Your Comprehensive Guide to Retirement Steps, Health Insurance, and Medicare Eligibility

340 likes | 455 Vues

Planning for retirement involves several key steps, including estimating your retirement income, understanding health insurance options, and meeting with Human Resources to finalize your plans. Inform your supervisor at least 3-6 months in advance, and file your Retirement Application 30 to 90 days before your retirement date. Explore your options for retirement distribution through ORP, ERS, and TRS, and ensure you're educated about health insurance eligibility and Medicare enrollment requirements. Stay informed for a seamless transition into retirement.

Your Comprehensive Guide to Retirement Steps, Health Insurance, and Medicare Eligibility

E N D

Presentation Transcript

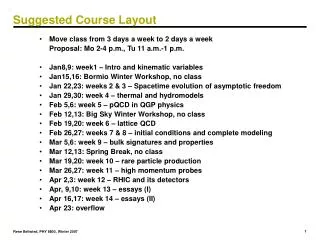

Suggested Timeline • Get Retirement Estimate (18 mo.) • Other retirement money issues: income sources and expenses (6 mo.) • Meet with Human Resources (6 mo.) • Inform your supervisor (3-6 mo.) • File Retirement Application 30 to 90 days before your retirement date if receiving distribution

Retirement Distribution ORP • Your choice how and when to begin income • Options include annuitizing, cash withdrawal, systematic withdrawal, etc. • ORP members can call their carriers to discuss retirement distribution options

Retirement DistributionERS and TRS • Visit web sites: • ERS: www.osc.state.ny.us/retire • TRS: www.nystrs.org • Request an estimate • Consult with a representative Must give 30 days notice but no more than 90 days

Know Thy Tier (ERS/TRS) • Tier 1: joined before July 1, 1973 • Tier 2: between July 1, 1973 and July 26, 1976 • Tier 3: between July 27, 1976 and August 31, 1983 • Tier 4: who joined on or after September 1, 1983 • Tier 5: who joined on or after January 1, 2010

HEALTH INSURANCE Am I Eligible in Retirement? • Minimum state service time: 10 years in benefits-eligible positions • Age 55 and eligible for retirement • Enrolled in a health insurance program on date of retirement

ELIGIBLE DEPENDENTS • Spouse - eligible after your death until they remarry • Domestic partner - eligible after your death until enters new partnership • Children • to age 19 • to age 25 if full-time students • disabled child

HEALTH INSURANCE2010 *Monthly* Rates(equal to your current share of cost) Individual Family • CDPHP (Albany area) $ 45.17 $ 252.01 • Empire Plan $ 49.91 $ 216.41 • HIP (Downstate) $ 30.78 $ 151.76 • Indep. Health (Buffalo) $ 82.13 $ 359.39 • MVP (Rochester) $ 79.42 $ 307.75

HEALTH INSURANCESICK LEAVE CREDIT • Good news: if you retire from state service, accrued sick leave helps pay for your health insurance throughout retirement! • Lifetime monthly credit that helps offset your cost of health insurance in retirement • Maximum accrual 200 days

HEALTH INSURANCESICK LEAVE CREDIT • Calculation based on • salary, • amount of accumulated Sick Leave, and • actuarial tables • Sick Leave credit applies only in retirement – it cannot be used by survivors if you die prior to retirement

COST of HEALTH INSURANCE... DUAL ANNUITANT • If you specify, your dependents may use your sick leave credit upon your death • 30% reduction of value of your credit • This choice must be elected prior to retirement

Sample Sick Leave Calculation • Employee Salary $65,000 • Age at retirement 65 • 200 sick days • Multiply daily rate of pay by the number of sick leave days and divide that figure by the life expectancy in months • 249.31 X 200 = $49,862/ 192 = $259.69 • $259.69 X .70 = $181.78 dual annuitant

Premiums will increase, credit will remain constant In the last 10 years monthly premiums up by 10.4% Ind, 10.1% Family In the last 5 years monthly premiums up by 11.8% Ind, 11.4% Family

DEFERRING HEALTH INSURANCE • Indefinite deferral... Must provide proof of other coverage • Sick Leave Credit increases • Must elect prior to retirement

Health Insurance Premium Payments • If you retired from ERS or TRS, the premium is deducted from your retirement check. • If you retired from the SUNY ORP, you will be billed quarterly

HEALTH INSURANCE PAYMENTS • May take up to six months to start • Be prepared for a large bill or pension check deduction for retroactivity

MEDICARE • Part A – hospital coverage (free) • Part B – outpatient and inpatient medical coverage. Cost for 2010 $96.40/mo. • Part D – prescription drugs (**Warning: few should enroll**) • No coverage outside the U.S.

MEDICAREWhen Does Eligibility Begin? It is your primary insurance if: • You are retired AND • You are over 65 (start enrollment process 3 months prior to birthday) • Diagnosed with end-stage renal disease or ALS (Lou Gehrig’s disease)

Medicare and NYSHIP WORKING • NYSHIP primary regardless of age • Medicare is secondary (if enrolled) • DO NOT have to enroll in Medicare until retire RETIRED • Medicare is Primary first day of month you or your dependent turns 65 • Must be enrolled for Medicare A & B • If out of US, NYSHIP is primary

MEDICARE • State reimburses Part B cost if primary • Enroll through Social Security • 1-800-772-1213 • State will NOT cover expenses that are a Medicare responsibility

MEDICARE • It is YOUR responsibility to enroll in Medicare Parts A and B • Contact Social Security • At least 3 months prior to retiring when you or your dependent is age 65 • If retired, at least 3 months prior to age 65

CHANGING COVERAGE • Permitted changes • option transfer at any time, once per 12 mo. • family to individual, individual to family • cancel and reenroll (no recalculation of SL) • Contact NYS Dept. Of Civil Service, Employee Benefits Division • 518-457-5754 • 1-800-833-4344

DENTAL AND VISION Benefits expire • Several options to consider • Sick Leave Credit does *not* offset Dental/Vision costs • Purchase through COBRA • same as current coverage • 18 months • elect within 60 days

Dental/Vision Coverage - CSEA • Must purchase as a package • Cost $75 per month - family or individual • Contact the CSEA Benefit Fund to convert • 1 (800) 323-2732 Ext 803 • CSEA also offers several other plans

DENTAL/VISION COVERAGE -M/C & PEF GHI Preferred Dental • Same as current coverage for those in GHI • Dental costs for 2010 • $30.00 Individual • $80.00 Family • Vision cost for 2010 • $4.00 Individual • $10 Family • Combined Dental/Vision • $35.00 Individual • $90.00 Family

DENTAL/VISION- UUP • COBRA • Monthly rates • $43.04 Individual • $102.75 Family • UUP dental programs • www.uupinfo.org/benefits • UUP also offers several other plans

Union Benefits • Life, auto, homeowners insurance • Retiree membership • Discounts/services

Paychecks • 2 weeks lag pay • 1 week deferred pay • CSEA, M/C, PEF • vacation pay (max 30 days)

RETURNING TO WORK • Applicable to NYS Public Employment • Could be a limit on social security earnings • Section 212: • $30,000 in 2010 • unlimited at age 65 +

NYSHIP benefits and return to work • If Benefits Eligible, can re-enroll in dental, vision, other benefits • Medicare stops being primary • Not eligible for Medicare reimbursement for Medicare Part B

Eligibility for Health Insurance as a Vestee • If leave state employment before age 55 may be eligible for health benefits at retirement • Must be enrolled in NYSHIP at the time you leave • Must have a minimum of 10 years of service in a benefits eligible position • Must continue NYSHIP coverage until retirement age

Eligibility for Health Insurance as a Vestee • To continue coverage in NYSHIP by: • Paying 100% of the cost of the insurance through retirement age OR • Continuing NYSHIP enrollment as a dependent OR • Be employed by another agency that participates with NYSHIP

QUESTIONS?? Office of Human Resources 2 Union Ave. Saratoga Springs, NY 12866 518-587-2100, ext. 2240 518-587-5448 (fax) Website: www.esc.edu/hr