Draft QIPP

170 likes | 503 Vues

Draft QIPP. RECOVERY PLAN – Month 4. Craig Alexander - Deputy Director - QIPP. Summary of current position (as at Month 4)

Draft QIPP

E N D

Presentation Transcript

Draft QIPP RECOVERY PLAN – Month 4 Craig Alexander - Deputy Director - QIPP

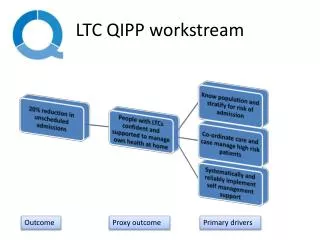

Summary of current position (as at Month 4) Brent CCG QIPP programme position as at month 4 has a negative YTD variance of £207k with a negative forecast outturn variance of £837k (based on PBR metrics). This variance is largely due to the underperformance of the UUC scheme at Northwick Park Hospital due to the over performance of NEL activity year to date. Therefore particular focus has been made in this recover to gaining understanding of this over activity and putting in place measures to bring this back in line with the plan. The following slides detail these underperforming ‘Red’ rated schemes around risk and mitigating actions in place. How we will tackle underperforming projects ‘Red’ rated schemes have, up to Month 4, used the same reporting measures as performing schemes due to the recognised lack of detail when reporting activity shifts for the first quarter or a scheme. This was also done to focus efforts on implementation of complex initiatives. As at Month 4 ‘Red’ rated schemes have moved to a fortnightly reporting style with CRO/SRO of the ‘at risk’ projects reporting to QIPP Sub-Committee on risks and actions. Fortnightly reports remain in place until performance is brought back in line with the plan. How we will change the focus We will be bringing focus back to QIPP performance on a fortnightly basis rather than monthly and project leads will not only be required to work to reduce and remove risk of project performance but will also be responsible for achieving the original QIPP target either through ‘claw back’ of lost savings or introduction of new savings opportunities. The leads will be supported by the sub-committee as well as the QIPP deputy director and project manager in indentifying and implementing new schemes.

Recovery Plan – High-Level Actions Outpatient Activity: Referral Management – As at Month 4 there is an outpatient referral over performance of 3.4% against target. The referral management project has a QIPP target of £1.7m for 12/13 based on a 7.5% reduction against target. To ensure this project is successful we will be introducing monthly review meetings with clinical director, referral champions and borough representation to review performance by locality, share best practice and support actions to ensure targets are met. This monthly review is set to start week commencing 17th September 2012. In addition all outstanding clinical pathways will be signed off and live from the 1st October 2012 which will be a major enabler in the change of GP referral practices. NEL Activity: Urgent Care Workshop - The urgent care review is looking into all aspects of urgent care services to identify trends in activity and areas that require intervention or change to support effective service delivery. A&E attendances and non Elective activity are increasing despite a number of services that are working with high risk patients. In addition, patients still have length of stays in hospital that could be reduced through supported Community services and discharge. This review covers primary, community, intermediate, and acute services, linking in with Brent Social Services to ensure a joint approach is taken across the Borough. The results of the review will be presented to a workshop scheduled for the 25th of September that will bring together the key clinicians, commissioners, and contract managers delivering the current services. The aims of the workshop are tackling issues and delivering solutions to key areas, and to nominate a distinct working group to progress these forward to solid commissioning intentions. We are also reviewing Harrow's recovery plan and looking at ways we can work collaboratively to effect change as fast as possible. The outcomes of their findings will feature heavily in the discussions at the urgent care workshop.

Recovery Plan – High-Level Actions (cont.) Investment in Primary Care capacity – As part of Brent CCG’s investment in primary care a proposed £2.3m investment in primary care capacity is being developed. As part of this investment designed around extending hours and GP access we would align a QIPP saving to a reduction in NEL activity targeting ‘type 5’ activity. The specifics as to the targeted reductions are work in progress with a targeted date of 24th October for CCG Executive discussions. Integrated Care Pilot - The ICP is set to make a net savings target for 2012/13 of £700k starting in October which we will be measuring closely and working with Cluster colleagues to ensure delivery is achieved. Outpatients Procurement project – Project savings of £92k had original assumptions of a 15% reduction of tariff. Current assumptions based on final proposals are above 30% reduction giving an additional savings for Q4 2012/13 of £100k High Risk Projects – The Elective Procedures and ‘Pre-Op Assessment schemes are high risk projects due to shift of activity required for viable shift of setting to community for Elective Procedures and the clinical governance linked to ‘pre-op assessment’. These schemes have a combined net savings target of £154k. In order to early identify risk to delivery we will be adding these to the recovery plan total. Recovery Plan – We will be setting a recovery plan target of £1m to achieve the 12/13 target which will be split to locality level by budget size. The draft recovery plan will be agreed at the CCG executive on 26 September, plans at locality level will be developed and signed off at the CCG Executive on the 24th October. These locality recovery plans will be monitored individually as part of the QIPP sub-committee with schemes added and monitored using the QIPP reporting mechanisms. Locality QIPP recovery plans can also be linked to the clinical commissioning incentive scheme to support change in clinical behaviour and peer review.

At the CCG Executive on the 26th September a QIPP recovery plan was presented with the objectives of agreeing current position of the programme, key risks and recovery actions. To that end the Executive agreed the following actions: Given the pressure of the ‘referral standardisation’ project meeting its target in light of current overactivity of outpatient referrals the Executive agreed that a ‘plan b’ should be prepared in the event the current schemes do not provide the desired results. The target for ‘referral’ standardisation’ is £1.7m which is accepted as a challenging target. Given this challenging target a review of the effectiveness of each localities was agreed to take place in December 2012 which would provide sufficient time for accurate data to be used to measure the success of each localities schemes. The ‘plan b’ which is being prepared for a January 12 start is based on a single referral management centre/system, the details of which are to be worked up. This system would be ready to go live in January 2013 following a decision from each locality to make the decision to switch from their existing initiative. Where localities wish to continue with their locality based initiative agreement would be subject to assurance that the QIPP saving can be made. The second key action was made around the overactivity of urgent care across Brent. The key QIPP scheme being impacted by the overactivity is the UCC scheme at Northwick Park Hospital however the QIPP Committee and the CCG Executive are mindful that the success of Brent CCG is based on more than the effectiveness of its QIPP programme. To that end the CCG executive agreed seeking additional support for developing and implementing an urgent care recovery plan. This resource will potentially come from the intensive support team in the light of needing to develop a whole system approach. This plan will be worked up collaboratively with expert input from NWL hospital trust. We have already made significant progress following the Urgent Care workshop described in the following slides. The workshop identified and developed recovery initiatives which will be the basis of the recovery plan. The CCG Executive have asked for the recovery plan to be presented by the 31st October. The final action agreed by the CCG was as mentioned above to set locality level recovery plans. For the 24th October each locality has agreed to set and present a recovery plan to the value of £200k NET to impact 2012/13 QIPP. This will give a combined target of £1m for 2012/13 which will sufficiently cover the M4 FOT shortfall and give a contingency for any further in year shortfall. The key requirements of the locality plans are: To recover QIPP plans based on avoided admissions and outpatients activity; To identify any new opportunities for QIPP savings; To support/implement urgent care recovery plan including a proposal to divert from the Urgent Care Centre at NWP to primary care Recovery Plan – Agreed next steps from CCG Executive (26th September) 5

Urgent Care Review - Progress and Actions • The urgent care review is looking into all aspects of urgent care services to identify trends in activity and • areas that require intervention or change to support effective service delivery. A&E attendances and non • Elective activity are increasing despite a number of services that are working with high risk patients. In • addition, patients still have length of stays in hospital that could be reduced through supported Community • services and discharge. • This review covers primary, community, intermediate, and acute services, linking in with Brent Social • Services to ensure a joint approach is taken across the Borough. The results of the review will be • presented to a workshop scheduled for the 25th of September that will bring together the key clinicians, • commissioners, and contract managers delivering the current services. The aims of the workshop are • tackling issues and delivering solutions to key areas, and to nominate a distinct working group to • progress these forward to solid commissioning intentions. • There are significant numbers of data sets being reviewed as part of this project; these include: • A&E attendance – reason for attendance, time of attendance, top 10 reasons for A&E attendance across all providers. • Non-elective activity – activity type, time of presentation to A&E, top 10 types across all providers • Over performance of providers, identifying the providers and then the high use population, both geographically and by type of attendance • Urgent Care Activity – time of attendance, reason for attendance, %of A&E referrals. • STARRS service – number of referrals, source of referrals, identifying low and high use practices, time of referrals, previous A&E attendance prior to referrals.

Case management – time of referral, reason for referral • Brent social services - number of section 2 requests that are progressed successfully • Total costs of all services and broken down by service and then averaged cost per patient for efficiency measures. • Whole patient journeys – joint working with Brent Social Services to identify every intervention in particular cases, reviewing costs and appropriateness. • GP Risk analysis – examples of the number of patients identified through a local risk analysis and the cross reference with the number of A&E attendances by type. • GP Out of Hours – peak time of activity, type of activity, localities or practices with high activity. • Where possible data has been collected for years 10/11 & 11/12 and up to month 4 of 12/13. A&E • analysis broken down by GP practice and locality has already been collected and this is also being used as part of this project. This will identify key GP practices that may require additional support in supporting patients with urgent care needs. • Data is being analysed for trends geographically, by service type, by cost, by time of day and by the trend of high use activity. It is also been looked at through a system approach rather than an individual service approach. This will deliver the key areas on which to focus the workshop groups and ensure that each group is tackling a live and current issue, identified through current data analysis. • A key part of this workshop is “myth busting”, ensuring that the attendees are dealing with the real issues that are present within the system. In order to do so, the data is backed up with interviews from a range of professionals working within the urgent care system.

Interviews with all management and clinical leads for all delivery areas and commissioning and contract managers have been held, these accounts reflected on their views of their service, staff performance, overall concerns and issues throughout the system. • Individual interviews were held with: • GP commissioners • General Manager of Adult Services for Community Services • General Manager of Children’s Services for Community Services • Head of District Nursing - Case Management • GP lead for Older people services At Willesden • STARRS service lead • STARRS contract managers • Urgent Care Centres • North West London Hospitals • The interviews have obviously given a subjective account of one individual’s perception but they do service to support the data findings and generate initial ideas for improvements to be taken to the workshop.

All this information will be presented as challenges to the attendees of the workshop. The attendees will have local experience from service delivery, public health, contract management and • commissioning as well as expertise from the Kings Fund and the Emergency Care Intensive Support Team, to deliver solutions to the challenges. It is a working day that will deliver tangible solutions that will be developed into options appraisals and eventually commissioning intentions for 13/14. • The workshop and the resulting commissioning intentions will be focused on the key objectives of: • A system approach to urgent care with a clear pathway for patients • Increased use of Urgent Care Centres and reduced A&E activity • Increased early identification of “high risk” (to be defined) patients in primary care and subsequent management. • Focus group to develop commissioning intentions and service delivery functions for community and intermediate services. • Work streams to reduce non-elective activity • Cohesive working with 111 and the use of Telehealth in the support of services. • The workshop also opens to opportunities for increased joint working with Harrow PCT/CCG, particularly in the following areas: • Approach taken to A&E activity workstreams • GP risk analysis tools and subsequent management • Commissioning community and intermediate care services

Summary of the position of red rated projects and mitigating actions • BR039 – Urgent Care centre Expansion – NwP Hospital (Urgent Care) • Current Issues: • Currently the UCC has over achieved the 11/12 baseline by seeing 20% more activity but is under achieving against the 12/13 extended plan by 9%. • Zero savings have been attributed to QIPP due to a £341k overspend in NwP A&E and UCC. • Financial impact is £168k. • Actions: • A ‘deep dive’ review of A&E activity in underway. This will include analysis of activity input ‘hotspots’. Following an understanding of where the influx of activity is coming from an action plan will be set with progress reports coming to QIPP Committee and Urgent Care Committee – End of Sept 2012 • Having a stakeholders event including invitation to providers reviewing the above at 25th September 2012 • Project Risks & Mitigating Actions: • None

Summary of the position of red rated projects and mitigating actions • BR007 – Community Case Management to reduce NEL Admissions (Urgent Care) • Current Issues: • Project Manager has now been appointed and commenced work in August 2012. • Staggered Case Management rollout to all Brent localities concluded at the end of April with plans to achieve the full year target by 31st March 2013. • Actions: • Weekly meetings being held with provider to ensure continued engagement • The District Nursing productivity rate is being monitored (70% patient facing time); this is currently being achieved and is ongoing • Teams to be monitored against the target number of referrals – 30 Sept 2012 • Meeting with EHT Director of Information to agree roll out of IT Solution and piloting of options – Pilot has been undergoing in August and review will be taking by end of Sept 2012

Summary of the position of red rated projects and mitigating actions BR2.5 – Pre-Op Assessments done at the GP Practice (Planned Care) Current Issues: Scheme was originally planned as a joint pilot with Harrow. This has not been possible therefore alternative options are currently being reviewed. Decision on next steps to be made 26th September. Actions: Recommendation of how to progress to be made end of September. If scheme is not seen as viable the project leads will be required to plan alternative methods of achieving savings target. Project Risks & Mitigating Actions: Risk of under achievement of financial savings target.

Summary of the position of red rated projects and mitigating actions • BR5.5 – Estates Review • Current Issues: • This scheme has not yet started due to the utilisation of current vacant space not being achieved as per the planned phasing. Saving is linked to under utilised clinical space within key PCT sites being reviewed and reallocated inline with the ‘outpatient procurement’ project. Phasing should have been set for last quarter of 12/13. Current phasing is split across the whole of 2012/13 • Actions: • Business case for utilisation review funding approved. Utilisation review planned for start in September in line with outpatient project wave 1 beginning in January 2013. • Project Risks & Mitigating Actions: • Risk of under achievement of financial savings target.

Summary of the position of red rated projects and mitigating actions • BR5.7 – Pathology Tender • Current Issues: • There was a one month delay in signing the contract to begin this project means the project will be slightly under plan due to the planned phasing with a financial impact of £84k. • Actions: • The full year effect will be achieved in 2013/14, delivering eleven months in 2012/13. • Alternative savings will be identified to cover the shortfall this financial year. • ACV raised contract variation; escalated to chief executive and would expect matter to be resolved by 30.09.2012. • Meeting with Rob Larkman and Jonathan wise with NWLH to discuss pathway rescheduled from 4 September to 17 September 2012. • Project Risks & Mitigating Actions: • Risk of under achievement of financial savings target.

Summary of the position of red rated projects and mitigating actions • BR5.8 – Cluster Wide Primary Care Contracting (Primary Care) • Current Issues: • Awaiting response from the Primary Care contracting team in regards to whether the planned savings would be achieved. • Actions: • Meeting with Primary Care Director cancelled on 11th September (to be rearranged). Primary Care Contracting Director to be invited to QIPP Sub-Committee meetings and expected to complete QIPP highlight reports until the scheme is on track. • Project Risks & Mitigating Actions: • Without engagement with the primary care contracting team it is impossible for Brent CCG to report on savings made through PC contracting.

Summary of the position of red rated projects and mitigating actions • BR5.17 – Acute Direct Access (Primary Care) • Direct Access project is linked to the ‘Referral Standardisation’ QIPP project which aims to reduce Direct Access activity. The Referral Standardisation project is aimed to go live across Brent in July with impact on reduced referrals being monitored from October 2012. • Current Issues: • Direct Access has activity which is £50k above plan and is therefore demonstrates no QIPP saving. • Financial impact is £51k. • Actions: • This project is part of the NWLHT Acute contract which is a block contract for 2012/13. Any over activity will be absorbed by NWLHT this year. Analysis of Direct Access activity will take place at QIPP Committee to understand the over performance of referrals year to date – End of October 2012 • Following this analysis an action plan will be set to reduce the number of referrals which will most likely be to target GP practices with the highest rate of referrals – End of November 2012 • This action plan will be taken to CCG Executive to ensure ‘buy in’ from the clinical directors. This is a quick fix to impact and reduce the referral rates to Direct Access – Early December 2012 • In the long term we should see similar impacts through the ‘referral standardisation’ project from October 2012. • Project Risks & Mitigating Actions: • This project should have been profiled to achieve savings from October 2012 however the profile is an even split for 12 months. Assuming no change to the savings profile can be made to reflect this we are likely to see no savings until the second half of 2012/13. • A second risk to this saving is the over performance from the 2012/13 baseline which the savings are predicated on.

Summary of the position of red rated projects and mitigating actions • BR5.18 – Acute High Cost Drugs (Other) • Current Issues: • Brent High Cost Drugs is currently demonstrating no QIPP savings due to SLAM showing a year to date overperformance of £155k. • NWL Cluster Threshold/ Budget 12-13 has now been agreed with ACV and NWLHT. • A meeting has taken place between NWLH and Kathryn Magson who is to agree the processes for the group that is to be set up. • Financial impact is £32k. • Actions: • This project is part of the NWLHT Acute contract which is a block contract for 2012/13. Any over activity will be absorbed by NWLHT this year. • Project Risks & Mitigating Actions: • None