Quick Check

E N D

Presentation Transcript

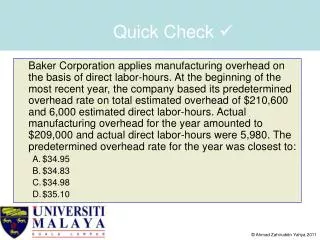

Quick Check Baker Corporation applies manufacturing overhead on the basis of direct labor-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $210,600 and 6,000 estimated direct labor-hours. Actual manufacturing overhead for the year amounted to $209,000 and actual direct labor-hours were 5,980. The predetermined overhead rate for the year was closest to: A. $34.95 B. $34.83 C. $34.98 D. $35.10

POAR = Total Budgeted OH . Total Budgeted Activity = $210,600 6,000 DLH = $35.10 per DLH

Quick Check Baker Corporation applies manufacturing overhead on the basis of direct labor-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $210,600 and 6,000 estimated direct labor-hours. Actual manufacturing overhead for the year amounted to $209,000 and actual direct labor-hours were 5,980. The predetermined overhead rate for the year was closest to: A. $34.95 B. $34.83 C. $34.98 D. $35.10

Quick Check Baker Corporation applies manufacturing overhead on the basis of direct labor-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $210,600 and 6,000 estimated direct labor-hours. Actual manufacturing overhead for the year amounted to $209,000 and actual direct labor-hours were 5,980. The applied manufacturing overhead for the year was closest to: A. $208,283 B. $209,001 C. $209,898 D. $209,180

OH applied = Actual activity x Budgeted rate (POAR) OH applied = 5,980 DLH x $35.10 OH applied = $209,898

Quick Check Baker Corporation applies manufacturing overhead on the basis of direct labor-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $210,600 and 6,000 estimated direct labor-hours. Actual manufacturing overhead for the year amounted to $209,000 and actual direct labor-hours were 5,980. The applied manufacturing overhead for the year was closest to: A. $208,283 B. $209,001 C. $209,898 D. $209,180

Quick Check Baker Corporation applies manufacturing overhead on the basis of direct labor-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $210,600 and 6,000 estimated direct labor-hours. Actual manufacturing overhead for the year amounted to $209,000 and actual direct labor-hours were 5,980. The overhead for the year was: A. $702 underapplied B. $898 underapplied C. $702 overapplied D. $898 overapplied

OH applied = $209,898 Actual OH = $209,000 Difference $898, overapplied.

Quick Check Baker Corporation applies manufacturing overhead on the basis of direct labor-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $210,600 and 6,000 estimated direct labor-hours. Actual manufacturing overhead for the year amounted to $209,000 and actual direct labor-hours were 5,980. The overhead for the year was: A. $702 underapplied B. $898 underapplied C. $702 overapplied D. $898 overapplied

Quick Check Cribb Corporation uses direct labor-hours in its predetermined overhead rate. At the beginning of the year, the estimated direct labor-hours were 17,900 hours and the total estimated manufacturing overhead was $341,890. At the end of the year, actual direct labor-hours for the year were 16,700 hours and the actual manufacturing overhead for the year was $336,890. Overhead at the end of the year was: A. $22,920 underapplied • $17,920 overapplied • $17,920 underapplied • $22,920 overapplied

POAR = $341,890 / 17,900 DLH = $19.1 per DLH OH applied = 16,700 DLH x $19.1 = $318,970 Actual OH = $336,890 So, difference = $17,920, underapplied

Quick Check Cribb Corporation uses direct labor-hours in its predetermined overhead rate. At the beginning of the year, the estimated direct labor-hours were 17,900 hours and the total estimated manufacturing overhead was $341,890. At the end of the year, actual direct labor-hours for the year were 16,700 hours and the actual manufacturing overhead for the year was $336,890. Overhead at the end of the year was: A. $22,920 underapplied • $17,920 overapplied • $17,920 underapplied • $22,920 overapplied

Quick Check The contribution margin ratio is equal to: A. Total manufacturing expenses/Sales. • (Sales - Variable expenses)/Sales. • 1 - (Gross Margin/Sales). • 1 - (Contribution Margin/Sales).

Quick Check The contribution margin ratio is equal to: A. Total manufacturing expenses/Sales. • (Sales - Variable expenses)/Sales. • 1 - (Gross Margin/Sales). • 1 - (Contribution Margin/Sales).

Quick Check Minist Company sells a single product at a selling price of $15.00 per unit. Last year, the company's sales revenue was $225,000 and its net operating income was $18,000. If fixed expenses totaled $72,000 for the year, the break-even point in unit sales was A. 15,000 B. 9,900 C. 14,100 D. 12,000

Breakeven point (BEP) = Fixed Cost Contribution Margin (CM) Contribution Margin (CM) = Selling Price – Variable Cost Contribution Margin (CM) = $15.00 – ? Workings: Net Operating Income = Sales Revenue – Variable Cost – Fixed Cost $18,000 = $225,000 – Variable Cost – $72,000 So, Variable Cost = $225,000 - $72,000 - $18,000 = $135,000 Variable Cost per unit = $135,000 / 15,000 units = $9

Breakeven point (BEP) = Fixed Cost Contribution Margin (CM) Contribution Margin (CM) = Selling Price – Variable Cost Contribution Margin (CM) = $15.00 – $9= RM6 Breakeven point (BEP) = $72,000 $6 Breakeven point (BEP) = 12,000 units

Quick Check Minist Company sells a single product at a selling price of $15.00 per unit. Last year, the company's sales revenue was $225,000 and its net operating income was $18,000. If fixed expenses totaled $72,000 for the year, the break-even point in unit sales was A. 15,000 B. 9,900 C. 14,100 D. 12,000

Quick Check Darwin, Inc., sells a particular textbook for $20. Variable expenses are $14 per book. At the current volume of 50,000 books sold per year the company is just breaking even. Given these data, the annual fixed expenses associated with the textbook total: A. $300,000 B. $1,000,000 C. $1,300,000 D. $700,000

Breakeven point (BEP) = Fixed Cost Contribution Margin (CM) 50,000 = Fixed Cost $20 - $14 Fixed Cost = 50,000 x ($20 - $14) Fixed Cost = $300,000

Quick Check Darwin, Inc., sells a particular textbook for $20. Variable expenses are $14 per book. At the current volume of 50,000 books sold per year the company is just breaking even. Given these data, the annual fixed expenses associated with the textbook total: A. $300,000 B. $1,000,000 C. $1,300,000 D. $700,000

Quick Check Frank Company manufacturers a single product that has a selling price of $20.00 per unit. Fixed expenses total $45,000 per year, and the company must sell 5,000 units to break even. If the company has a target profit of $13,500, sales in units must be: A. 6,000 B. 5,750 C. 6,500 D. 7,925

Breakeven point (BEP) = Fixed Cost Contribution Margin (CM) 5000 = $45,000 $20 – Variable Cost ($20 - Variable Cost) x 5000 = $45,000 Variable Cost = $11.00

Units to sell = Fixed Cost + Targeted Profit Contribution Margin (CM) = $45,000 + $13,500 $20 – $11 = 6,500 units

Quick Check Frank Company manufacturers a single product that has a selling price of $20.00 per unit. Fixed expenses total $45,000 per year, and the company must sell 5,000 units to break even. If the company has a target profit of $13,500, sales in units must be: A. 6,000 B. 5,750 C. 6,500 D. 7,925

Quick Check Spencer Company expects to sell 60,000 units next year. Variable production costs are $4 per unit, and variable selling costs are 10% of the selling price. Fixed expenses are $115,000 per year, and the company has set a target profit of $50,000. Based on this information, the unit selling price should be: A. $7.00 B. $10.75 C. $7.50 D. $6.75

Units to sell = Fixed Cost + Targeted Profit Contribution Margin (CM) 60,000 = $115,000 + $50,000 SP – ($4 + 0.1SP) 60,000 [SP – ($4 + 0.1SP)) = 165,000 60,000 (0.9SP - $4) = 165,000 54,000SP – 240,000 = 165,000 SP = $7.50

Quick Check Spencer Company expects to sell 60,000 units next year. Variable production costs are $4 per unit, and variable selling costs are 10% of the selling price. Fixed expenses are $115,000 per year, and the company has set a target profit of $50,000. Based on this information, the unit selling price should be: A. $7.00 B. $10.75 C. $7.50 D. $6.75

Quick Check Company X sold 25,000 units of product last year. The contribution margin per unit was $2, and fixed expenses totaled $40,000 for the year. This year fixed expenses are expected to increase to $45,000, but the contribution margin per unit will remain unchanged at $2. How many units must be sold this year to earn the same net operating income as was earned last year: A. 22,500 B. 27,500 C. 35,000 D. 2,500

Profit last year : (25,000 units x $2 CM) - $40,000 = $10,000 Units to sell = Fixed Cost + Targeted Profit Contribution Margin (CM) Units to sell = $45,000 + $10,000 $2 Units to sell = 27,500

Quick Check Company X sold 25,000 units of product last year. The contribution margin per unit was $2, and fixed expenses totaled $40,000 for the year. This year fixed expenses are expected to increase to $45,000, but the contribution margin per unit will remain unchanged at $2. How many units must be sold this year to earn the same net operating income as was earned last year: A. 22,500 B. 27,500 C. 35,000 D. 2,500

Quick Check Baker Company has a product that sells for $20 per unit. The variable expenses are $12 per unit, and fixed expenses total $30,000 per year. Required: (a). What is the total contribution margin at the break-even point? (b). What is the contribution margin ratio for the product? (c). If total sales increase by $20,000 and fixed expenses remain unchanged, by how much would net operating income be expected to increase? (d). The marketing manager wants to increase advertising by $6,000 per year. How many additional units would have to be sold to increase overall net operating income by $2,000?