace Industry-wide Output Reduction

Case Study #3 Does the Merger Change the Industry Structure to Make Coordination More Likely?

Case Study #3: Premdor-Masonite • Industries • Upstream: “Doorskins,” a key input to the manufacturing of doors • Downstream: Doors • Transaction • Premdor, primarily a downstream door producer, sought to acquire Masonite, an upstream doorskin producer

Structure of the Industries: Pre-Merger VI VI Masonite Doorskins JV Doors Premdor Small Producers Retailers, Distributors

Structure of the Industries: Post-Merger Premdor Premdor VI VI Doorskins Doors Small Producers Retailers, Distributors

FTC Thought Pre-Merger Conditions Prevented Coordination • Upstream coordination between Masonite and VI prevented by Premdor threatening to further vertically integrate backward into doorskins (by expanding the JV) • Downstream coordination between Premdor and VI prevented by Masonite expanding supply to other door manufacturers • Both downstream and upstream coordination prevented by VI having a different cost structure than Masonite and Premdor • Premdor does not have information about upstream conditions and Masonite does not have information about downwtream conditions, making it hard to detect and punish cheating by VI

FTC Was Concerned That the Merger Could Change These Conditions • The combined Premdor/Masonite would be vertically integrated • No firm remains at either level with the incentive and ability to prevent coordination between Premdor/Masonite and VI • Premdor/Masonite would have a cost structure similar to that of VI • Premdor/Masonite would have more complete information about production and pricing

Outcome • FTC obtained a consent decree, under which the merged firm divested one of Masonite’s two plants • Preserved a strong non-vertically integrated firm at the upstream level • This firm could also frustrate coordination at the downstream level by increasing supply to the smaller door producers