Binomial Models

1.13k likes | 1.66k Vues

Binomial Models. Dr. San-Lin Chung Department of Finance National Taiwan University. In this lecture, I will cover the following topics: 1. Brief Review of Binomial Model 2. Extensions of the binomial models in the literature 3. Fast and accurate binomial option models

Binomial Models

E N D

Presentation Transcript

Binomial Models Dr. San-Lin Chung Department of Finance National Taiwan University

In this lecture, I will cover the following topics: 1. Brief Review of Binomial Model 2. Extensions of the binomial models in the literature 3. Fast and accurate binomial option models 4. Binomial models for pricing exotic options 5. Binomial models for other distributions or processes

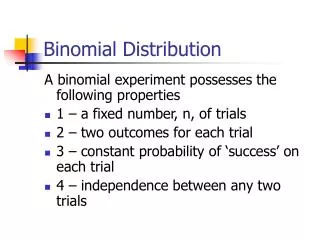

1. Brief Review of Binomial Trees • Binomial trees are frequently used to approximate the movements in the price of a stock or other asset • In each small interval of time the stock price is assumed to move up by a proportional amount u or to move down by a proportional amount d

The main idea of binomial option pricing theory is pricing by arbitrage. If one can formulate a portfolio to replicate the payoff of an option, then the option price should equal to the price of the replicating portfolio if the market has no arbitrage opportunity.Binomial model is a complete market model, i.e. options can be replicated using stock and risk-free bond (two states next period, two assets).On the other hand, trinomial model is not a complete market model.

Generalization (Figure 10.2, page 202) • A derivative lasts for time T and is dependent on a stock S0 u ƒu S0 ƒ S0d ƒd

Generalization(continued) • Consider the portfolio that is long D shares and short 1 derivative • The portfolio is riskless when S0uD – ƒu = S0dD – ƒd or S0 uD – ƒu S0– f S0dD – ƒd

Generalization(continued) • Value of the portfolio at time Tis S0uD – ƒu • Value of the portfolio today is (S0uD – ƒu )e–rT • Another expression for the portfolio value today is S0D – f • Hence ƒ = S0D – (S0uD – ƒu)e–rT

Generalization(continued) • Substituting for D we obtain ƒ = [ p ƒu + (1 – p )ƒd ]e–rT where

Risk-Neutral Valuation • ƒ = [ p ƒu + (1 – p )ƒd ]e-rT • The variables p and (1– p ) can be interpreted as the risk-neutral probabilities of up and down movements • The value of a derivative is its expected payoff in a risk-neutral world discounted at the risk-free rate S0u ƒu p S0 ƒ S0d ƒd (1– p )

Irrelevance of Stock’s Expected Return When we are valuing an option in terms of the underlying stock the expected return on the stock is irrelevant

Movements in Time dt(Figure 18.1) Su p S 1 – p Sd

Tree Parameters for aNondividend Paying Stock • We choose the tree parameters p, u, and d so that the tree gives correct values for the mean & standard deviation of the stock price changes in a risk-neutral world erdt= pu + (1– p )d s2dt = pu2 + (1– p )d 2 – [pu + (1– p )d ]2 • A further condition often imposed is u = 1/ d

2. Tree Parameters for aNondividend Paying Stock(Equations 18.4 to 18.7) When dt is small, a solution to the equations is

The Complete Tree(Figure 18.2) S0u4 S0u3 S0u2 S0u2 S0u S0u S0 S0 S0 S0d S0d S0d2 S0d2 S0d3 S0d4

Backwards Induction • We know the value of the option at the final nodes • We work back through the tree using risk-neutral valuation to calculate the value of the option at each node, testing for early exercise when appropriate

Example: Put Option S0= 50; X = 50; r =10%; s = 40%; T = 5 months = 0.4167; dt = 1 month = 0.0833 The parameters imply u = 1.1224; d = 0.8909; a = 1.0084; p = 0.5076

Trees and Dividend Yields • When a stock price pays continuous dividends at rate q we construct the tree in the same way but set a = e(r – q )dt • As with Black-Scholes: • For options on stock indices,qequals the dividend yield on the index • For options on a foreign currency, qequals the foreign risk-free rate • For options on futures contracts q = r

Binomial Tree for Dividend Paying Stock • Procedure: • Draw the tree for the stock price less the present value of the dividends • Create a new tree by adding the present value of the dividends at each node • This ensures that the tree recombines and makes assumptions similar to those when the Black-Scholes model is used

II. Literature Review (1/5) There have been many extensions of the CRR model. The extensions can be classified into five directions. The first direction consists in modifying the lattice to improve the accuracy and computational efficiency. Boyle (1988) Breen (1991) Broadie and Detemple (1996) Figlewski and Gao (1999) Heston and Zhou (2000)

II. Literature Review (2/5) The second branch of the binomial OPM literature has incorporated multiple random assets. Boyle (1988) Boyle, Evnine, and Gibbs (1989) Madan, Milne, and Shefrin (1989) He (1990) Ho, Stapleton, and Subrahmanyam (1995) Chen, Chung, and Yang (2002)

II. Literature Review (3/5) The third direction of extensions consists in showing the convergence property of the binomial OPM. Cox, Ross, and Rubinstein (1979) Amin and Khanna (1994) He (1990) Nelson and Ramaswamy (1990)

II. Literature Review (4/5) The fourth direction of the literature generalizes the binomial model to price options under stochastic volatility and/or stochastic interest rates. Stochastic interest rate: Black, Derman, and Toy (1990), Nelson and Ramaswamy (1990), Hull and White (1994), and others. Stochastic volatility: Amin (1991) and Ho, Stapleton, and Subrahmanyam (1995) Ritchken and Trevor (1999)

II. Literature Review (5/5) The fifth extension of the CRR model focus on adjusting the standard multiplicative-binomial model to price exotic options, especially path-dependent options. Asian options: Hull and White (1993) and Dai and Lyuu (2002). Barrier options: Boyle and Lau(1994), Ritchken (1995), Boyle and Tian (1999), and others.

3. Alternative Binomial Tree3.1 Jarrow and Rudd (1982) Instead of setting u = 1/d we can set each of the 2 probabilities to 0.5 and

Su pu pm S S pd Sd 3.2 Trinomial Tree (Page 409)

3.3 Adaptive Mesh Model • This is a way of grafting a high resolution tree on to a low resolution tree • We need high resolution in the region of the tree close to the strike price and option maturity

3.4 BBS and BBSR The Binomial Black & Scholes (BBS) method is proposed by Broadie and Detemple (1996). The BBS method is identical to the CRR method, except that at the time step just before option maturity the Black and Scholes formula replaces at all the nodes.

3.5 Tian (1999)(1/3) The second method was put forward by Tian(1999) termed “flexible binomial model”. To construct the so-called flexible binomial model, the following specification is proposed: where λ is an arbitrary constant, called the “tilt parameter”. It is an extra degree of freedom over the standard binomial model. In order to have “nonnegative probability”, the tilt parameter must satisfy the inequality (8) after jumps, u and d, are redefined.

3.6 Heston and Zhou (2000) Heston and Zhou (2000) show that the accuracy or rate of convergence of binomial method depend, crucially on the smoothness of the payoff function. They have given an approach that is to smooth the payoff function. Intuitively, if the payoff function at singular points can be smoothing, the binomial recursion might be more accurate. Hence they let G(x) be the smoothed one; where g(x) is the actual payoff function.

3.8 WAND (2002, JFM) WAND (2002) showed that the binomial option pricing errors are related to the node positioning and they defined a ratio for node positioning.

3.8 WAND (2002, JFM) The relationship between the errors and node positioning.

3.9 GCRR model Theorem 1.In the GCRR model, the three parameters are as follows: where is a stretch parameter which determines the shape of the binomial tree. Moreover, when , i.e., the number of time steps n grows to infinity, the GCRR binomial prices will converge to the Black-Scholes formulae for European options. • Obviously the CRR model is a special case of our GCRR model when . • We can easily allocate the strike price at one of the final nodes.

3.9 GCRR model Various Types of GCRR models:

4. Binomial models for exotic options Topics: 1. Path dependent options using trees • Lookback options • Barrier options 2. Options where there are two stochastic variables (exchange option, maximum option, etc.)

Path Dependence: The Traditional View • Backwards induction works well for American options. It cannot be used for path-dependent options • Monte Carlo simulation works well for path-dependent options; it cannot be used for American options

Extension of Backwards Induction • Backwards induction can be used for some path-dependent options • We will first illustrate the methodology using lookback options and then show how it can be used for Asian options

Lookback Example (Page 462) • Consider an American lookback put on a stock where S = 50, s = 40%, r = 10%, dt = 1 month & the life of the option is 3 months • Payoff is Smax-ST • We can value the deal by considering all possible values of the maximum stock price at each node (This example is presented to illustrate the methodology. A more efficient ways of handling American lookbacks is in Section 20.6.)

70.70 70.70 0.00 62.99 62.99 56.12 56.12 3.36 62.99 56.12 6.87 0.00 56.12 50.00 50.00 5.47 4.68 56.12 50.00 44.55 44.55 6.12 2.66 56.12 50.00 50.00 11.57 5.45 36.69 6.38 50.00 35.36 10.31 50.00 14.64 Example: An American Lookback Put Option (Figure 20.2, page 463) S0 = 50, s = 40%, r = 10%, dt = 1 month, A

Why the Approach Works This approach works for lookback options because • The payoff depends on just 1 function of the path followed by the stock price. (We will refer to this as a “path function”) • The value of the path function at a node can be calculated from the stock price at the node & from the value of the function at the immediately preceding node • The number of different values of the path function at a node does not grow too fast as we increase the number of time steps on the tree

Extensions of the Approach • The approach can be extended so that there are no limits on the number of alternative values of the path function at a node • The basic idea is that it is not necessary to consider every possible value of the path function • It is sufficient to consider a relatively small number of representative values of the function at each node

Working Forward • First work forwards through the tree calculating the max and min values of the “path function” at each node • Next choose representative values of the path function that span the range between the min and the max • Simplest approach: choose the min, the max, and N equally spaced values between the min and max

Backwards Induction • We work backwards through the tree in the usual way carrying out calculations for each of the alternative values of the path function that are considered at a node • When we require the value of the derivative at a node for a value of the path function that is not explicitly considered at that node, we use linear or quadratic interpolation

S = 54.68 Y Average S 47.99 51.12 54.26 57.39 Option Price 7.575 8.101 8.635 9.178 S = 50.00 Average S 46.65 49.04 51.44 53.83 Option Price 5.642 5.923 6.206 6.492 X S = 45.72 Average S 43.88 46.75 49.61 52.48 Option Price 3.430 3.750 4.079 4.416 Z Part of Tree to Calculate Value of an Option on the Arithmetic Average 0.5056 0.4944 S=50, X=50, s=40%, r=10%, T=1yr, dt=0.05yr. We are at time 4dt